Back To Reality: The Earnings Recession Has Arrived

Sentiment became euphoric Thursday on the back of META earnings yesterday afternoon sending the NASDAQ up 3.25% and the S&P 1.47%. Unfortunately – as I suggested in my blog this morning (“The Bear Market Has Been Cancelled”) – price was diverging from fundamentals and Apple (AAPL), Google (GOOG/GOOGL) and Amazon (AMZN) earnings – just out after the close – have confirmed that suspicion.

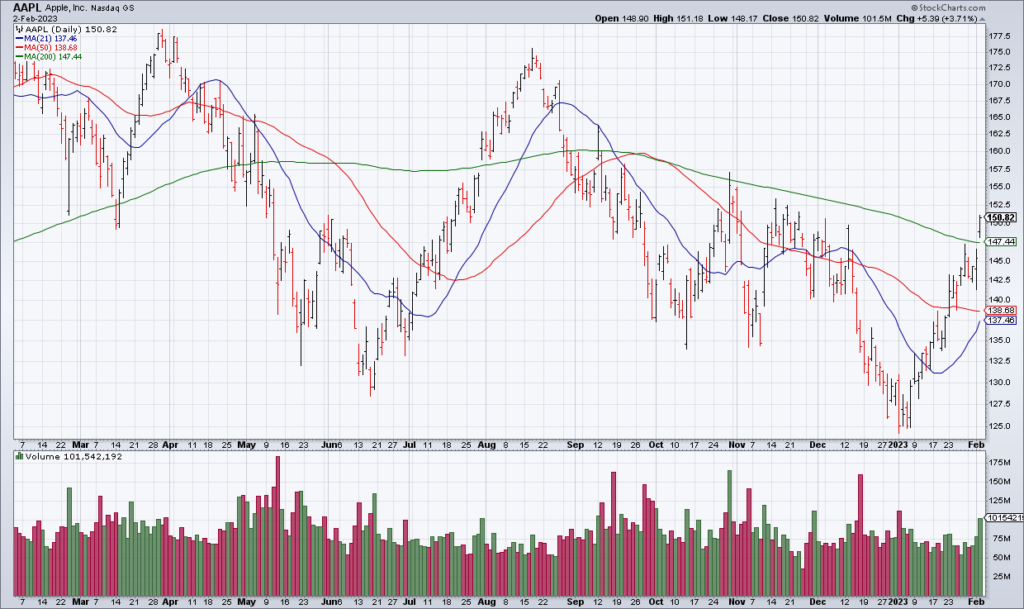

Let’s start with the most important stock in the world: AAPL. While AAPL broke out above its 200 DMA today, its fundamentals are actually breaking down and so its stay in that territory is likely to be short lived. Revenue declined 5.5% and Net Income 13.4% from a year ago, misses on both the top and bottom line. AAPL shares are currently -4% in the after hours.

GOOG/GOOGL also broke out above its 200 DMA today but the fundamental story is the same. Revenue was only +1% and EPS declined 31% year over year.

Same story with AMZN: the stock got ahead of fundamentals. The crown jewel of AMZN is Amazon Web Services (AWS) – their cloud business – and revenue growth in that segment decelerated to +20%. AMZN’s 1Q23 revenue guidance also came in light as you can see in the tweet above by Benzinga.

In last weekend’s Market Preview I said that this week was “poised to be epic” and it has not disappointed. Unfortunately for the bulls, it looks like it will be ending on a sour note.