Yields Break Out, The Olive Tree Barometer

In the wake of the Fed’s “hawkish pause” Wednesday, in which they paused their interest rate hiking campaign but said they may still hike one more time this year and increased their forecast for the Fed Funds rate at the end of next year, interest rates across the all durations broke out as the market started pricing in “higher for longer”. In technical analysis, a breakout like this above former resistance in supposed to be a “resolution” leading to even higher interest rates – unless it’s a “false breakout”.

My personal feeling is that the Fed is trying to talk tough to prevent financial conditions from loosening but that they’re done raising rates. Justin Lahart had the best line of the day in his WSJ Heard On The Street column Thursday morning which led with: “Doth the Fed project too much?” (“Don’t Believe The Fed’s Rate Projections Just Yet” [SUBSCRIPTION REQUIRED]).

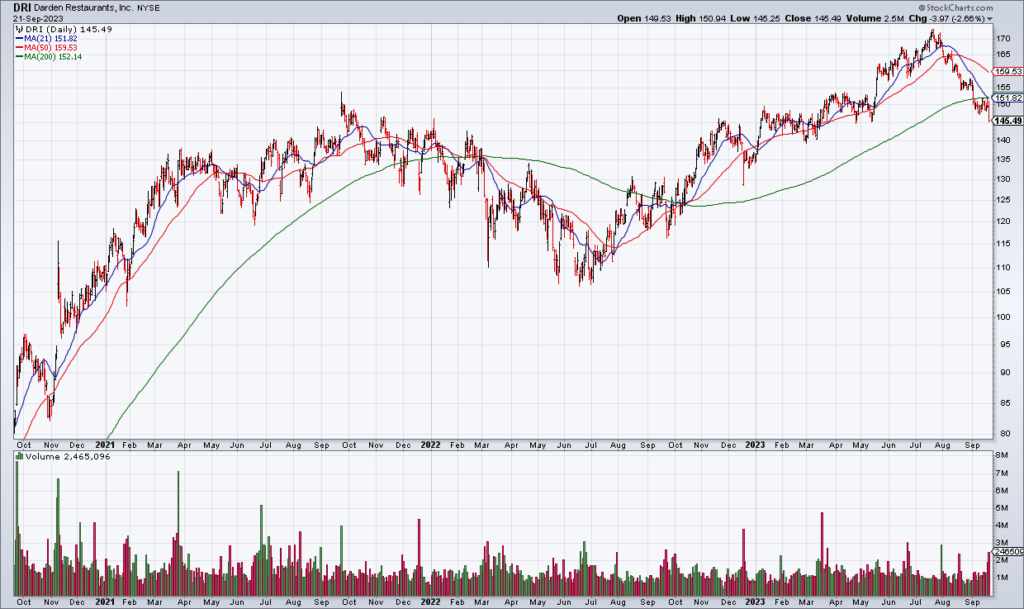

Darden Restaurants (DRI) – owner of the Olive Tree, America’s quintessential middle class restaurant – reported solid earnings Thursday morning. Comps were +5.0% and EPS increased 14%. DRI maintained its previous full year guidance, including EPS of $8.55-$8.85. Spencer Jakab argued in his WSJ Heard On The Street column this morning (“Olive Garden Keeps Blooming” [SUBSCRIPTION REQUIRED]) that DRI is a very well run company – and I don’t disagree. But I continue to be fractionally short the name because I think all the Fed’s tightening up to this point is bound to put a damper on the economy sooner rather or later. I’ve been saying this for a year now – and been wrong – but the economic rationale is inescapable.