DIS And The Bifurcated Market Thesis

I have written a lot about how the Magnificent 7 are holding up the market cap weighted indexes while beneath the surface many smaller stocks have broken down (“The Market Is About To Break”, October 3). My point has been that it’s only a matter of time before the Magnificent 7 themselves break down, bringing the market cap weighted indexes with them before the bear market is over. But the other side of the coin is that many of the smaller stocks have already had their bear market and are close to bottoming.

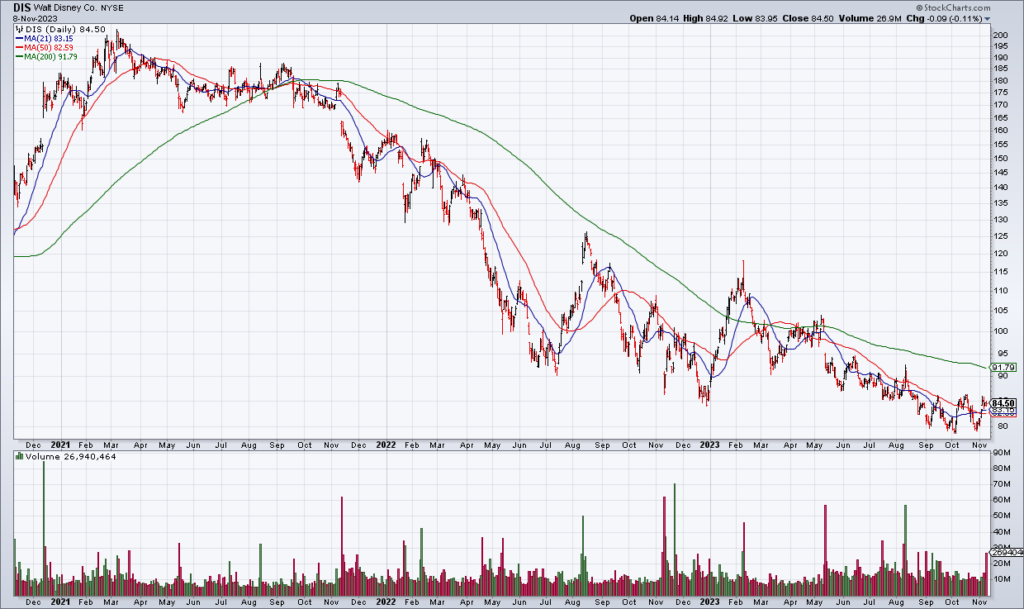

For example, take Disney (DIS) which reported FY4Q23 earnings Wednesday afternoon. The stock has already had a 60% drawdown in the last two years. While it could certainly go lower, it’s not going to $0. DIS has terrific assets like ESPN, its theme parks and Disney+. It had revenues of $89 billion and adjusted EPS of $3.76 in its just completed fiscal year. Most of its individual bear market is already behind it.

The same thing applies to a stock like PayPal (PYPL). Or even Bumble (BMBL) and Match (MTCH) which I wrote about yesterday. So in addition to my “Short QQQ, Long TLT” strategy, I think you can start picking around in some of the beaten up second tier and even lesser known stocks that have already mostly had their bear markets and represent great value.