Wednesday Review, Technical Overview: Tech & Reopen Value, The Feds Hands Are Tied

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

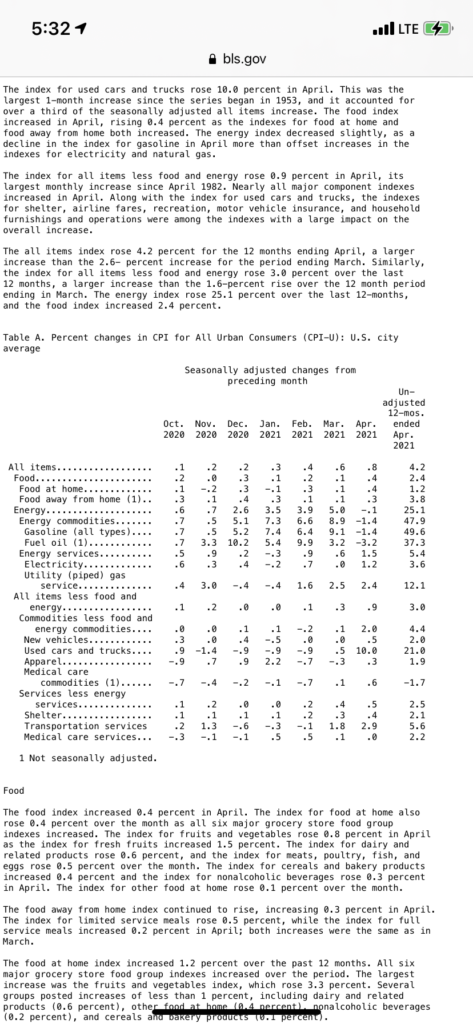

The catalyst for Wednesday’s selloff was a hotter than expected April CPI Report. Overall inflation came in at +4.2% year over year and +0.8% month over month. Core CPI, which excludes food and energy, was +3.0% year over year and +0.9% month over month. As a result, the yield on the 10 Year Treasury jumped 7 basis points to 1.695% and stocks got hit hard. The S&P was -2.14%, the NASDAQ -2.67% and the Russell -3.26%. NYSE + NASDAQ Advancers to Decliners were 1,350 to 6,298. Including unchanged issues, only 17% of securities traded on the two major exchanges, about 1 of 6, advanced on the day.

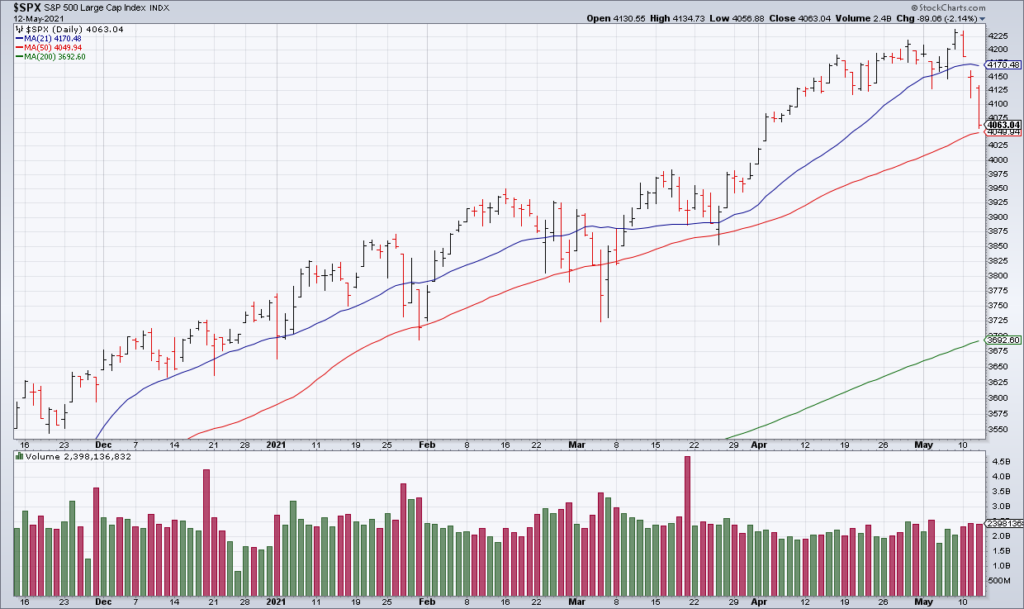

Let’s move on now to a technical overview of the market starting with the S&P 500. The S&P closed at an All Time High of 4,233 on Friday but has sold off 4% so far this week to 4,063. Technically, no damage has been done as it sits 14 points above its 50 DMA at 4,050. However, when we look beneath the surface and especially at Tech a different story emerges.

