ZM & ADSK Smashed, Interest Rates Rising

The destruction of important but not leading tech stocks continued Tuesday. Pandemic darling Zoom (ZM) reported decent earnings Monday afternoon but the market was merciless Tuesday crushing shares to the tune of -14.71% on big volume. I personally felt like enough was enough in ZM’s case and picked up a few shares below $200. Nevertheless, it is a broken stock for now.

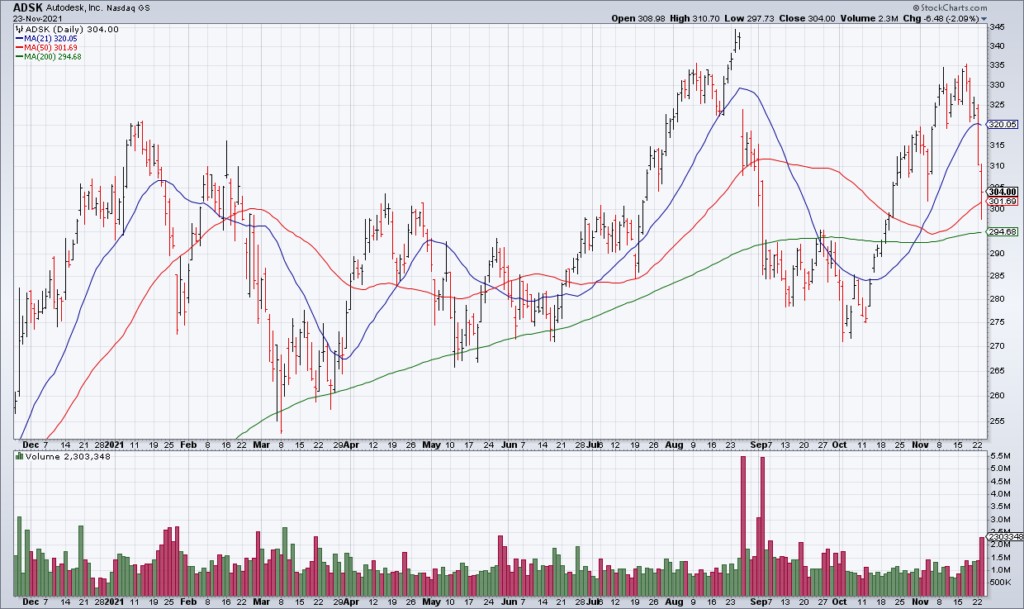

Investors seemed to be trying to get ahead of things in Autodesk (ADSK), selling off shares significantly in the two days leading up to earnings Tuesday afternoon, but to no avail. 3Q revenue was +18% and EPS +28% while 4Q guidance looked solid to me as far as I can tell. Regardless, shares were crushed in the after hours (-14.48%) and another expensive – and important though secondary – tech stock is set to bite the dust Wednesday.

Cundill Capital put up a fascinating excerpt of an exchange between two of the best investors in the world, Seth Klarman and Stan Druckenmiller, from a few weeks ago. Druckenmiller believes that we are in a massive Everything Bubble fueled by low interest rates. Remember how David Tepper thought that a year end “trader’s rally” was dependent on interest rates.

Well interest rates have been rising rapidly since the October CPI Report two Wednesday’s ago in which headline inflation rose 6.2% year over year and 0.9% month over month – much hotter than was expected. Keep an eye on this as this could add further fuel to the tech stock bonfire. If they continue to rise, Santa may not be coming to town this year despite the fact that everyone is expecting him.