Can The Fed Engineer A Soft Landing? AZO Earnings

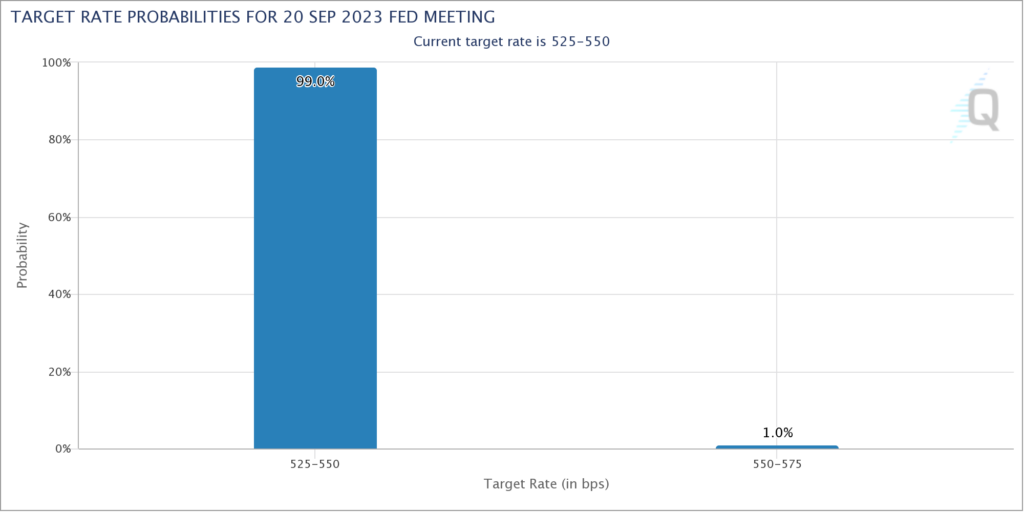

While the Fed is almost certain to pause its interest rate hiking campaign tomorrow, the question now is whether it can engineer a soft landing. On the front page of today’s WSJ, Nick Timiraos surveyed the risks (“Why A Soft Landing Could Prove Elusive” [SUBSCRIPTION REQUIRED]). Soft landings are extremely rare and difficult to achieve: “The Fed could temporarily achieve a soft landing, but I’m skeptical that it could stick the landing for very long,” said Peter Berezin, Chief Global Strategist at BCA Research in Montreal.

The first risk Timiraos notes is holding interest rates too high for too long and thus causing the economy to roll over into a recession. “My worry is that they’ll stay on ‘pause’ longer than they need to,” said Berezin. In his WSJ Heard On The Street column this morning, Justin Lahart argued that while the Fed may be done raising rates for this cycle, it may keep them higher for longer due to the economy holding up well so far (“Fed Isn’t Getting The Economy It Expected” [SUBSCRIPTION REQUIRED]).

So far, so good though: The Fed appears to have mostly tamed inflation while the economy has held up well in the face of its steep interest rate increases. My bet last year that all the Fed’s interest rate hikes would cause the economy to roll over into recession in 2023 has so far not proven out (“A Look Back At Next Year”, December 3, 2022). Will it last?

AutoZone (AZO) reported earnings for the quarter ended August 26, 2023 this morning. Once again domestic comps were a bit light at 1.7% but margins and profitability continue to hold up. The stock sold off at the open but has since rallied. The 200 Day Moving Average (DMA) has served as support for the last three years and it seems to acting as such this morning. I continue to like AZO as a perennial philosophy stock.