The Mag 7 Is Now The Fab 5, TSLA 1Q Deliveries, PVH -20%

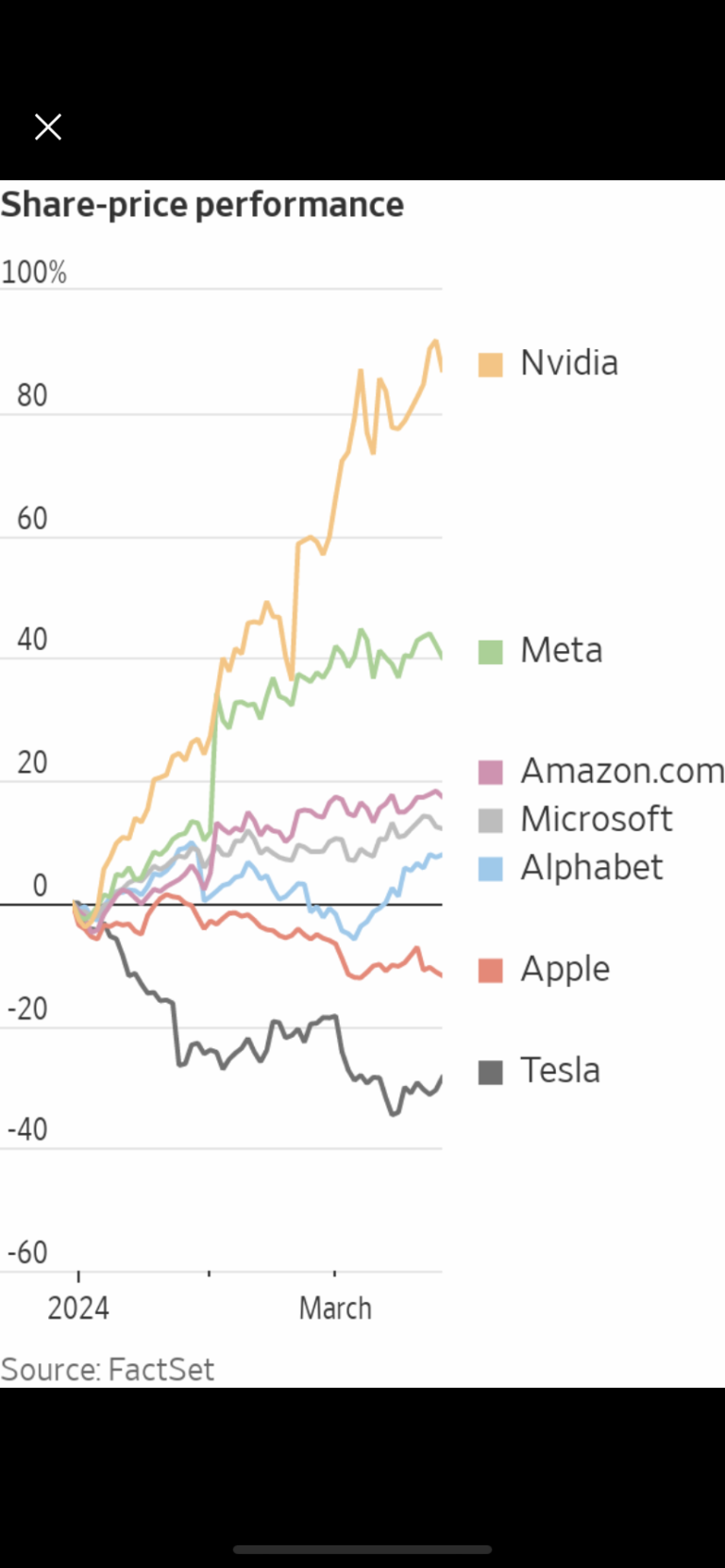

While the market held up last week despite underperformance from the Magnificent 7 (or Fab 5) because of strength in the rest of the S&P 500, it can’t go much higher without them leading. That’s simply a function of math:…