Buy The Dip, The Smaller, The Better, ZM Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

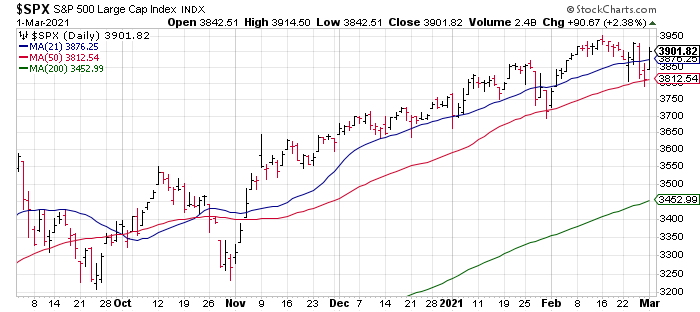

On Monday, the bulls roared back with a vengeance pushing the S&P up +2.38%, the NASDAQ +3.01% and the Russell +3.37%. These moves undid a lot of the damage from last week and puts the bulls back in charge once again.

The S&P’s 91 points gain pushed it back above 3,900 to 3,902, wedged right in the middle of its 21 DMA (3,876) and its All Time Closing High (3,933). Both are in play today and whichever level gets taken out first will determine who has control IMO.

While the NASDAQ was even stronger yesterday, adding 396 points to close at 13,589, it is still further from its ATHs and below its 21 DMA (13,699).

My only quibble with yesterday’s rally is light volume. NYSE + NASDAQ volume was 10.163 billion, down 18% from Friday’s 12.399 billion – which itself wasn’t a huge volume day (Source: WSJ Markets Diary).

I don’t think we’ll be able to tell if yesterday meant anything significant until we see what happens over the next few days.

Moving on, Grayson Roze put up an interesting chart yesterday afternoon showing that the smaller the stock, the better its done over the last six months: Micro Caps > Small Caps > Mid Caps > S&P 500. To me, this reeks of speculation as, in general, the smaller the stock, the higher the risk.

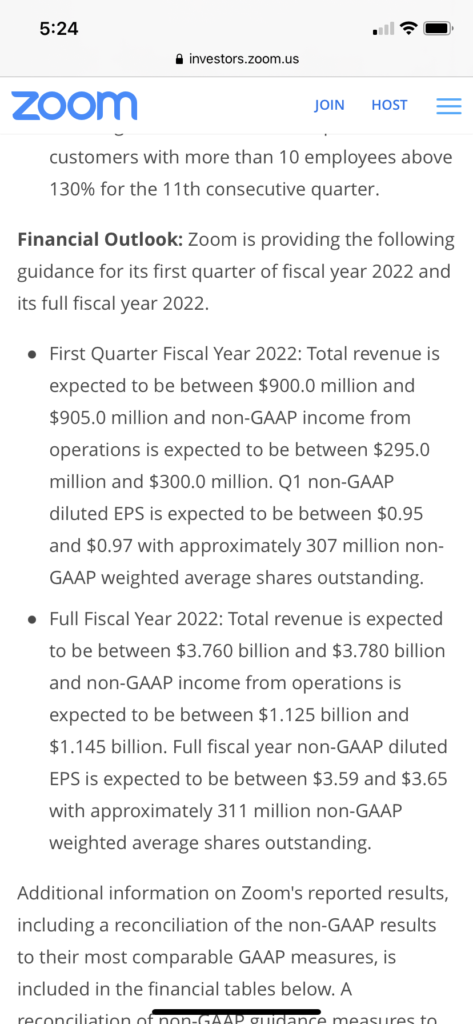

Lastly, I want to say a word about Zoom (ZM, Market Cap $133 Billion using the current premarket price) earnings from yesterday afternoon. ZM is the quintessential pandemic stock and it reported a great quarter with Revenue +369% and Non-GAAP Diluted EPS +713% year over year. However, growth will slow dramatically in 2021 as they guided Revenue Growth for the year to +42% and Non-GAAP Diluted EPS Growth to only +8% ($3.59-$3.65).

Because that guidance looks weak to me, I’m surprised investors are currently bidding up shares by ~8% in the premarket. At its current price, ZM has an EV to Forward Revenue multiple of 34x and EV to Forward Non-GAAP Diluted EPS of 119x. Those multiples seem way too high given the dramatic deceleration in growth as the pandemic begins to be contained.