It’s A Bull Market

NOTE: Every week or two I wrote a Client Note for my clients. I post most but not all of the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

The S&P is up another 1% since I last checked in in early June (“That 2013 Feeling”, June 9) and what I said then still applies. The path of least resistance continues to be higher.

The stock market sold off yesterday on the following comments by Fed Chair Janet Yellen:

Valuation metrics in some sectors do appear substantially stretched-particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year.

That generated a lot of chatter on Twitter and CNBC but seems mostly forgotten already this morning.

Second quarter earnings are starting to come in and so far so good. Portfolio holding Goldman Sachs (GS) reported an excellent quarter yesterday morning. EPS of $4.10 blew away estimates of $3.05. Both investment banking and investment management were solid. The stock rallied about 1%.

*****

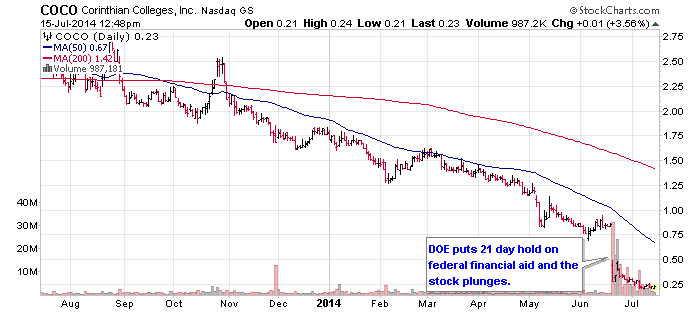

I have taken a small speculative position in for profit college operator Corinthian Colleges (COCO). Corinthian operates 107 schools under the Heald, Wyotech and Everest brands. A month ago the Department of Education (DOE) put a 21 day hold on federal student loans plunging Corinthian into a cash crisis. Without the funds, Corinthian warned it may not be able to continue as a going concern. The stuck plunged.

Negotiations with the DOE followed resulting in an operating agreement. Under the agreement, Corinthian will put up for sale 85 US schools and “teach out” the remaining 12. Separately, Corinthian will also sell its Canadian operations. As part of the agreeement, the DOE restored normal funding of federal student loans.

At 22 cents/share, Corinthian’s market cap is only $19 million. They had revenues of $1.456 billion in the previous 12 months ending March 31, 2014.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

Bay Area, CA

(916) 224-0113

FOLLOW ME ON Twitter, LIKE ME ON FaceBook AND ENGAGE WITH ME ON SeekingAlpha!