10 Year Yield Drops 11 Basis Points, NASDAQ on the Verge of New ATHs, Precious Metals on the Move

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

As you can see in the chart of the iShares 20+ Year Treasury Bond ETF (TLT) above, yields had been rising quickly in 2021 (bond prices and yields move inversely) until finding a bottom a couple weeks ago capped off by yesterday’s monster 11 basis point drop in the 10 Year Treasury yield to 1.53%.

On Wednesday morning, I argued that “Yields And Inflation Are Driving Everything”. The key chart in that blog was in a tweet by Schwab’s Chief Investment Strategist Liz Ann Sonders which showed that the move out of Cyclical Reopen names and back into Growth/Tech coincided with the stabilization of interest rates about a month ago.

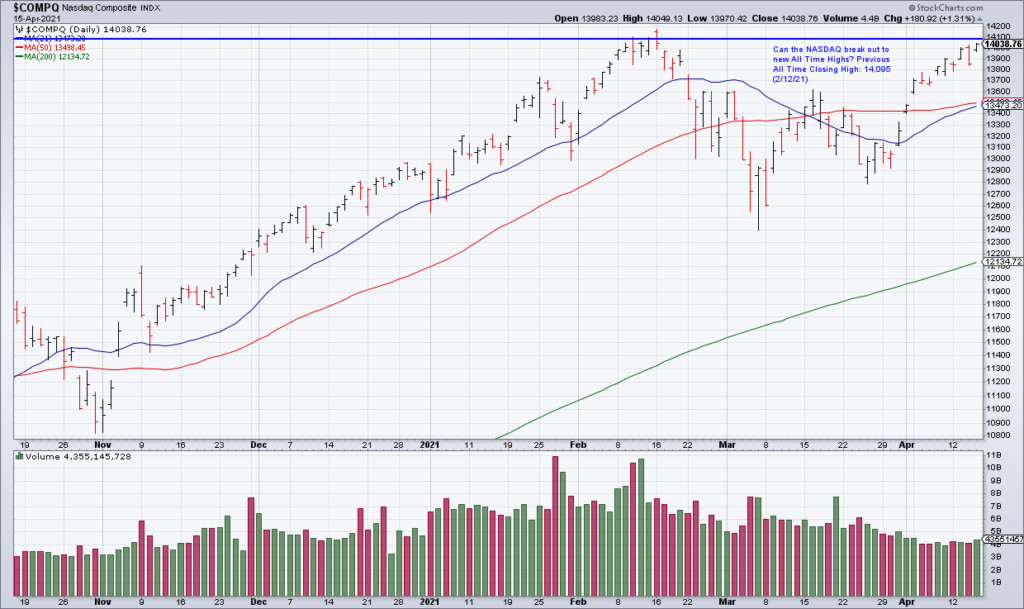

Well that held true yesterday as the NASDAQ continued to lead the market higher (+1.31%). The S&P advanced 1.11% led by Tech (XLK +1.72%). The NASDAQ closed at 14,039 – 56 points below its All Time Closing High of 14,095 from February 12. (The horizontal blue line in the NASDAQ chart above represents the index’s All Time Closing High). With upside momentum as strong as it is right now, odds are that we make new All Time Highs in the days ahead.

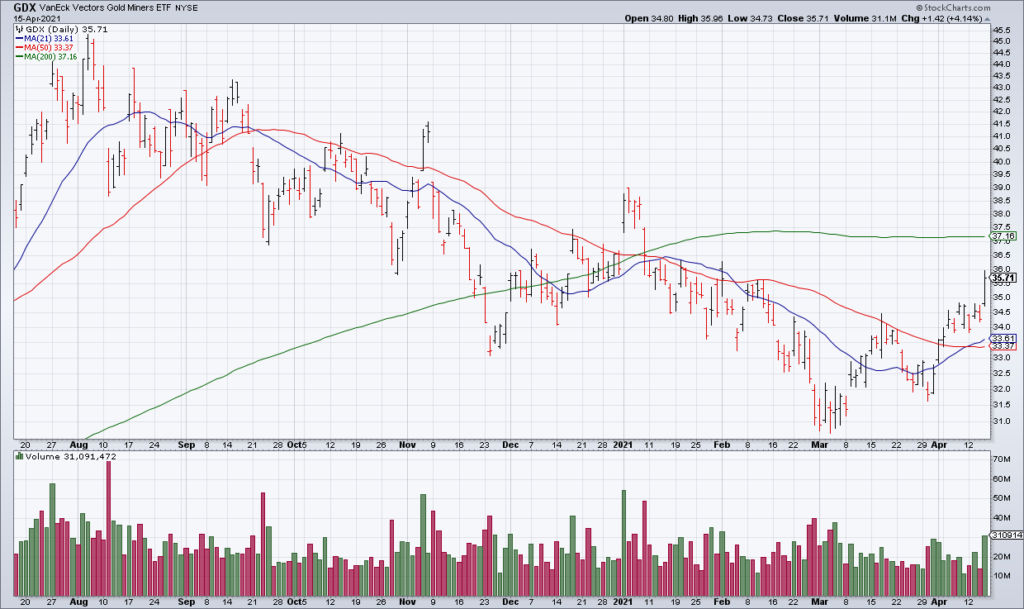

For Top Gun, the most important action yesterday was in the precious metals and their miners. I have massively over weighted the miners in our portfolios via the following four ETFs: GDX, GDXJ, SIL and SILJ. Those ETFs were +4.14%, +4.14%, +4.04% and +4.98%, respectively, yesterday resulting in the best single day return of my 14+ year professional investment career. This is just the beginning of a massive move in the precious metals and their miners IMO.