Logic Is With The Bears, Animal Spirits With The Bulls; NFLX Earnings

The S&P 500 broke out to new all time highs above 4800 Friday and the bulls were celebratory. Michael Antonelli – Market Strategist at Baird – reminded us that pessimists sound smart while optimists make money. Another financial advisor quipped “bears are poor”. But these are cliches not arguments.

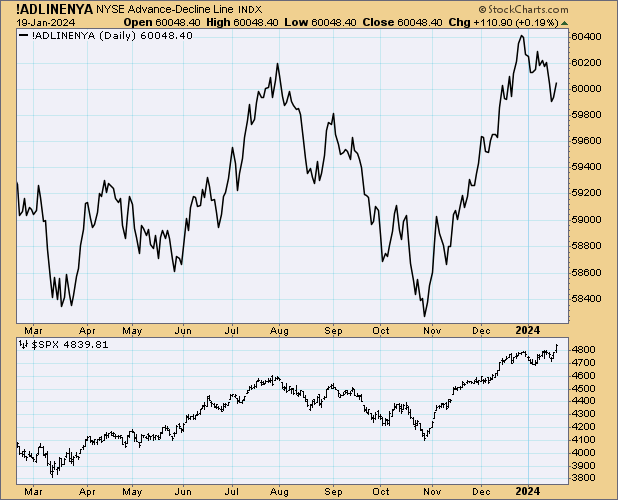

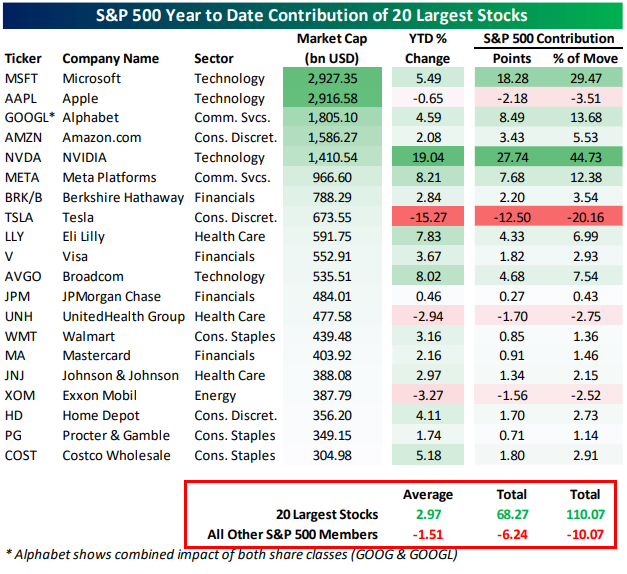

While the S&P made new highs on Friday, the Russell 2000 – which was supposed to play catch up this year as the rally broadened out – is about 20% below all time highs and down almost 3% this year. The NYSE Advance-Decline line started to head south at the end of last year, meaning more stocks are falling than rising. Microsoft (MSFT) and Nvidia (NVDA) account for 75% of the S&P’s gains so far this year. The top 20 stocks in the S&P account for 110% of the YTD gains while the other 480 have been a drag on the index. In other words: This is an extremely thin market. The only stocks really working are The Magnificent 7 – and they represent little fundamental value.

One interesting upcoming test is Netflix (NFLX) earnings Tuesday afternoon. NFLX has rallied about 40% since its last earnings report and analysts expect it to add 8.8 million paying subscribers in 4Q23 (“Netflix Has Its Own Tough Act To Follow” [SUBSCRIPTION REQUIRED], Dan Gallagher, WSJ Jan 22). NFLX is trading for ~35x current year earnings but revenue growth has been in the single digits for the last 7 quarters. Stocks don’t have to follow fundamentals but they usually do over the long term. I think NFLX is 50% overvalued with an intrinsic value of $300.