Extremely Thin Market, MCD CAT Earnings

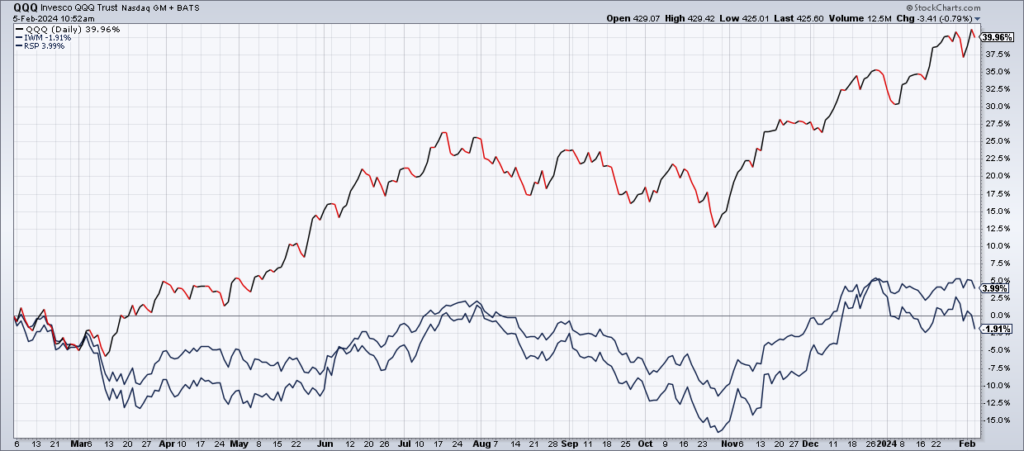

The most important thing to understand about this market is how thin participation in the rally is. I have heard technicians make various arguments that it’s not all tech using one statistic or chart or another but none of them hold water. The only thing you need to do is look at the chart above. Over the last year, QQQ is +40% – led by the Magnificent 7 – while the Equal Weight S&P (RSP) is +4% and the Russell 2000 Small Caps (IWM) is -2%. Make no mistake about it: The only thing working in this market are the big tech stocks.

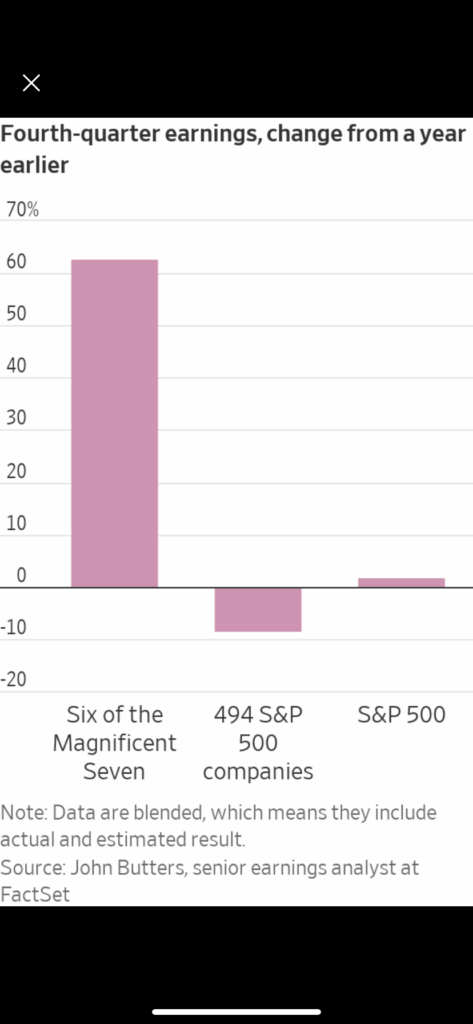

And there are fundamentals reasons for this. According to an article in today’s WSJ, 4Q23 earnings for 6 of the Magnificent 7 are +63% while earnings are -9% for the remaining 494 stocks in the S&P 500.

Friday was the perfect microcosm of this market. While all of the attention was on Facebook’s earnings and 20% move, very few noticed that more than 2 stocks declined for every one that advanced on the NYSE – only the second time this has happened when the S&P is +1% in the last 62 years according to Jason Goepfert.

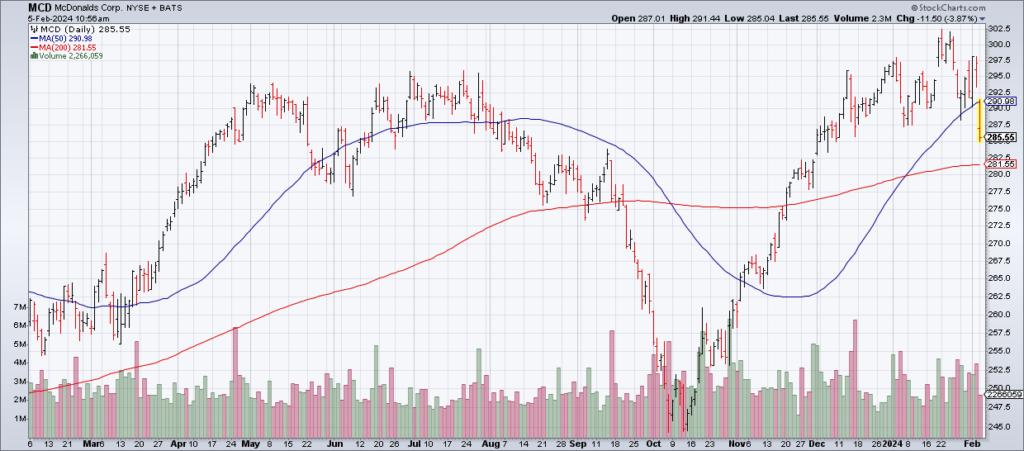

On the earnings front, two important secondary companies – McDonald’s (MCD) and Caterpillar (CAT) – reported earnings this morning. MCD is getting clipped (-4%) due to weaker than expected global comps of +4.3%. I don’t know what the reason is but I’m confident it’s just a hiccup and MCD will continue to be a long term winner.

CAT surged at the open but has since given back most of its gains. But to me the most notable data point from their earnings report was machinery sales up only +2%. That is far below normal.