Is Inflation Sticky? NVDL: 2x Long NVDA

The February CPI came in this morning marginally hotter than expected with both headline and core increasing by 0.4% month over month. As I wrote earlier this morning, bulls would have liked to see core at 0.3%. Which raises the question: Is inflation proving to be sticky?

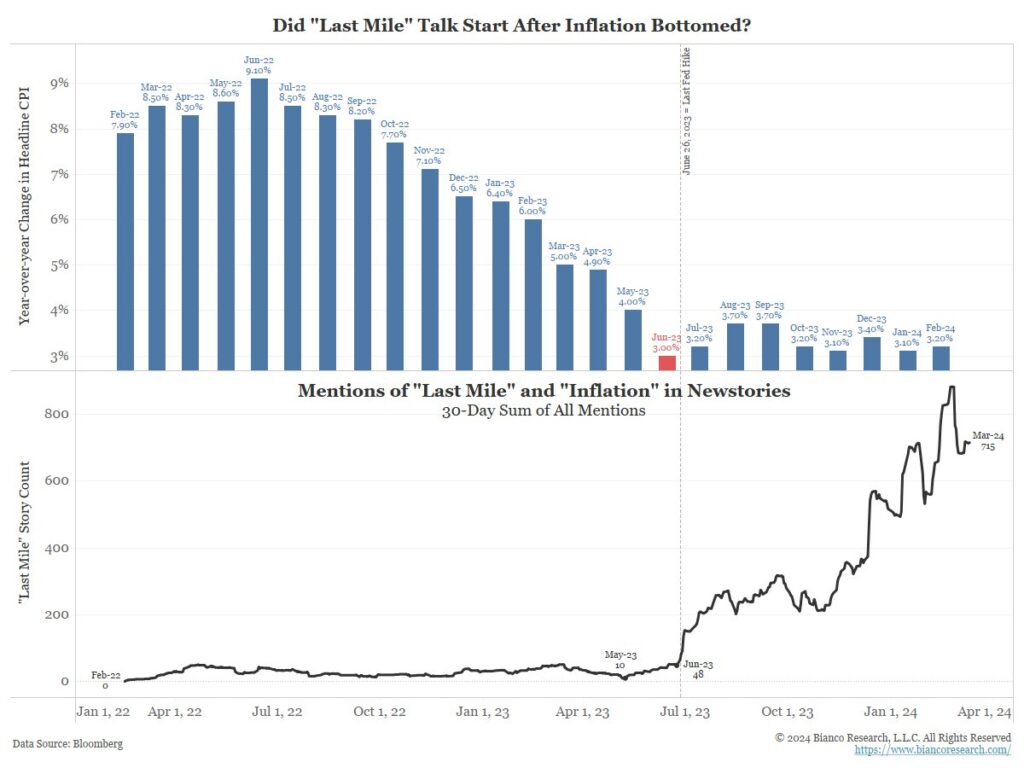

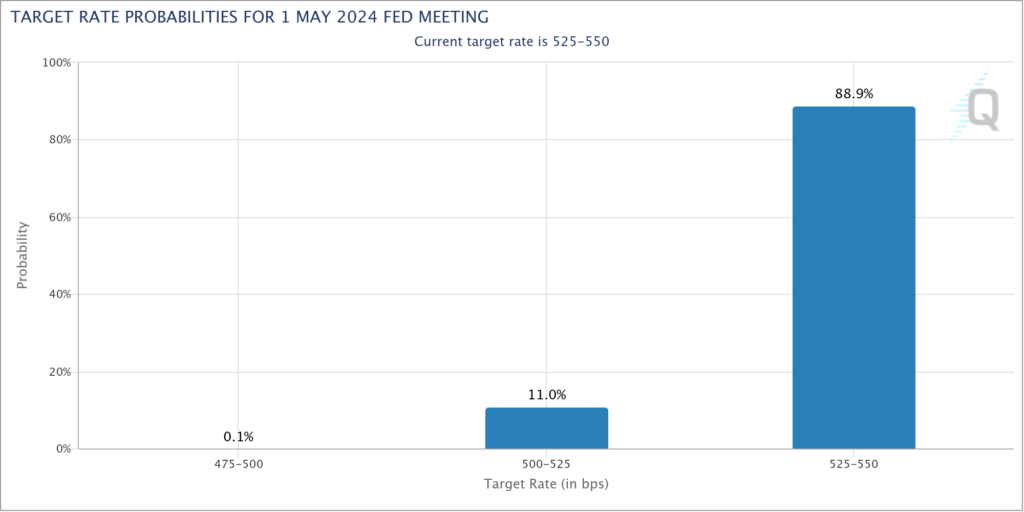

Inflation peaked in June 2022 with headline CPI of 9.1%. Due to the Fed’s aggressive rate hikes, it rolled over and came in at 3.0% a year later. But it has not made any progress toward the Fed’s long term target of 2% in the last eight months. As a result, Fed Futures have essentially taken a May rate cut off the table as you can see in the second chart above.

