Next Year Everybody Will Be Saying The ‘I’ Word

Friday morning’s much anticipated November CPI Report came in essentially inline with expectations with headline inflation up 6.8% year over year and 0.8% month over month. This likely means the Fed will go ahead with its accelerated tapering plan next Wednesday and the stock market seems fine with that – for now.

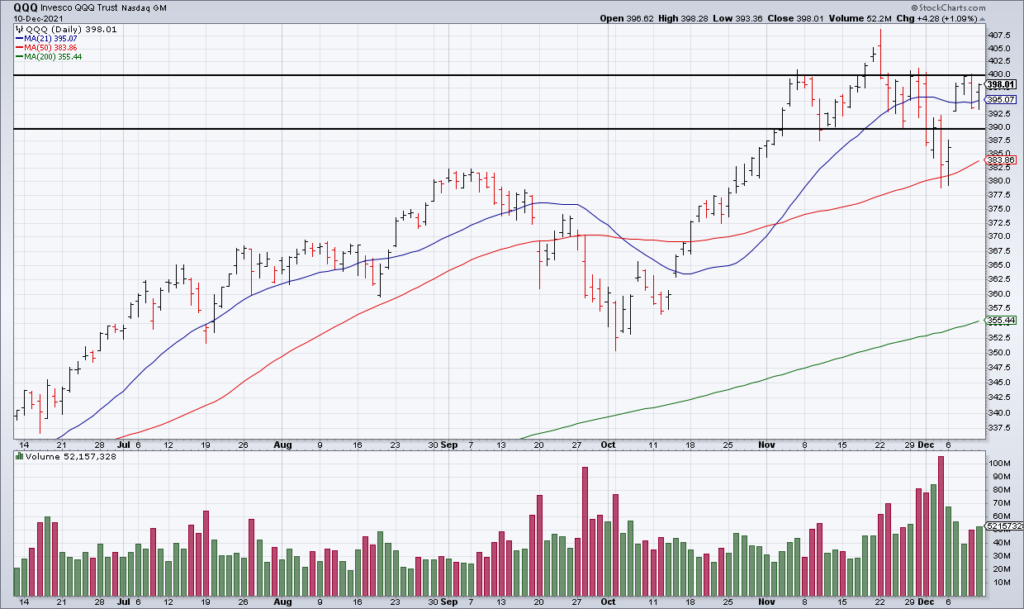

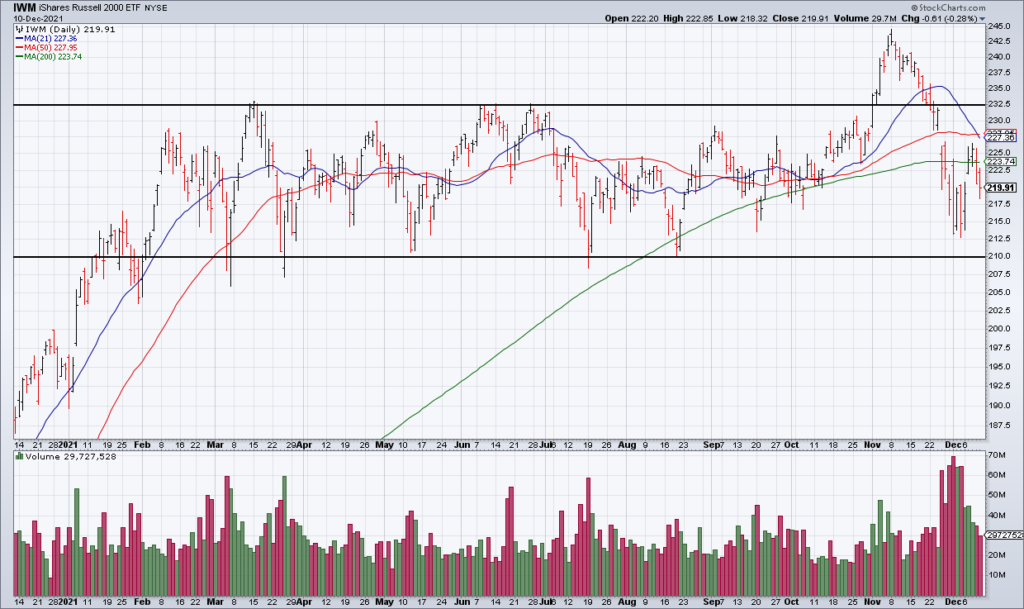

The S&P was +0.95%, the NASDAQ +0.73% and the Russell -0.38% Friday. NYSE + NASDAQ Advancers to Decliners were 3,471 to 4,561 on relatively light volume of 8.3 billion shares. QQQ closed at $398.01 and remains within the $390-$400 range that has mostly contained it for the last month plus. IWM closed at $219.91 and also remains within the $210-$232.50 range which has contained it for most of 2021. ARKK closed at $96.17; as long as it’s below $100 it is in breakdown mode IMO.

My best guess is that nothing much will change with QQQ, IWM and ARKK through year end. I can’t rule out QQQ breaking out to the upside but IWM likely won’t resolve its range until next year and ARKK will likely continue to trend lower in 2022.

Get ready to read a lot of media stories and hear a lot of chatter about inflation next year. While the Biden administration wants us all to believe that inflation has peaked, its motives are transparently political. The reality is that significant inflation is likely to persist for the foreseeable future. Next year everybody will be saying the ‘I’ word.