TSLA Is A Buy

Those of you who have followed me for a long time probably thought you’d never hear this: Tesla (TSLA) is a buy.

My beef with TSLA was always that it was significantly overvalued but that is no longer the case. TSLA is on track to earn ~$4/share this year. If you take today’s closing price of $109.10 and divide it by $4 that gives you a P/E of 27x on current year earnings. That is cheap for a company that grew revenue 56% in 3Q22.

Perhaps you believe – like me – that we’re headed for a nasty recession next year. Estimating TSLA 2023 earnings in this scenario is difficult. On the one hand you have a company that is still in the early stages of its growth cycle. On the other hand they do sell an expensive and discretionary product. Taking both factors into consideration I think its conservative to estimate that TSLA earnings will be flat next year at ~$4/share. So – again – we have a 27x multiple on 2023 earnings. That is inexpensive for the far and away leader in electric vehicles (EV) at this early stage in the company’s – and industry’s – growth cycle.

So – from a fundamental perspective – TSLA is a long term buy. I think that investors who buy TSLA now and are willing to sit on it for multiple years will do quite well.

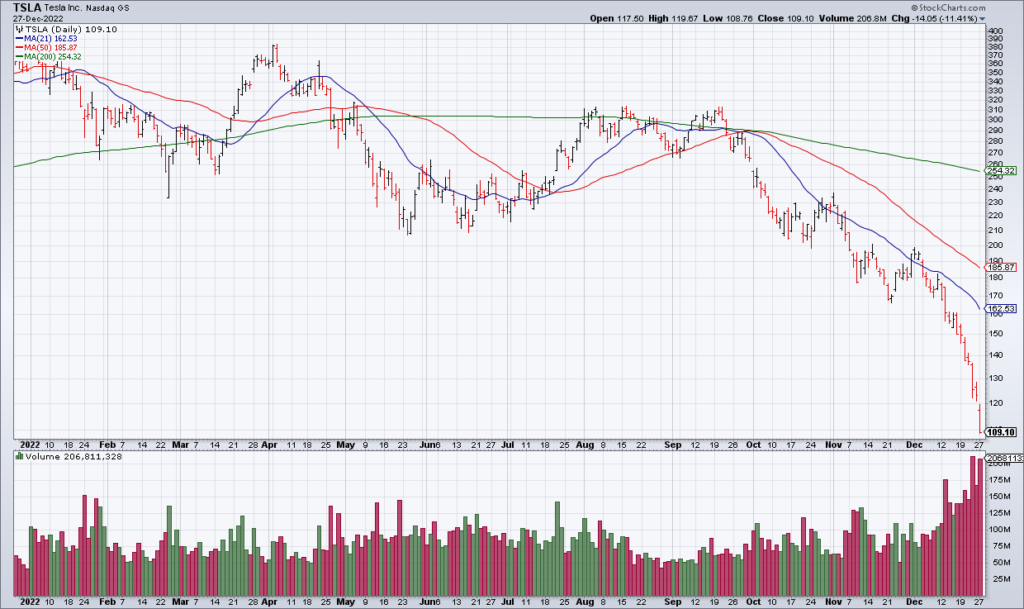

But what about short term traders? This is always a harder call but TSLA stock is showing clear signs of capitulation. The stock is down 44% just in December and volume has spiked to over 200 million shares on two of the last three trading days – by far the highest volume in the last year. This reeks of investors throwing in the towel. We are getting close to the point where everybody who wants to sell has already done so which creates the supply and demand dynamics for a nice bounce.

It’s hard to avoid the suspicion that part of the reason TSLA is dropping so much is because Elon is no longer cool. He has sent a number of politically incorrect tweets since taking over Twitter – and is shaking things up in a way that not everybody likes – which have received significant blowback. But that’s no reason to sell – or avoid – TSLA. Do you want to be politically correct or do you want to make money? If the latter you might want to consider buying TSLA stock.