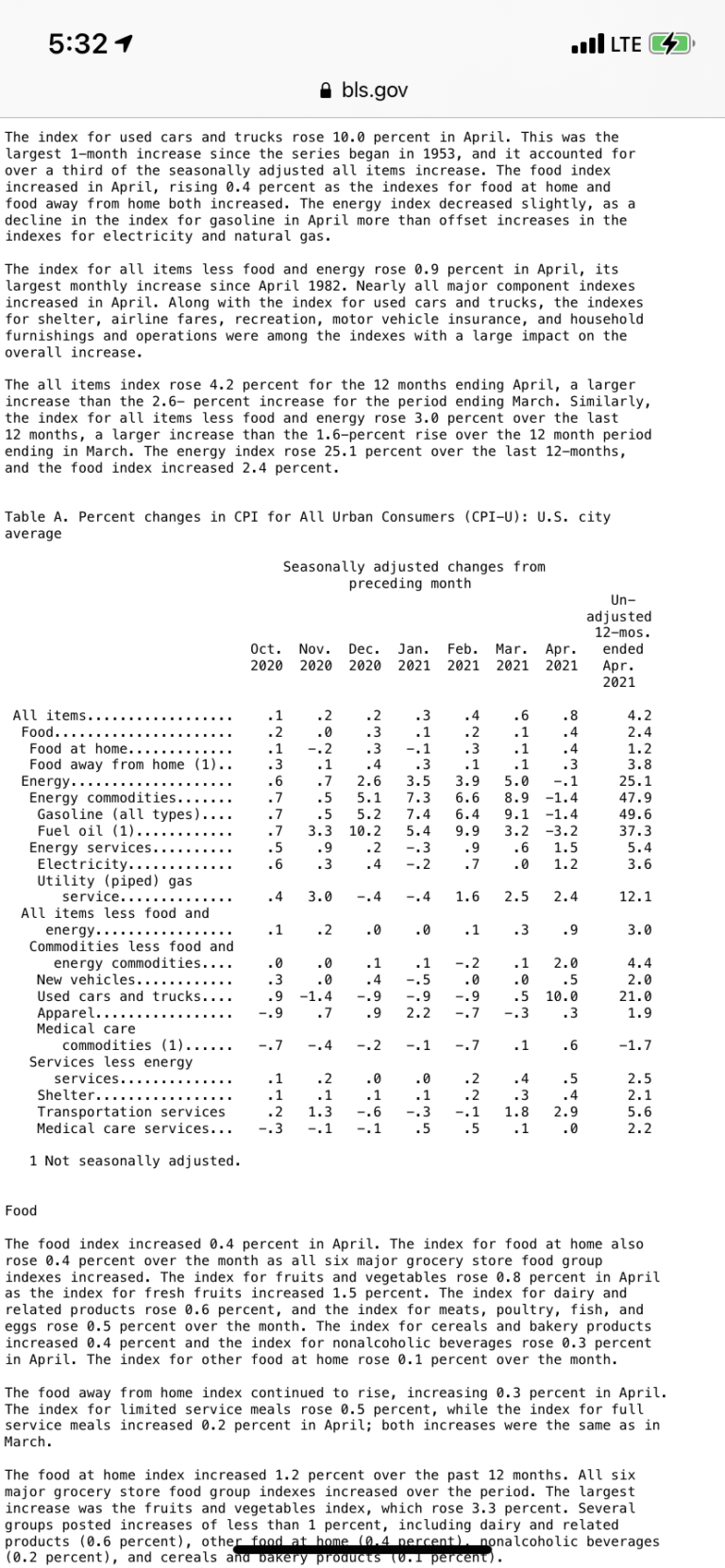

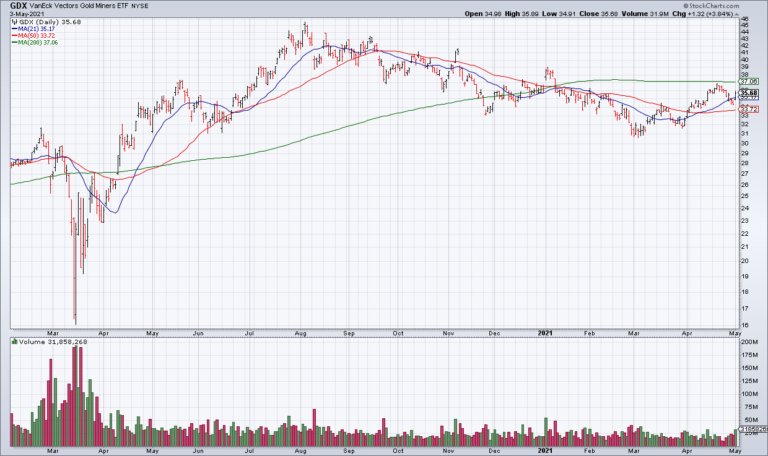

Impressive Breadth, Seasonality, TSLA, Monetary + Fiscal Policy = Supply Bottlenecks & Massive Inflation, CLF & MOS Earnings

Monday’s trading session was bullish and the trend remains up regardless of the fundamentals. The most positive development was the broadening out of market strength. Last week was all about mega cap tech pulling up a thin market. Today the…