After The Cliff

NOTE: Every week or two I wrote a Client Note for my clients. I post the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

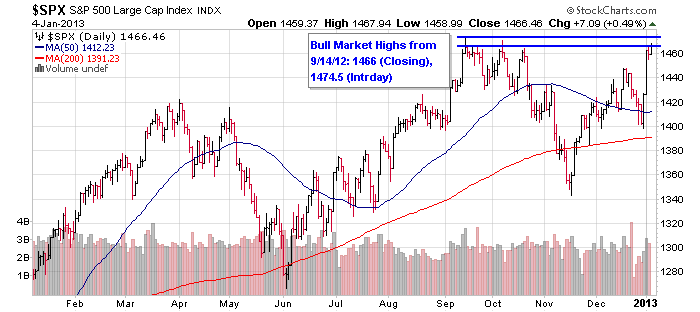

About 7 weeks ago in “The Fiscal Cliff And The Roadmap Into Year End” (e-mailed November 19th, not published on website), I recapped the correction which had taken place since QE Infinity in mid-September, singled out and overviewed the fiscal cliff as the most important issue into year end, and made the case for a year end rally based on sentiment, seasonality and a fiscal cliff deal as catalyst. Happily, things played out mostly as I expected – though I didn’t anticipate the political drama going down to the wire the way it did.

The market is subject to unreasoning waves of optimism and pessimism to paraphrase Keynes (“Keynes Critique Of Wall Street”, March 20, 2012). The deal reached on New Year’s Day has created a burst of enthusiasm and looking forward it is now time to take a fresh look at how things stand.

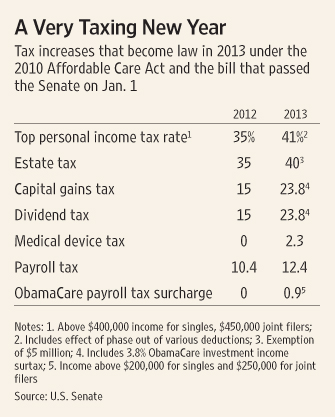

Negotiations centered on where the line would be drawn to define the wealthy whose taxes would rise. The two sides met in the middle deciding that singles earning $400,000 or more and couples earning $450,000 or more will have their marginal income tax rate increase from 35% to 39.6%. Some deductions will also be phased out above $250k/$300k. Everyone below those thresholds will have the same marginal rate.

The capital gains and dividend tax rate will increase to 20% for those above the $400k/$450k threshold and remain at 15% for those below. The 3.8% ObamaCare tax on investment income will also take effect for those above $200k/$250k. The Wall Street Journal created a nice table summarizing the tax increases.

While not a Grand Bargain addressing the long term unsustainability of our debt and deficits, the deal suits Wall Street’s short term mentality just fine. As a result, the S&P 500 is up more than 100 points from the mid-November lows and on the verge of making new bull market highs. Indeed, 88% of S&P stocks are currently trading above their 50 DMA according to BeSpoke Investment Group. With the market overbought and the much anticipated catalyst behind us, caution is in order.

One stock notably not participating in the recent move is Apple (AAPL). After making new highs around $700 in mid-September in correlation with the rest of the market, Apple has lagged in recent weeks. At $530, it is off about 25% and has become a battleground stock.

Legendary bond investor Jeff Gundlach has been bearish and yesterday on CNBC predicted $425. On the other hand, the hedge fund leaders continue to be bullish as far as we know. David Einhorn’s Greenlight Capital had a $728 million position out of $6 billion in total holdings and David Tepper’s Appaloosa Capital Management $348 million out of $4 billion as of Sept 30, 2012.

An article in the most recent Barron’s showed how cheap shares are (“No Matter How You Look At It, Apple Shares Are Cheap”, Tiernan Ray, December 29), but I am worried about the brutal comps they are up against in the first half of the year. The right policy has been to give the stock the benefit of the doubt since the skeptics have always been proved wrong and that is what I intend to do with our position. But as always the spotlight will shine brightly when they report December quarter earnings on January 23rd.