Revisiting The 2007 Topping Process

“Tops are a process; bottoms are an event.” —Source unknown

I started Top Gun in 2006 to capitalize on my conviction that the bursting housing bubble would cause a nasty recession. 2006 was spent creating my website, studying and taking the Series 65, applying to the State of CA for my RIA (Registered Investment Advisor) license, finding office space and in general getting everything set up. I went live managing money on Jan 1, 2007 with a little less than $1 million AUM. I was 29 years old.

In this Client Note, I want to discuss the topping process in 2007. The market hit a peak on 7/19/07 with an intraday high of 1555. It then crashed for a month in the wake of the blowup of two Bear Stearns hedge funds invested in subprime mortgage backed securities and pressures on other financial firms and investors holding similar securities, making a bottom on 8/15/07 with an intraday low of 1404. Then, to my dismay, the market embarked on an almost two month long rally, making a marginal new intraday high of 1565 on 10/9/07. The narrative behind this rally was that subprime would be “contained”, as then Fed Chair Bernanke said. (The narrative this time is of a V-shaped recovery). I remember being confounded by the rally at the time, in the same way I am by the current one. In my opinion, the current rally is the exact corollary of the 8/15/07 to 10/9/07 rally. After enduring that 2 month rally, I was vindicated when I returned 15% compared to -38.5% for the S&P in 2008. The same thing will happen this time around.

After an 11-year, 400+% bull market, investors have been conditioned to buy the dip. It has worked for 11 years so they figure it will work again this time. Because they also believe this correction is ONLY about the coronavirus, the consensus is expecting a V-shaped recovery once the virus is contained and the market is already looking ahead to that outcome. For why the consensus is wrong, see my “Understanding The Consensus View And Why It’s Wrong” (4/5/20; The consensus view and why it’s wrong). Ben Graham famously said that the market is a voting machine in the short run and a weighing machine in the long run. Right now, crowd psychology is overly bullish due to the incredible bull run we just experienced from 2009 through 2020 and that is driving the market relentlessly higher. However, reality will ultimately set in as the economy and corporate earnings remain depressed for longer than is now expected, causing share prices to come down, ultimately breaking the March 23 low of 2192.

*****

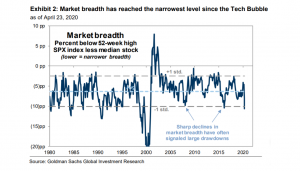

Sharp declines in market breadth in the past have often signaled large market drawdowns — David Kostin and his team at Goldman Sachs (4/24/20; Goldman says narrow breadth in S&P 500 a bad sign for stocks)

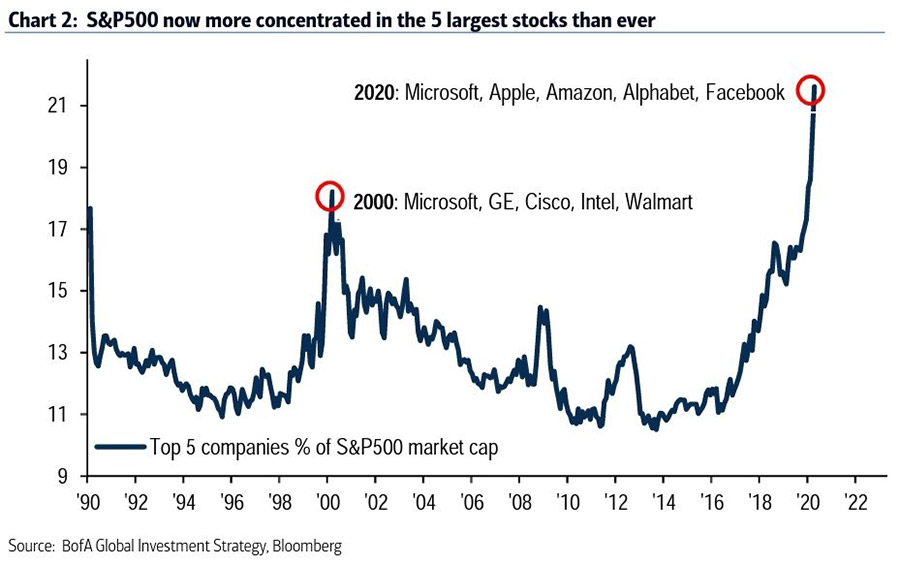

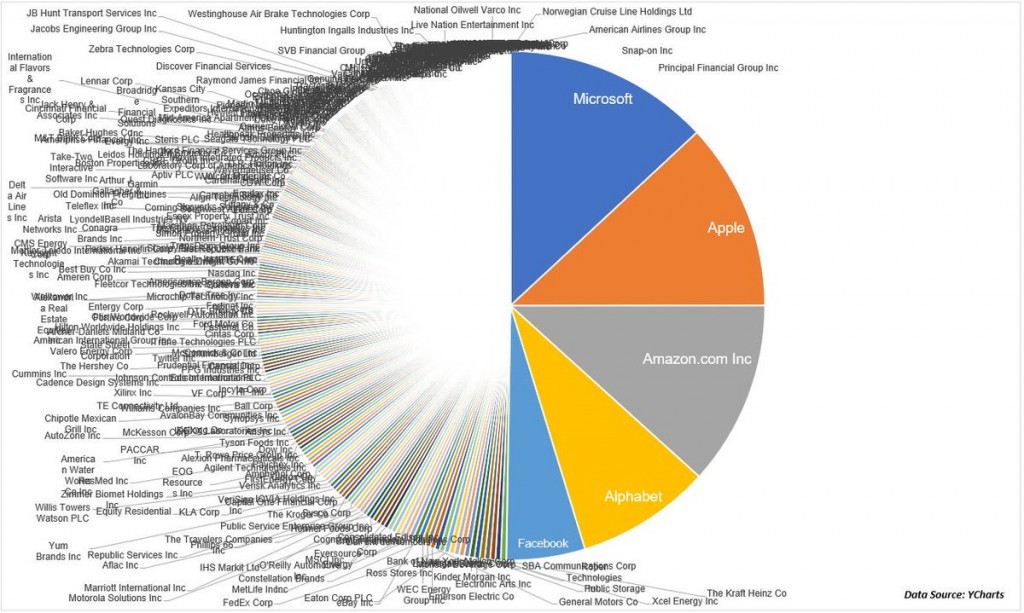

The market is being driven higher primarily by The Big 5 tech companies – Amazon (AMZN), Apple (AAPL), Google (GOOG, GOOGL), Microsoft (MSFT) and Facebook (FB) – which now make up 21% of the S&P’s market cap – a higher concentration than even the top of the 2000 dotcom bubble. Correspondingly, while the S&P is 17% below its February 2000 peak, the median stock in the index is 28% below its peak. That’s because The Big 5, who all report earnings this week, are carrying the entire market. Most stocks in the S&P 500 have not bounced nearly so hard, but with The Big 5 making up such a large % of the market cap of the S&P they are able to carry things for now. Once they breakdown, the entire market will as well. That’s why this week is the most important week of the year so far.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

825 San Antonio Road #205, Palo Alto, CA 94303

(916) 224-0113

Stocktwits (55k followers)/Twitter: @TopGunFP

Instagram: topgunfinancialria