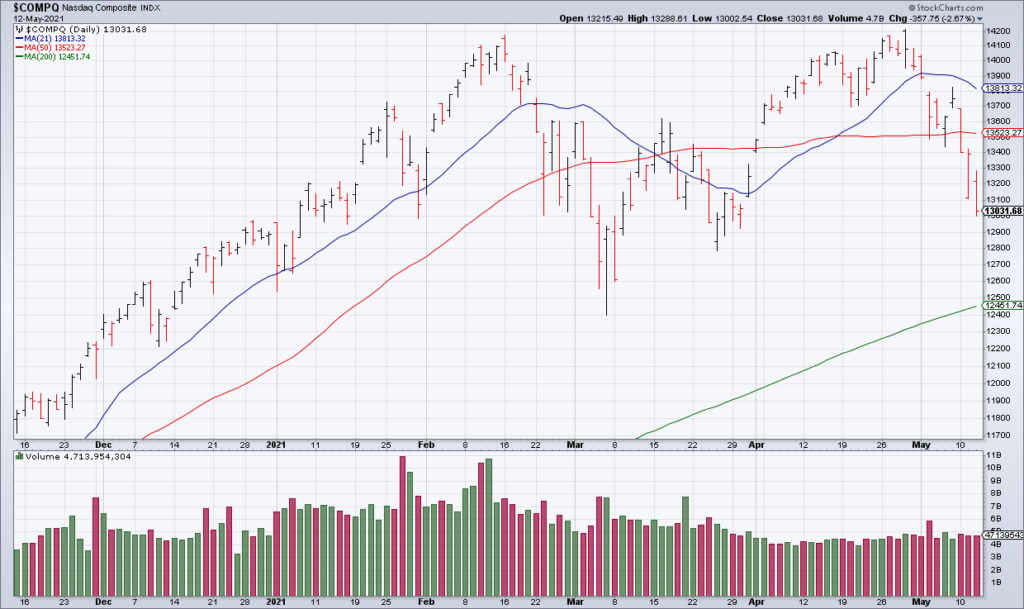

The NASDAQ has suffered significantly more technical damage. It is down ~8% from its April 26 All Time Closing High and sits smack between its 50 DMA and 200 DMA. In addition, as you can see in the chart in Ian McMillan’s tweet, the Advance/Decline line and % of stocks above their 200 DMA are rolling over. There is real trouble here.

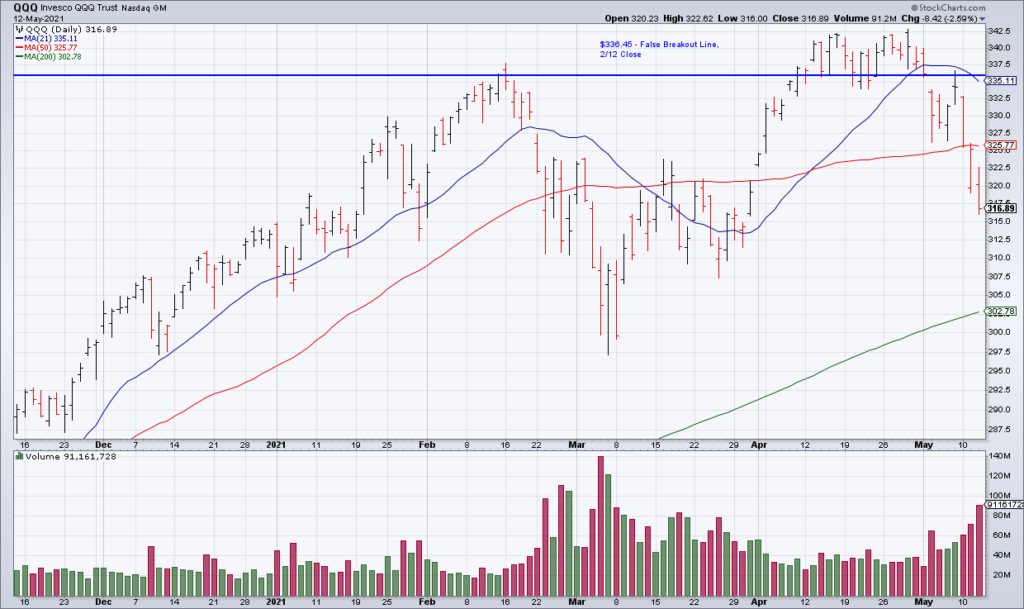

Things look about the same for the NASDAQ-100 ETF (QQQ), the most important ETF in the market. The false breakout I was tracking for the last couple of weeks looks to be a done deal at this point and the QQQ is down more than 7% from its All Time Closing High of $342.01 on April 16. It also sits squarely between its 50 DMA and 200 DMA.

Next, let’s take a look at Apple (AAPL), the most important stock in the market with a market cap of almost $2.1 trillion. AAPL closed Wednesday right on its 200 DMA for the first time during essentially the whole post-COVID rally. Obviously, a close below the 200 DMA would get a lot of investors attention.

