The Market Is About To Break

On August 24, I argued in “The Bear Market Rally Is Over” that the outperformance of The Magnificent 7 was masking weak overall market internals and that the bear market was over. About a month later on September 20, the Fed did its “hawkish pause” when it paused its interest rate hiking campaign but implied that rates would stay higher for longer. As you can see in the chart above of the 30 Year Treasury yield, interest rates have soared since then. It’s not coincidental that the Equal Weight S&P ETF (RSP) broke decisively below its 200 DMA on the following day. That was the advance warning that the market was cracking.

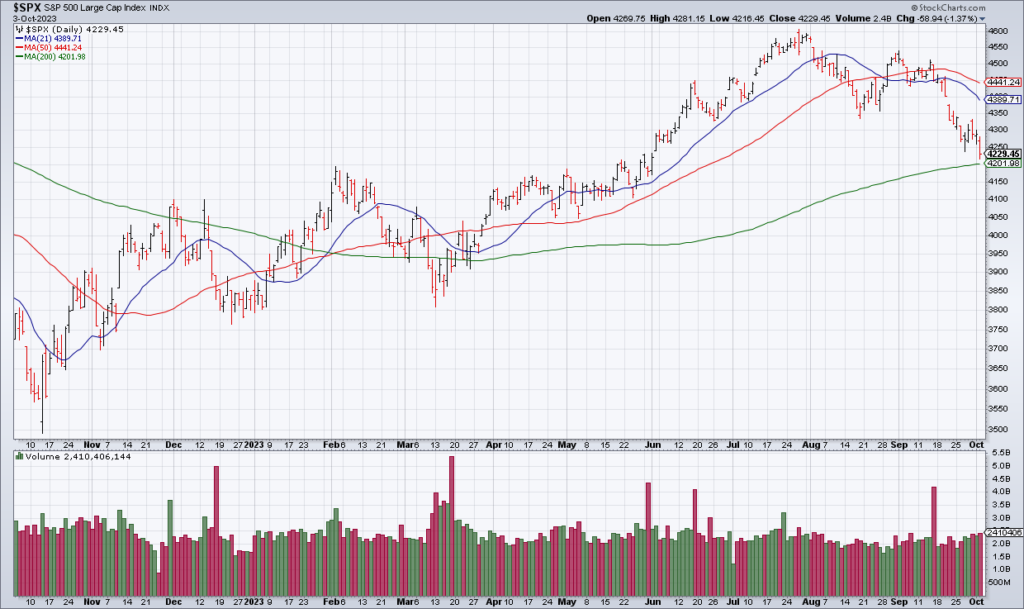

On Friday, I dedicated a section of that day’s blog to the idea that higher for longer is not sustainable. I also pointed out that the S&P’s 200 DMA was starting to come into play. As you can see in the chart above, the S&P closed Tuesday less than 30 points above its 200 DMA. When it gives way, it will be a nasty wake up call to investors around the world that the market is breaking. It won’t be long at this rate. As I’ve said repeatedly: There will be no soft landing (“Can The Fed Engineer A Soft Landing?”, Top Gun Financial, September 19).