Positioning Ahead Of The Fed, AAPL $3 Trillion

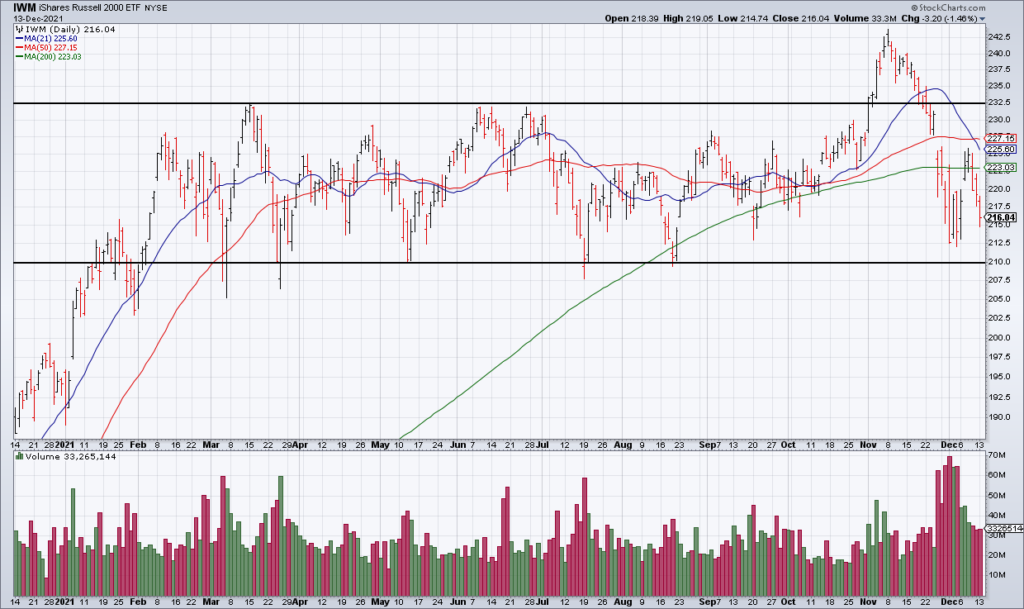

My best guess is that nothing much will change with QQQ, IWM and ARKK through year end. I can’t rule out QQQ breaking out to the upside but IWM likely won’t resolve its range until next year and ARKK will likely continue to trend lower in 2022 – Top Gun Financial, Friday 12/10

The stock market continued to be volatile Monday with the S&P -0.91%, the NASDAQ -1.39% and the Russell -1.42%. NYSE + NASDAQ Advancers to Decliners were 2,333 to 5,700 with 8.7 billion shares trading hands.

QQQ was -1.44%, IWM -1.46% and ARKK -1.74% but no levels of technical significance were breached. I continue to think that the most likely path into year end is for each of these three key ETFs to continue within their current ranges/trends. The relevant ranges/trends are $390-$400 for QQQ, $210-$232.50 for IWM and below $100 for ARKK.

Remember: the last major data point for 2021 is the Fed Decision on Wednesday. Pay attention to the reaction. If it is contained within the ranges/trends outlined above this week, it is highly likely they will hold for the remainder of 2021 as well.

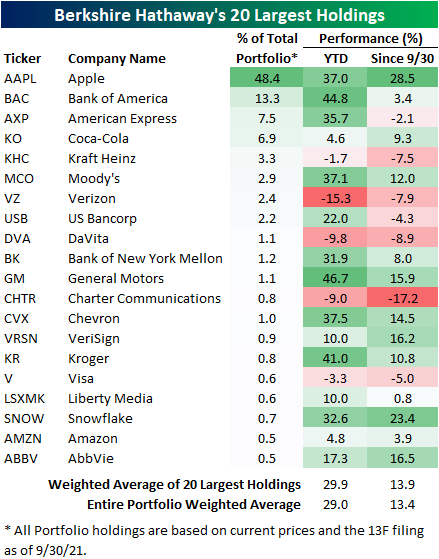

Apple (AAPL) is once again the most important stock in the world for a number of reasons. First and most obviously, AAPL is the biggest stock in the world valued at almost $3 trillion. This means it is the largest position in the trillions of dollars in passively managed index funds. Second, because of AAPL’s size, it has an outsized influence on the major indexes. A 0.10% move in AAPL represents a $3 billion change in market cap – equal to the entire size of some companies in the S&P and NASDAQ. Therefore, strength in AAPL can – and has – hide a lot of weakness in smaller stocks beneath the surface. Third, AAPL now makes up almost 50% of the stock portfolio of the greatest investor in the world. Therefore, in many ways, as goes AAPL, so goes the stock market.