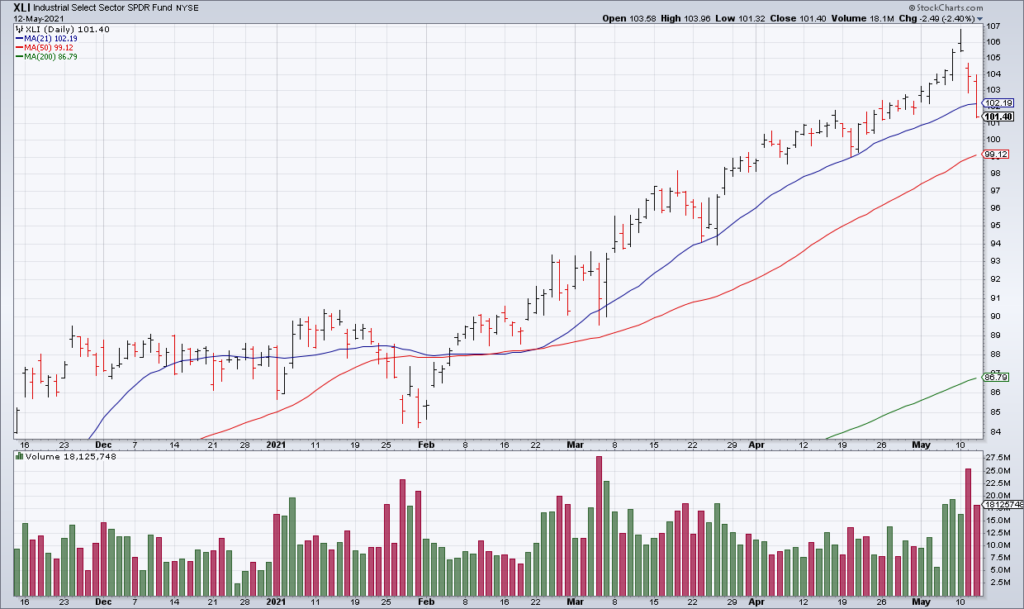

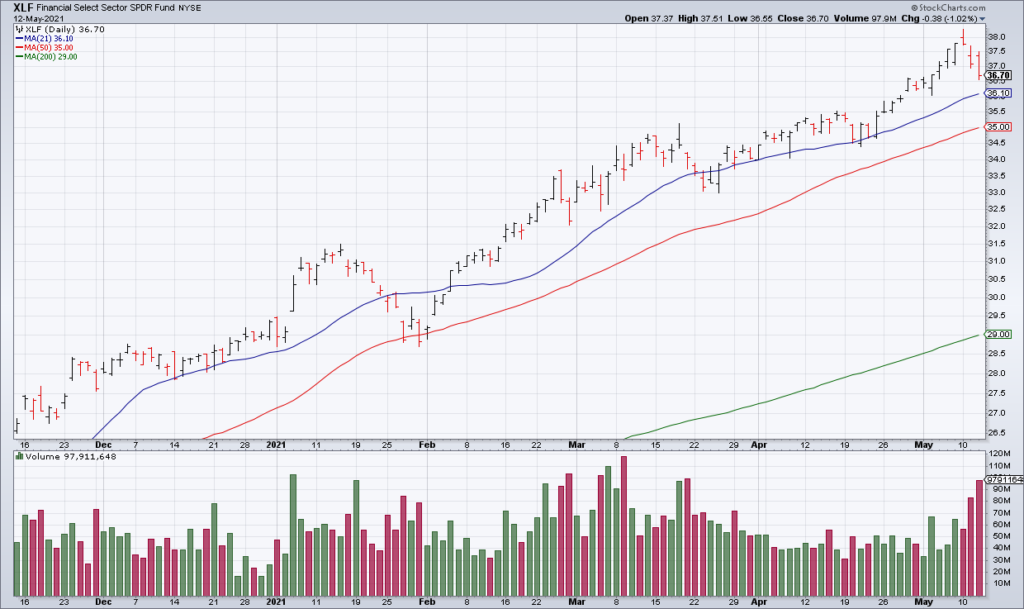

The S&P Industrials (XLI) and the S&P Financials (XLF) are the two quintessential Reopen Value sectors. They have been leading the S&P higher in recent weeks despite weakness in Tech and the NASDAQ. However, that has begun to change this week. The XLI is down ~4% this week and just avoided a buying climax* on Monday, surging well into new all time high territory before falling back to close up just 10 cents from Friday. It closed yesterday below its 50 DMA for the first time in three months. The XLF is down ~3% this week and did suffer a buying climax on Monday (barely) surging into all time high territory before closing 3 cents below Friday’s close.

[* A buying climax is when a security surges to a 52-week high intraday before closing back below the previous day’s close. It is a sign of technical exhaustion and often marks at least a short term top].

Let’s try and put it all together. Tech had been the leader of this bull market since 2009 until it started faltering earlier this year. The S&P, however, continued to chug higher led by Reopen Value, mainly XLI and XLF. Reopen Value has started to get hit this week, however, dragging down the S&P 500. In other words, Tech and Reopen Value have been the drivers of this market. With both of them breaking down, unless something changes, this market has nothing to stand on as I wrote yesterday morning.

From a macro perspective, yesterday’s hotter than expected April CPI Report puts the Fed in a tough spot. If markets fall further, the Fed would be taking an enormous risk with inflation and the dollar were it to step in with more liquidity. Put another way, the infamous Fed Put may have been taken out of play by yesterday’s April CPI Report leaving markets to fend for themselves – and they are struggling. Combining this fact with the deteriorating technical picture starts to confirm my premonition yesterday morning that last Friday may have marked a significant top.