Market Technicals Heading Into Big Tech Earnings

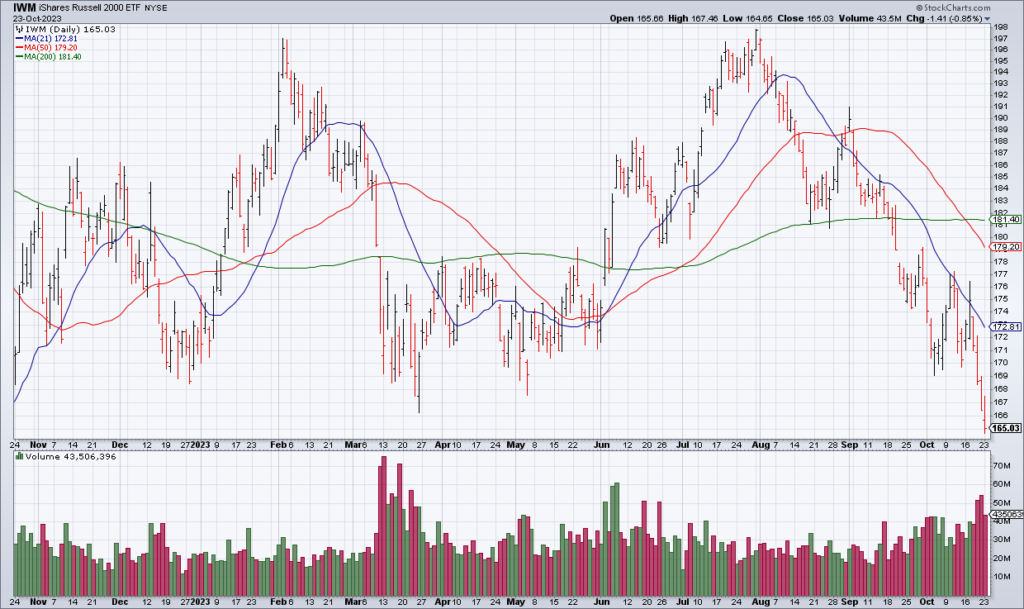

The market weight S&P 500 closed just below its 200 DMA Monday as we head into the heart of 3Q23 earnings season with Google (GOOG/GOOGL), Microsoft (MSFT), Facebook (META) and Amazon (AMZN) all reporting earnings this week. As Karen Langley pointed out in Monday’s WSJ (“High Tech Earnings To Test The Market” [SUBSCRIPTION REQUIRED], B1), the Magnificent 7 now make up 30% of the S&P’s market cap – and they are carrying the market as I’ve pointed out many times – so their reports are extremely important for the overall market. The Equal Weight S&P (RSP) and Russell 2000 (IWM) have already broken down well below their respective 200 DMAs.

My personal view is that Big Tech is maturing while the stocks are quite expensive (“Apple Zero And The Maturation Of Big Tech”, August 5). I’m in agreement with portfolio manager Carin Pai who told Langley: “These stocks are currently trading at high valuations that don’t leave much room for disappointment.” Any weakness in their reports could be the catalyst for the market weight S&P to decisively break below its 200 DMA which I’ve been forecasting for three weeks now (“The Market Is About To Break”, October 3).