Markets Recalibrate Fed Rate Cut Expectations, DFS: Haves and Have Nots

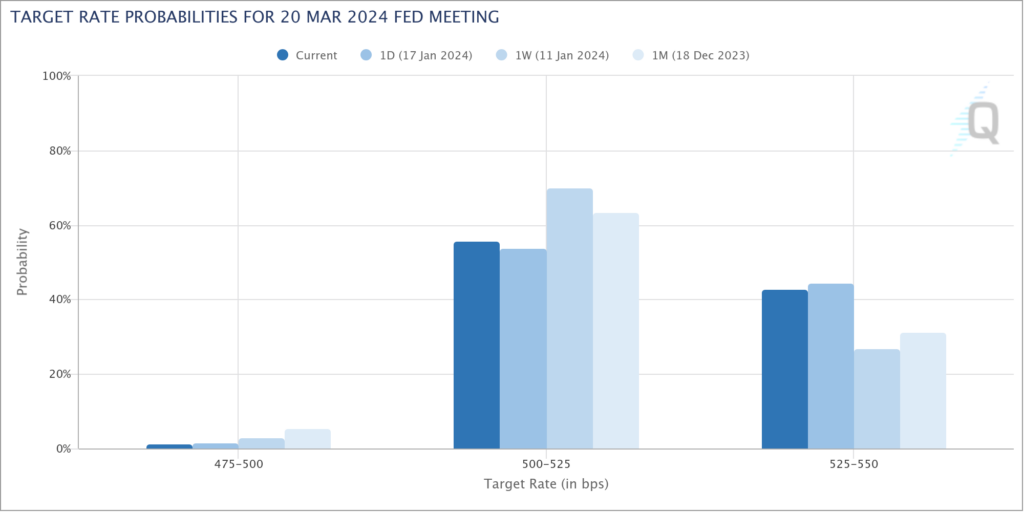

Contemporary financial markets are more about forecasting monetary policy than analyzing company fundamentals. And what we’ve seen in the first two and a half weeks of 2024 is a recalibration of expectations about how quickly and how much the Fed will cut interest rates this year. On Wednesday Fed Governor Christopher Waller warned that any interest rate cuts this year will need to be “carefully calibrated and not rushed”. The March 20 Fed Meeting has been the focal point. As you can see in the chart above, a week ago expectations for a 25 point rate cut were about 70%. Today they are about 55%.

On the earnings front, credit card company Discover Financial (DFS) reported 4Q23 earnings Wednesday afternoon. Both charge off and delinquency rates increased more than expected resulting in the stock opening today -7%. DFS provides credit cards to those with lower credit scores and therefore its results underscore my thesis that the American economy continues to be a story of haves and have nots.