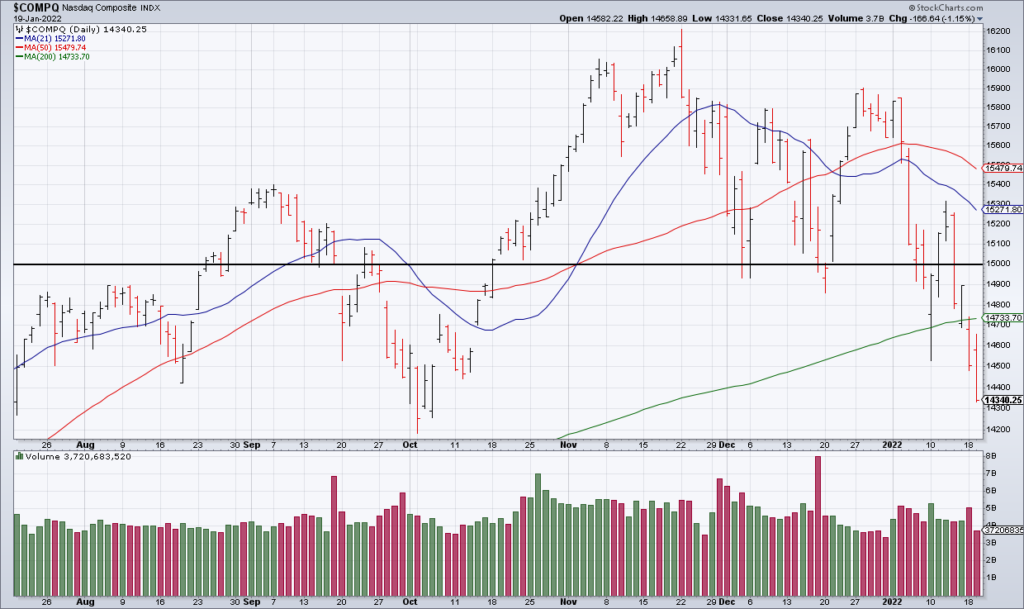

The Technical Case For A NASDAQ Bear Market

The NASDAQ appears to me to be in serious technical trouble. For a while now, I’ve been writing about the “stealth bear market”. That is, important but not leading stocks have been breaking down beneath the surface without doing much damage to the major indexes. For example, about 40% of the NASDAQ’s components are down at least 50% from their 52-week highs as you can see in the chart above by Sentimentrader.

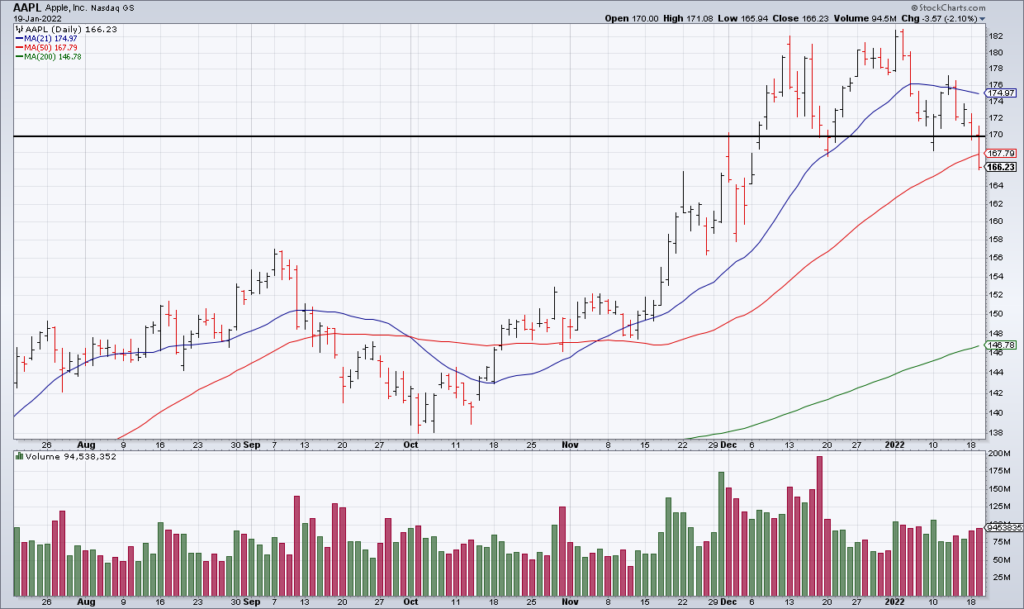

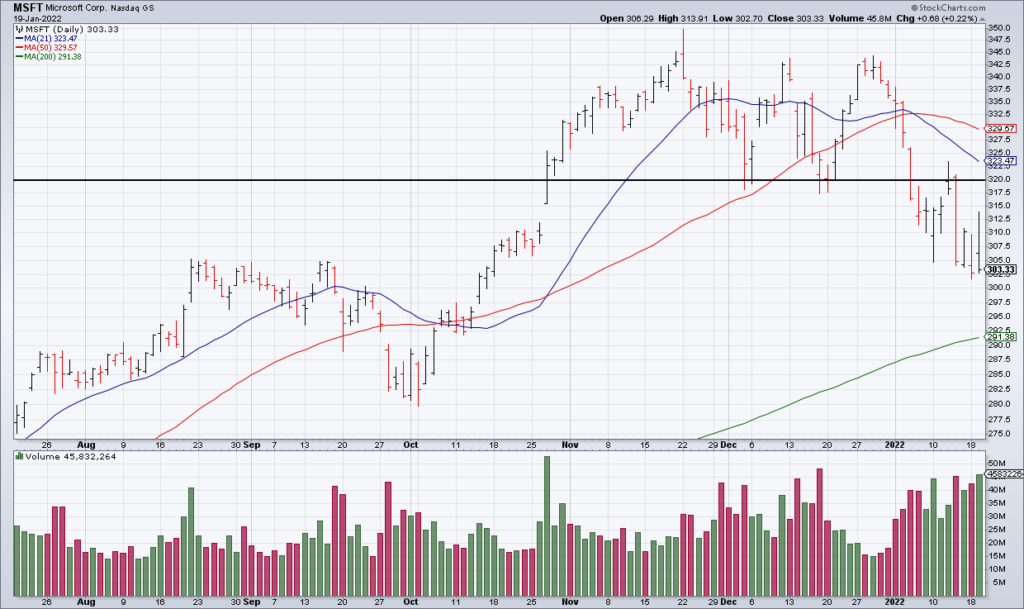

But now the generals are starting to break down as well. Apple (AAPL) has broken down below the $170 level I consider important, Microsoft (MSFT) below $320, Google (GOOG) below $2800 and Tesla (TSLA) below $1000. 7 stocks – including these four – have been propping up the market for months. Without them, the market doesn’t have legs to stand on.

Combine this technical deterioration with the raging inflation, compressed profit margins and rising interest rates that I wrote about earlier this morning and you have the recipe for a nasty bear market.