Two Scoops Of Hawkishness With A Dovish Cherry On Top

The expectation heading into Wednesday’s Fed Decision is that the Fed will double the pace of its taper to $30 billion/month. That much has probably been priced into markets after Tuesday’s session. Further, my guess is that Chairman Powell will try to soften the blow to financial markets by saying that the Fed is willing to “adjust” (i.e. stop) tapering if conditions down the line warrant another pivot. If so, I would expect the market to firm up in the wake of his press conference following the release of the statement. Chairman Powell’s press conference may rise to the level of performance art.

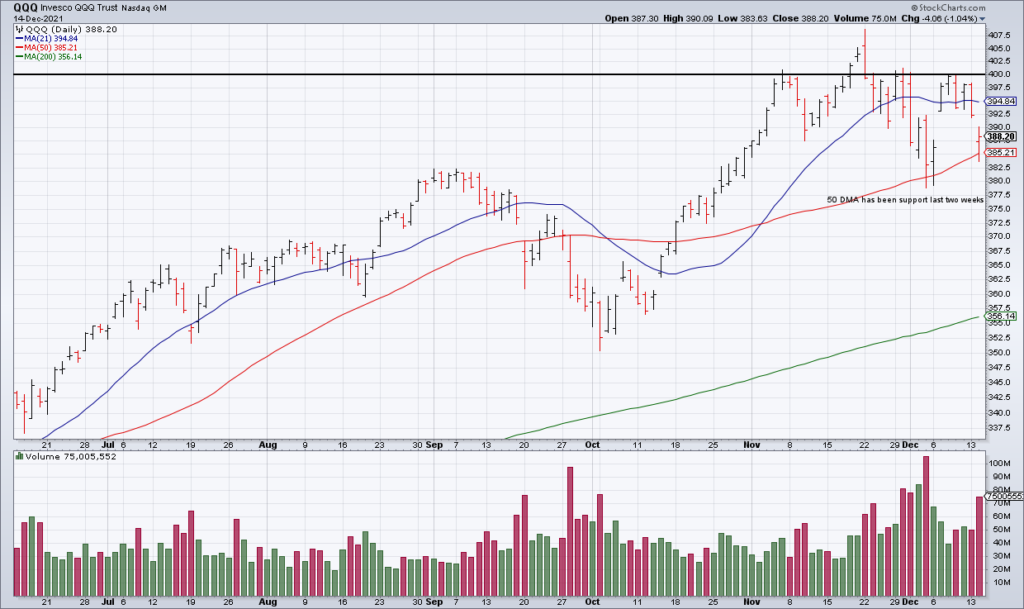

The stock market sold off again Tuesday ahead of the Fed Decision. The S&P was -0.75%, the NASDAQ -1.14% and the Russell -0.96%. NYSE + NASDAQ Advancers to Decliners were 2,334 to 5,768 on 9.2 billion volume. QQQ broke through $390 but found support for the second time in as many weeks at its 50 DMA. IWM was weak and it is looking more and more like November’s breakout was a bull trap (see chessNwine tweet above) but it has not broken down yet. If my Fed forecast is correct, I would expect these levels to hold for the remainder of 2021.