The Fed Threads The Needle, Treasury Yields Surge Overnight Hitting Futures, Inflation Is Here, Rising Rates Will Kill The Bull Market

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the email.

The problem is that the Fed is trying to prop up an asset bubble on which the economy depends, which requires easy money, while assuring a fragile bond market that it has its eye on inflation as well, which requires tighter money. If the Fed is too dovish in support of risk assets, the bond market may sell off resulting in rising interest rates and a selloff in risk assets anyway. If the Fed is too hawkish and starts to announce plans to tighten policy, the bond market may be appeased but risk assets are likely to selloff directly. Jerome Powell is going to have to pull off an almost impossible balancing act. The reaction to the Fed Decision in the last two hours of today’s session will go a long way in telling us whether he pulled it off (Section 3: “Fed This Afternoon”, Top Gun Financial, Wednesday March 17).

I really didn’t think Jerome Powell and the Fed could pull it off yesterday but they did manage to thread the needle – at least on Wednesday. They somehow satisfied both the stock and the bond markets with the former staging an impressive intraday rally after the Fed Decision at 11am PST and the latter holding it together. The S&P ended up finishing +0.29%, the NASDAQ +0.40% and the 10 Year Treasury yield only rose two basis points on the day.

I was surprised the bond market took it so well since Powell and company basically said we’re going to keep doing what we’re doing and not worry about inflation. I would have thought that would’ve sent bonds into a tailspin but they hung in there – yesterday.

However, overnight in Europe Treasury Yields are surging resulting in a selloff in our Futures. I have noticed that a lot of times the reaction to the Fed in the remaining two hours of the session is reversed the following day and that seems to be exactly what is happening today.

Buyers have concluded that locking up their money for a decade or more in Treasuries is now riskier than before, because there is a much greater chance of high inflation eroding the value of fixed income (“Putting The Risk Into Risk-Free Treasuries”, James Mackintosh, WSJ B1, Wednesday March 17 [SUBSCRIPTION REQUIRED]).

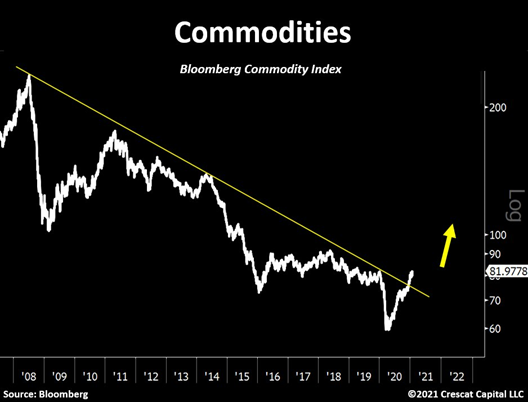

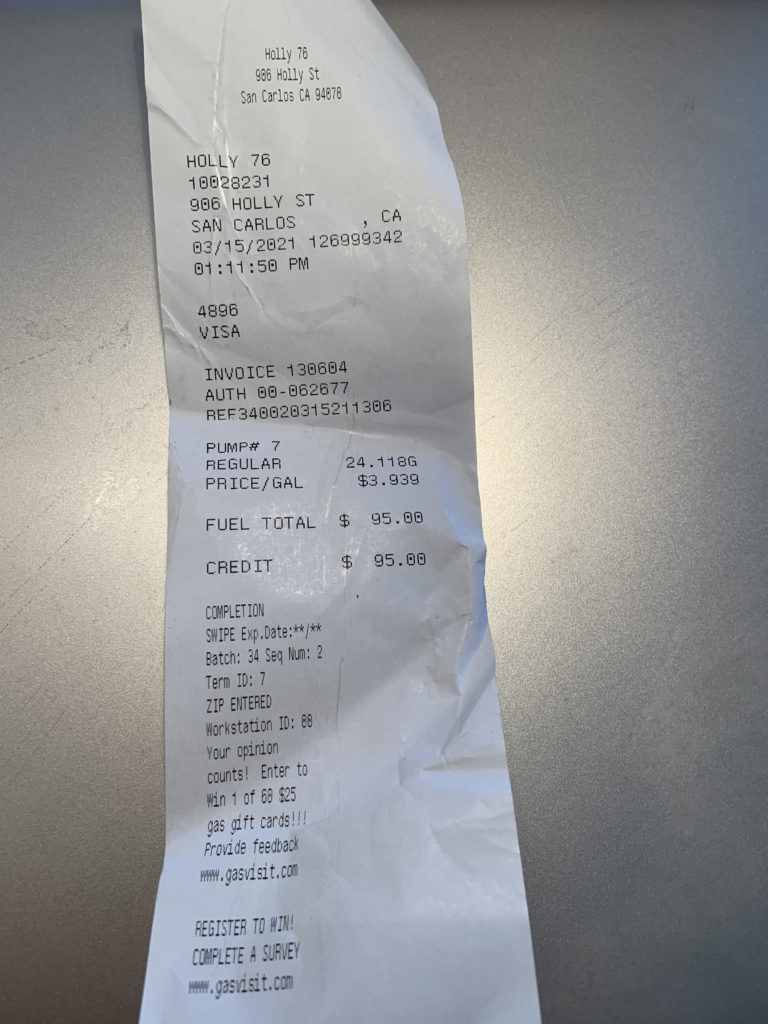

The surge in interest rates makes complete sense because inflation is here and so the Fed has lost control of the long end of the yield curve. You can see it in the chart of the Bloomberg Commodities Index. Personally, the reality of inflation was driven home for me Monday when I paid $95 to fill up my car – the most I can remember paying in my almost 28 year driving career. And consumers are noticing the increase in prices as inflation expectations are on the rise as evidenced in the chart in Kevin Smith’s tweet.

While interest rates were steady yesterday, the precious metals, including the miners, took flight. I believe the precious metals have put in a bottom and their secular bull market is resuming.

Rising yields would again challenge Big Tech and similar growth stocks, and might drag down the entire market. As Matt King, global markets strategist at Citigroup, puts it: “If it is just about better growth then that is positive for equities, but if it is about risk premia coming back then ugh” (Mackintosh)

Rising rates will kill the bull market. Rising rates were the catalyst for the recent three week selloff, especially in growth stocks (I explained why in “The Differing Impact of Rising Rates On Growth and Value Stocks”, Top Gun Financial, February 23). In addition, “The NASDAQ has a valuation problem”, according to MKM’s Michael Darda. Further, I have argued that Reopen Value stocks are fully valued. For example, see my discussions of Lyft (LYFT) and Ulta Beauty (ULTA). Therefore, I don’t see anything left to pull this market higher. While the Fed might have completed a Hail Mary yesterday, their apparent victory is being undone as I write. The End Game is upon us.