Peak Hawkishness: All In On TLT

[Powell] didn’t sound to me like he was itching to hike again. He sounds like he’s pretty comfortable where they are, sitting back, and watching things play out – Michael Feroli, Chief Economist JP Morgan (quoted in Nick Timiraos, “Fed Stands Pat But Keeps Hike In Play” [SUBSCRIPTION REQUIRED], WSJ A1).

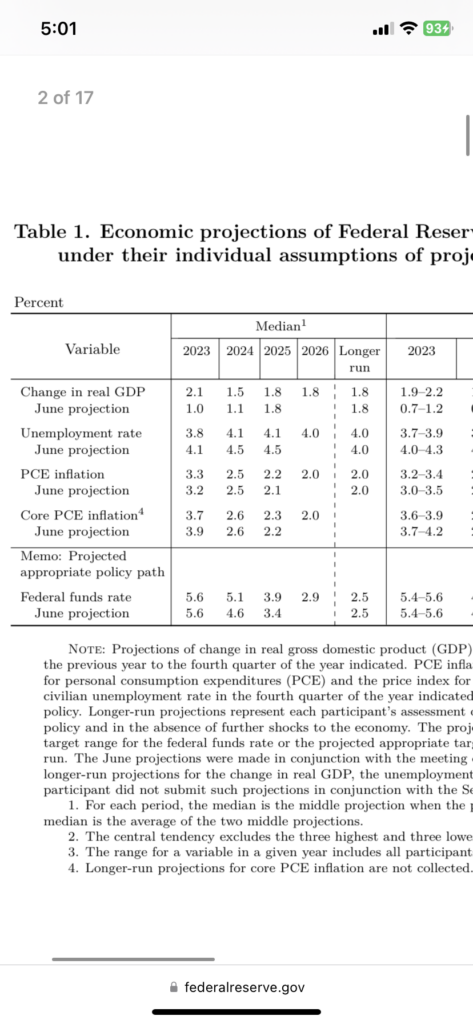

Yesterday the Fed did what has been termed a “hawkish pause”. That is they paused in their interest rate hiking campaign but said that they may not be done hiking and that in addition they will keep rates higher for longer. 12 of 19 officials expect another rate hike this year and the projections for the Feds Fund Rate at the end of 2024 increased to 5.1% from 4.6% in June. As a result, interest rates are surging this morning and the stock futures are deeply in the red. In other words, today is shaping up to be an interesting and important day.

Personally, however, I think Powell is bluffing. He doesn’t want to declare “Mission Accomplished” which would cause stocks and bonds to rally wildly and so he accompanied the pause with a lot of tough talk and hawkish projections. But I don’t think the Fed will follow through. I think they’re done raising rates and will wait and see what effect all the previous tightening has on the economy. This is also the correct course.

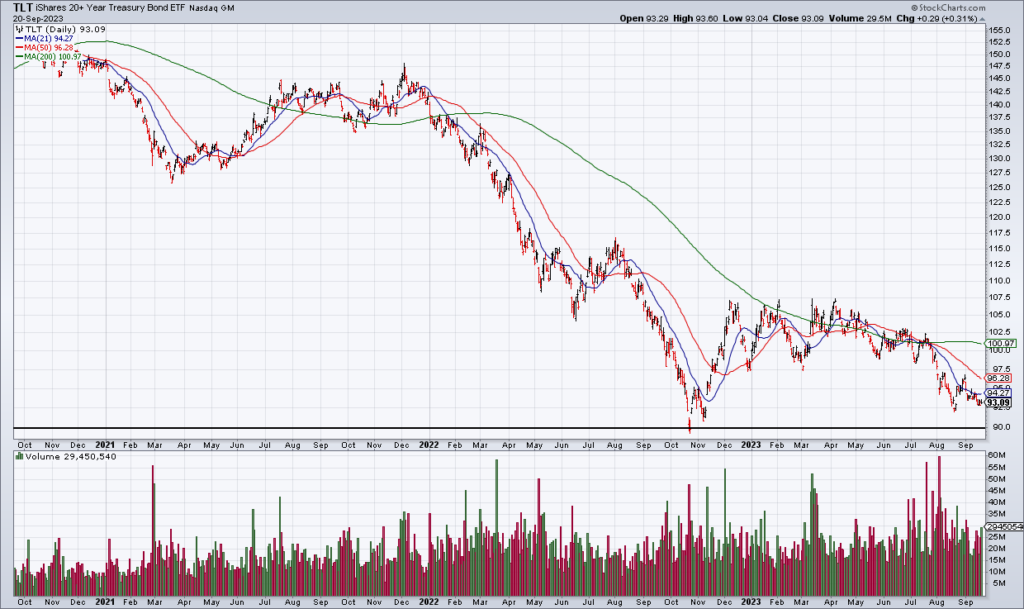

So what of it? Personally I am looking to go “All In” on long term treasuries. TLT is testing its 52-week low around $90 in the premarket – but I think it will hold. And I’ll use the selloff to add to my position. If interest rates have peaked, that’s prima facie bullish for stocks too so you might think I’d be buying QQQ as well. However I’m not because I believe that all of the Fed’s previous tightening will eventually hit the economy, corporate earnings and stocks.

In sum, we’re seeing the kind of extreme sentiment in the bond market this morning that frequently marks turning points – and creates great opportunities.