TSLA Loses $157 Billion In Market Value, PYPL Cracks, PLTR -9%, COIN & UPST To Get Smacked Wednesday

Tesla (TSLA) stock went parabolic a couple weeks ago so it was always a matter of when not if it was going to reverse. Tuesday turned out to be the day with TSLA -11.99% or $157 billion in market cap. It wouldn’t surprise me at all if this continued Wednesday.

I wrote about weak PayPal (PYPL) earnings Monday afternoon and the stock confirmed it Tuesday, down 10.46% on more than 7x average volume.

I didn’t see much “wrong” with Palantir (PLTR) 3Q21 earnings Tuesday morning but the stock’s market cap was greater than 40x 2021 revenue guidance and the market isn’t much in the mood for insanely valued tech stocks at the moment. PLTR got whacked 9.35% on heavy volume.

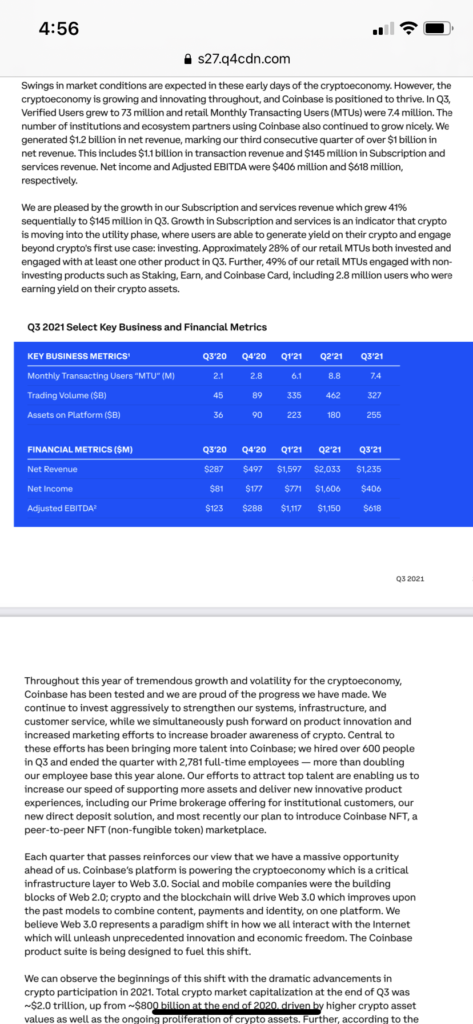

Coinbase’s (COIN) 3Q metrics reported Tuesday afternoon – from Monthly Transacting Users, Trading Volume, Net Revenue to Adjusted EBITDA – were all substantially off from 2Q21, though crypto activity on its platform rallied in October along with crypto prices. Nevertheless, COIN closed the after hours Tuesday -13.24%.

I couldn’t see anything “wrong” in $30 billion market cap artificial intelligence lending platform Upstart’s (UPST) 3Q21 numbers but, like PLTR, the market is not acting very nicely toward excessively valued tech stocks right now. UPST finished Tuesday’s after hours -20.53%. I’m not sure if Mark Minervini knows what the company does yet.