Two Chart Patterns In Early Stage Growth Say Go Small And Be Dynamic

I’ve been writing a lot lately about opportunities in early stage growth or what I have termed “the leaders of the future”. I regret that I haven’t been more forceful in emphasizing that it’s too soon in what I expect to be an epic bear market to do anything but nibble. A look at the charts of some of these stocks bears this out.

When looking at the charts of my “leaders of the future” I see two patterns. The first pattern is a hard post-earnings relief rally that gets faded in the ensuing days. You can see this clearly in the charts of Snapchat (SNAP), Bumble (BMBL), Square (SQ) and Carvana (CVNA) above. I have drawn an arrow pointing at the hard post-earnings relief rally and subsequent fade in each case. SNAP is the quintessential example because it reported 4Q21 earnings in early February and so the chart has had more time to develop than the others. Let me be clear: these bounces are to be sold into. I have been taking half off into these post-earnings moves from small positions (1%-2%) to begin with. This is a time for dynamic trading in these names, not buy and hold.

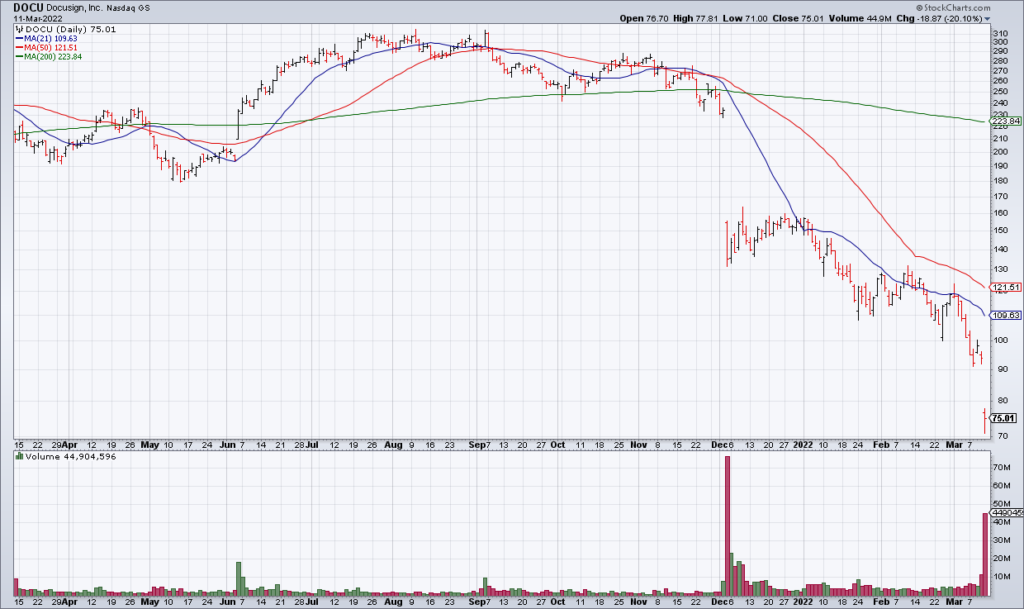

The second pattern is relentless selling. You can see this in the charts of Shopify (SHOP), Docusign (DOCU), Zoom (ZM) and DoorDash (DASH) above. I expect these to bounce as well at some point but – again – these bounces are to be sold into. Even if you’re still underwater take at least half off because these bounces will almost certainly be faded as in the first pattern.

There will be plenty of opportunities in this long bear market to pick up your favorite early stage growth names. You can hold onto a stub but trade around your positions; don’t buy and hold. You need to be nimble in these names because they need time; there will be no V-shaped rally at this stage. These are names to keep an eye on because they will be the leaders of the next bull cycle but – again – that cycle is many years away.