Deteriorating Internals, MSFT Earnings And A Big Earnings Afternoon (AAPL TSLA FB)

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

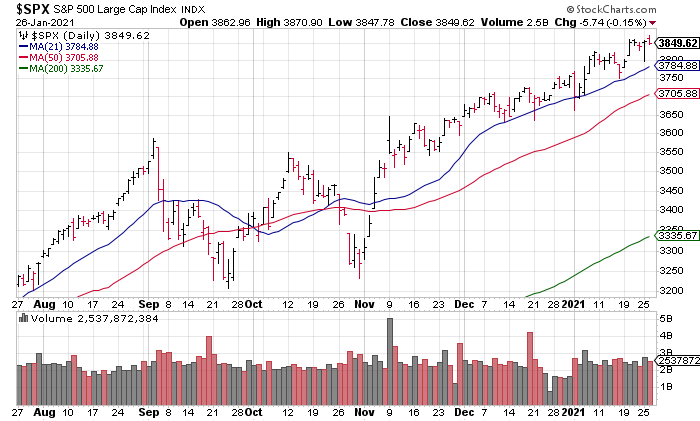

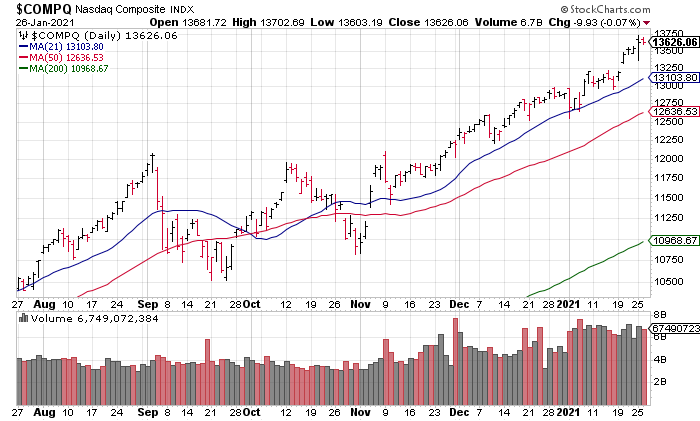

When studying the markets, most investors look at the major indexes, mainly the S&P and NASDAQ. A look at them suggests the market is in perfect health.

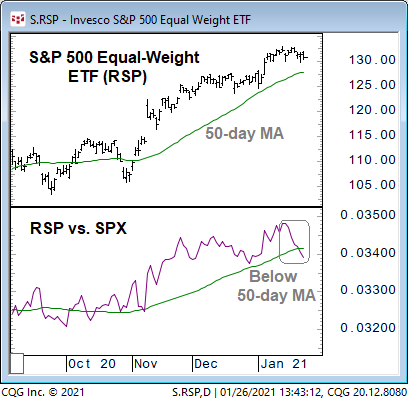

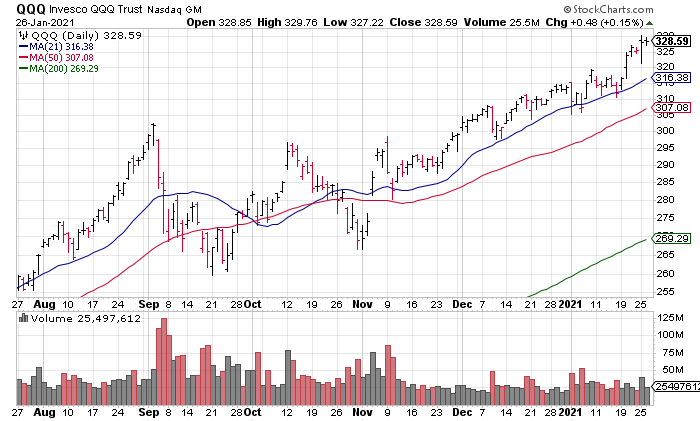

However, beneath the surface internals have been deteriorating the last few days. The rotation from Mega Cap Tech best represented by the QQQ into Small Caps best represented by the IWM has reversed. That is, Mega Cap Tech stocks have been holding the market up in recent days while their smaller brethren, who have less impact of the market cap weighted indexes, have started to struggle. This was beautifully illustrated yesterday in a chart by Katie Stockton of the S&P Equal Weight Index as represented by the RSP ETF and the RSP to SPY ratio (Chart Source: Katie Stockton Twitter, January 26, 10:54am PST).

While the S&P itself is essentially trading at All Time Highs, the S&P Equal Weight Index has started to rollover in recent days, especially relative to the S&P itself. Why? Because investors are selling smaller stocks and rotating back into the Mega Cap Tech stocks represented by the QQQ which are holding up the major averages.

For example, let’s delve a bit into Tuesday’s session. The S&P was -0.15% while the NASDAQ was flat. However, the Equal Weight S&P (RSP) was -0.49% and the Russell -0.62%. What held the market together was the QQQ which was +0.15%. Remember: Because the major indexes are market cap weighted, a stock like Apple (AAPL), which has been ripping of late, counts ~20x as much as a stock like Starbucks (SBUX) which will likely be down in today’s session after reporting somewhat poorly received earnings yesterday afternoon. In addition, for a flat day, breadth was pretty bad with NYSE + NASDAQ Advancers to Decliners 2,776 / 4,255.

Now, if we’re experiencing an end of the rotation from QQQ into IWM and the beginning of the rotation back the other way, the big Mega Cap Tech stocks better deliver or the market will crack. Microsoft (MSFT) kicked things off for the Big 6 (AAPL AMZN MSFT GOOG GOOGL TSLA FB) yesterday and its report was strong and well received. Revenue was +17% (Cloud +23%) resulting in 34% increase in Diluted EPS. Shares rallied in the after hours.

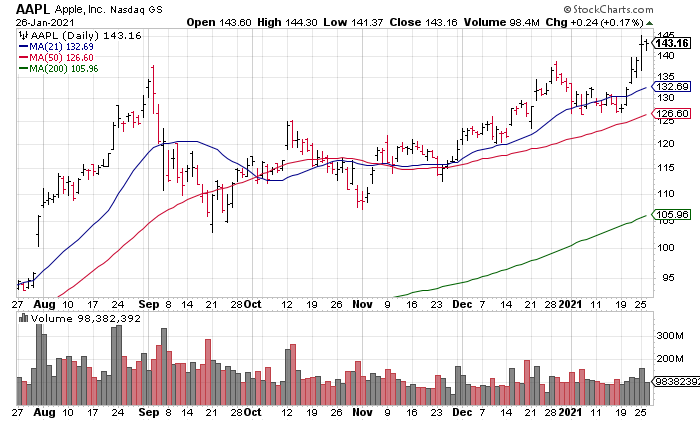

But the real test comes this afternoon when Apple (AAPL), Tesla (TSLA) and Facebook (FB) all report. All three stocks are coming into their reports strong and with high expectations, especially AAPL – the largest and most important stock in the world with a market capitalization of $2.47 trillion as of yesterday’s close (Tuesday January 26). They’ll have to meet or exceed those expectations for the market to keep working higher in the coming days.

As I said, AAPL’s report this afternoon is especially important and the expectations are high. The problem is that AAPL’s business has matured and is actually in decline while its stock continues to trade as if it is still in the midst of its growth cycle (see “Apple Is Worth ~$54”, Top Gun Financial, December 30, 2020).