The CPI Report We Deserve

The scenario I laid out Tuesday morning is playing out exactly as I thought it might: a lower than expected October CPI Report combined with extremely bearish investor positioning has resulted in a massive relief rally (“Speculating On The October CPI”). If you bought the ARKK $38 November 11 Calls I recommended in the blog it’s going to be close. I’m hoping for another push higher today but we’ll see. Obviously you have to sell them today as they expire.

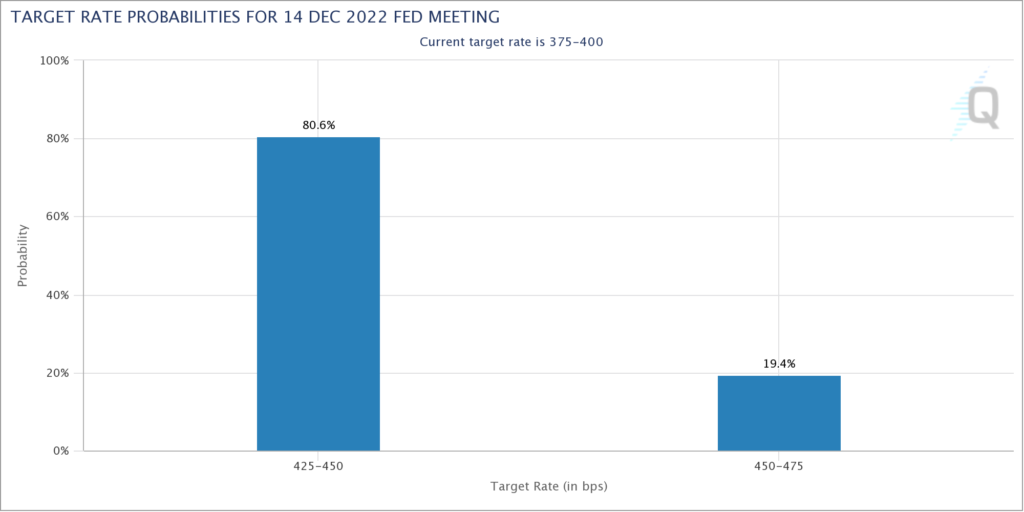

The Fed now looks poised to at least slow its pace of rate hikes starting with a 50 – as opposed to 75 – point hike in December. This may even be a real inflection point as real world inflation has been rolling over for some time and that is now filtering into the CPI in categories such as “owner’s equivalent rent” (see Justin Lahart, “The Inflation Cooldown Is Finally Here” [SUBSCRIPTION REQUIRED], WSJ November 11).

All that said I do not think this is the end of the bear market as all the tightening the Fed has done and continues to do is still working its way through the system and will lead to a recession next year in my opinion. This is a welcome reprieve and opportunity to reposition your portfolio but what I wrote yesterday morning still applies (“Things Are Starting To Break”).