TLT $115: The Forces At Play In The Treasury Market

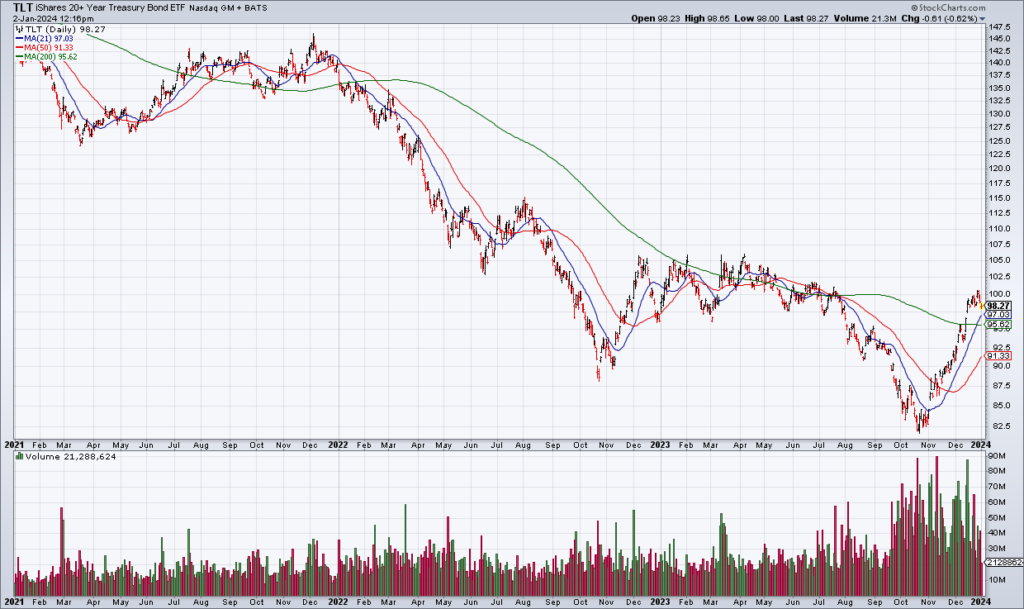

My biggest position is the Long Term Treasury ETF (TLT). After being early and getting slaughtered, TLT has rallied hard in the last two months. The reasons are tame CPI reports and the Fed Pivot. With the 10 year yield having dropped from 5% to under 4% and TLT rallying from the low $80s to close to $100, the question now arises for me: What next?

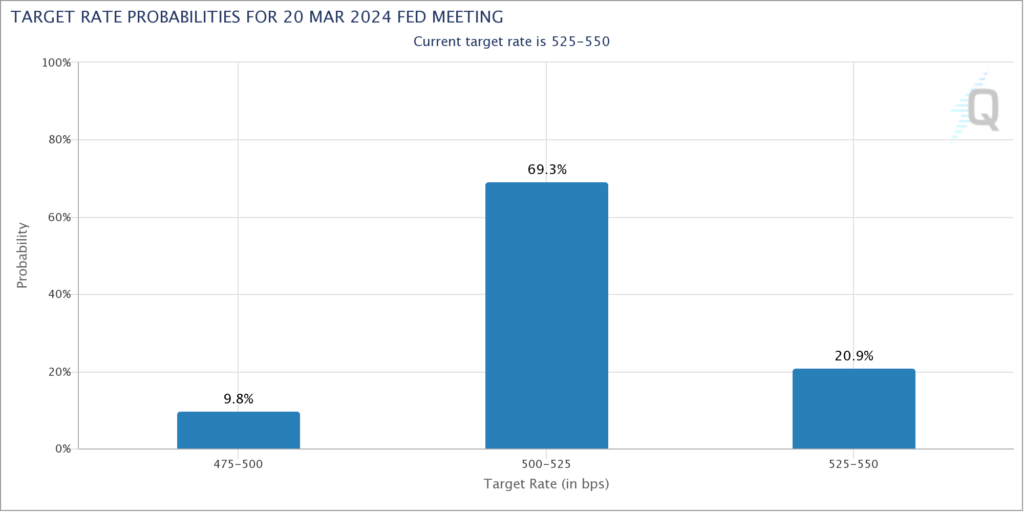

The key issue IMO is whether all the Fed’s previous tightening will slow the economy and even throw it into a recession. This has been my base case for a long time. However, most investors disagree, believing the economy is heading for a soft landing. In addition, the Fed Pivot makes that more likely. Investors are pricing in a 70% probability that the Fed cuts rates by 25 basis points on March 20. If they do, that would certainly help cushion the economy from any potential slowdown. In my estimation, then, all the tightening will at least significantly slow the economy and at worst throw it into a mild recession. That slowing of economic growth means interest rates will continue to trend lower. I believe the 10 year treasury will hit 3% sometime around the middle of this year – at which point I believe they will have reached fair value and I’ll be a seller.

What are the alternatives? Eric Wallerstein had an excellent article on the bond market in today’s WSJ (“How To Play the 2024 Bond Market” [SUBSCRIPTION REQUIRED]) in which he surveyed the views of some of the big players. James St. Aubin, CIO at Sierra Mutual Funds, is sticking to the premise that monetary policy acts with a lag and will throw the economy into recession in 2024: “The long and variable lags of monetary policy shouldn’t be ignored, and I think they are right now.” If he’s right, the 10 year yield could go below 3% and TLT above $115.

One perspective not to be neglected by bond bulls is that of Torsten Slok, Chief Economist of Apollo Global Management. Slok thinks bond investors are overly focused on the Fed and not enough on the Federal Government. The government continues to run massive deficits which it finances by issuing treasuries. All this supply – in theory – should drive down prices and increase rates: “There’s a tug of war between the Fed at one end of the rope and the supply of Treasurys at the other end. The market needs to take the bond supply more seriously.” For whatever reason, our massive deficits haven’t mattered as long as I’ve been doing this and my guess is that – however irrational – this will continue to be the case in 2024 and as long as we live in a world in which the dollar and treasurys are the foundation of the global financial system.