Russia Is A Sideshow; Interest Rates Are Everything

The stock market rallied hard Tuesday on hopes that Russia will not invade Ukraine. The S&P was +1.58%, the NASDAQ +2.53% and the Russell +2.76%. 75% of stocks on the NYSE and NASDAQ advanced on the day. Since most investors are long biased and highly correlated with the indexes, they cheer when stocks go up. In addition, hopes are high that the bottom is in. However, longer term one day is meaningless and Russia is a sideshow. The real driver of financial markets and the economy going forward will be interest rates and they’re going higher.

The other big story besides Russia/Ukraine last week was the hot January CPI Report and the yield on the 10 year treasury breaking through 2%. However, despite the rapid rise in interest rates since the start of the year, most investors believe they aren’t going much higher as can be seen in the tweet above by Chris Verrone. If they’re wrong – and like Chris I believe they are – today’s rally is likely to be just a brief respite in an ongoing bear market. The reason I believe interest rates are going higher is because inflation isn’t going anywhere. If my inflation forecast is correct, bond investors aren’t likely to continue accepting negative real returns in perpetuity so they’ll continue to sell bonds, sending interest rates higher.

Why are interest rates so important? For one, in our highly indebted economy rising interest rates increase debt service costs for businesses, consumers and the government squeezing their budgets and forcing them to cut back elsewhere. This is contractionary for the overall economy. Second, higher interest rates means a higher discount rate for future earnings which is bearish for the highly valued technology stocks that dominate the US stock market. Hence, rising interest rates deliver a one-two punch, hitting corporate earnings by contracting the economy as well as deflating valuation multiples.

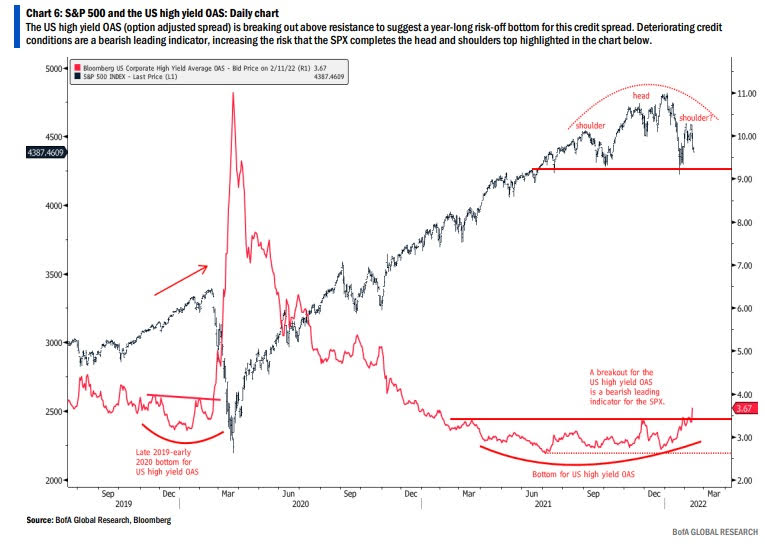

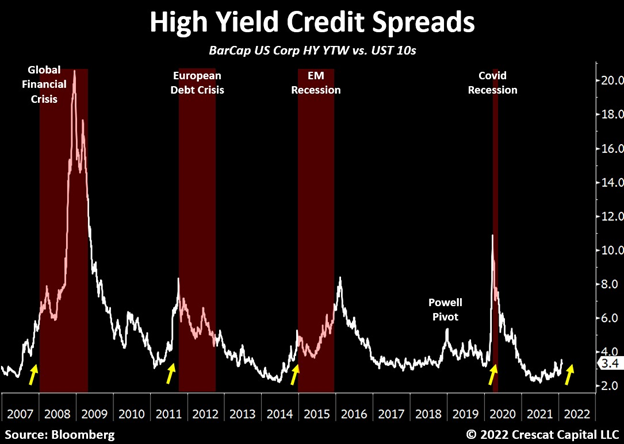

While rates on safe haven treasuries are rising, rates on junk bonds are rising even faster. That’s what the red line in the first chart above from Bank of America of the option adjusted spread for high yield bonds shows. Indeed – as you can see in the second chart above – the Junk Bond ETF (JNK) is close to breaking down below support to 52-week lows.

Why are interest rates on junk bonds rising even faster than treasuries? The reason is that while treasury rates are rising because of inflation, junk bond rates are rising because of inflation and risk aversion. Put another way, junk bond investors are taking their chips off the table. This is important because for whatever reason widening high yield spreads tend to be a harbinger of trouble. They were in 2020 – as you can see in the Bank of America chart – and they were in 2008 as well – as you can see in the Crescat Capital chart. I doubt this time is any different.