Impeccable DIS & UBER Earnings Ahead Of The Jan CPI

Disney (DIS) reported sparking 4Q21 earnings after the close Wednesday. Disney’s streaming service Disney+ continues to grow extremely rapidly adding more than 10 million subscribers in the quarter to reach 129.8 million from 118.1 million at the end of 3Q21. Another bright spot was their Parks & Experiences segment which continues to recover as the economy reopens. Revenue of $7.2 billion was just shy of the $7.6 billion they reported in the pre-pandemic 4Q19. As a result DIS shares are currently +7% in after hours to about $157 – though they still have a gap to fill at about $162.50 from the gap down in the wake of 3Q21 earnings last November.

Uber (UBER) also reported an impeccable 4Q21 after the close Wednesday. Gross Bookings in their Mobility segment continued to improve as the economy reopens reaching $11.3 billion compared to $13.5 billion in the pre-pandemic 4Q19. Their Delivery (food) segment continues to grow rapidly as consumers continue the pandemic trend of having food delivered rather than going out. Bookings reached an all time high of $5.8 billion – a 19% sequential increase from the previous record set in 3Q21. UBER shares are currently +5% in the after hours.

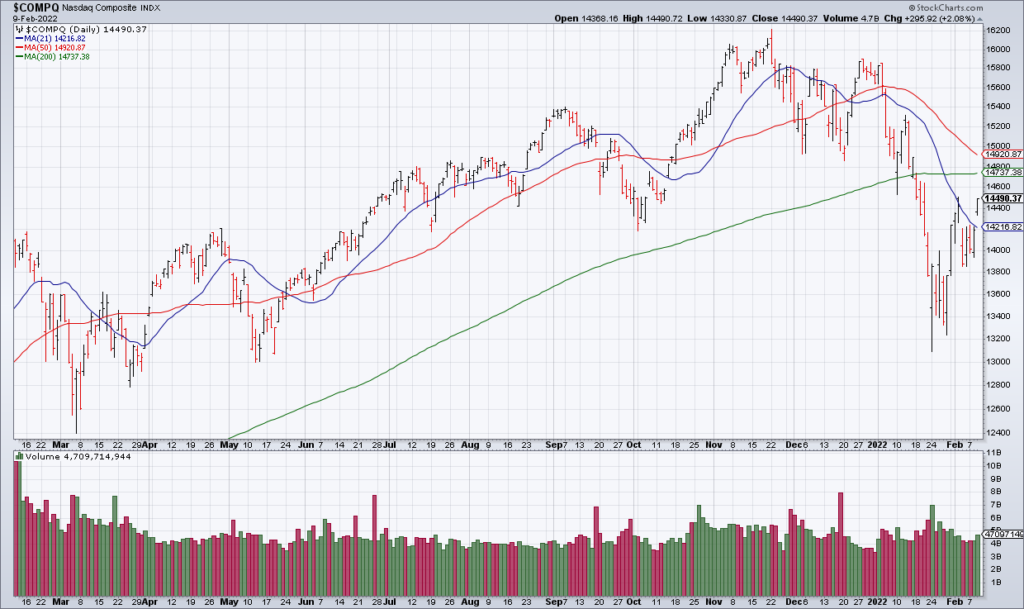

The wildcard for the current rally is the January CPI Report out Thursday morning at 8:30am EST. A hot print could rekindle fears that The Fed is behind the curve on inflation and may even do a 50 basis point hike at its March meeting. This could also cause the 10 year treasury yield to test 2%. On the other hand, a cooler than expected number could allow the relief rally to continue – though I don’t see the NASDAQ getting much above its 200 DMA at 14,737.