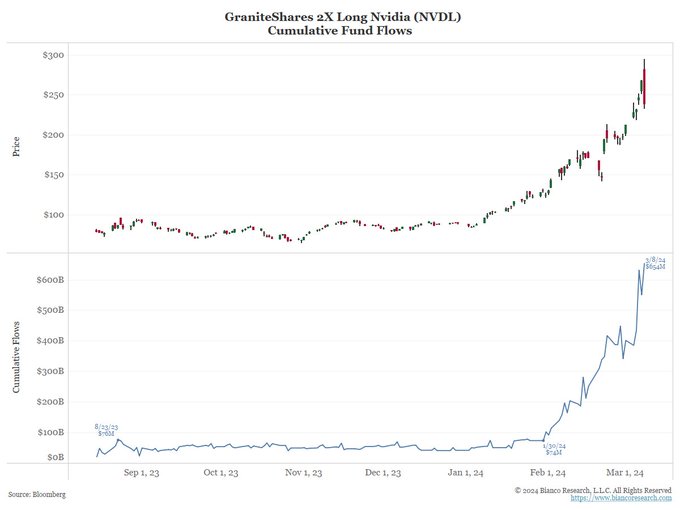

Nevertheless, the market continues to levitate. Jim Bianco had an excellent thread on Sunday about NVDL, the GraniteShares 2x Long NVDA ETF. $600 billion flowed into the ETF over the last five weeks. $100 billion traded hands on Friday alone. As if NVDA itself weren’t enough, investors are pouring money into even more speculative plays like NVDL and Super Micro Computer (SMCI).

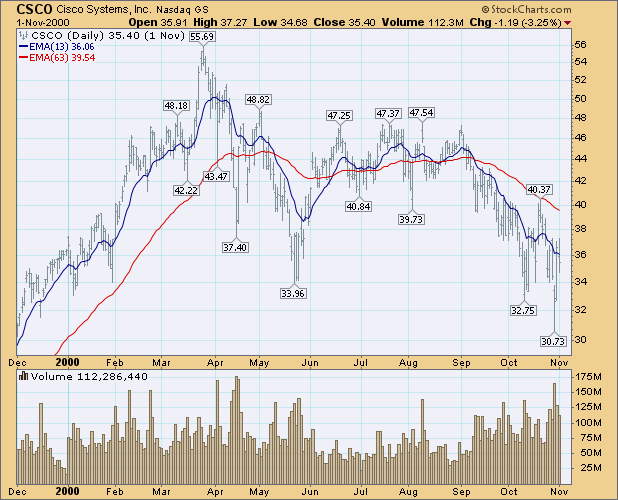

A couple weeks ago the WSJ’s Jon Sindreu made an excellent analogy between NVDA and Cisco (CSCO) at the end of the Dot Com Bubble (see “Don’t Call It A Bubble”, 2/29). The technician Walter Deemer helpfully tweeted a chart of CSCO in 2000 on Sunday. When the mania ultimately broke in March, CSCO lost a third of its value in a few weeks.