Fed Minutes Look Hawkish And NVDA & SNOW Disappoint But The Market Seems Resilient

In Wednesday morning’s blog, “Pay Attention To The Fed Minutes”, I wondered if Powell would blink or continue to hammer away at the necessity to tackle inflation. As far as I can tell, he stuck to his guns on the latter, arguing that at least two more 50 basis point rate hikes at the June and July meeting are appropriate. Nevertheless, markets rallied on the news. Go figure.

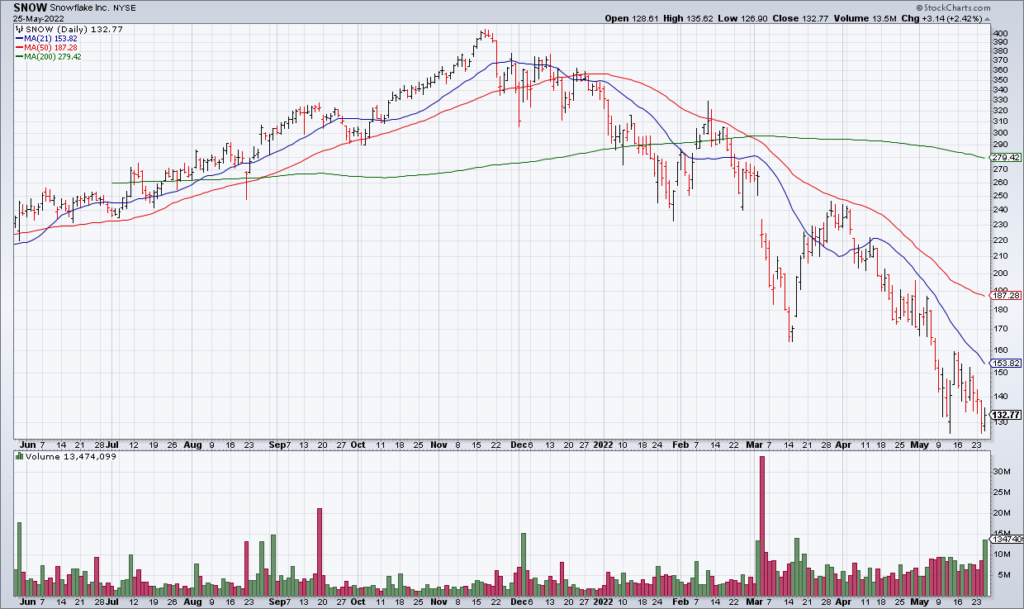

Adding to the crosscurrents were poorly received earnings reports from $400 billion chip maker Nvidia (NVDA) and $40 billion data analysts company Snowflake (SNOW) Wednesday afternoon. While NVDA’s 1Q came in fine, revenue guidance of $8.1 billion for 2Q22 came in a bit light and shares are currently -5% in the premarket.

SNOW reported 84% revenue growth in the 1Q22 and guided 2Q22 revenue growth to 71%-73%- though it still trades at 20x current year revenue. As with NVDA, these numbers are by no means terrible but SNOW shares are nevertheless -14% in the premarket.

Personally, I continue to believe the right stance is to lean somewhat long short term. While the bear market is just beginning, it will not be a straight down affair. Powerful countertrend rallies will complicate things. For now, the resilient price action in spite of bad news has me hoping that it’s all priced in. Whether that’s true or not only time will tell.