DIS Cracks, Precious Metals Rip, BMBL For The Long Term, RIVN IPO: $100 Billion Valuation “Pre Revenue”

The market had a marginal bounce Thursday after two days of selling with the NASDAQ +0.52%, S&P +0.06% and Russell +0.82%. I wouldn’t get too excited if I was a bull because in addition to the gains being limited, volume was tepid and the final hour was weak.

The most important thing that happened in the stock market IMO was that Disney (DIS) – one of the 25 most important stocks in the market – cracked below $167.50 on heavy volume, erasing all gains over the last 11 months.

From an overall financial market standpoint, I think the most important thing that happened Thursday was that the precious metals continued to rip in the face of Wednesday morning’s hot October CPI Report. The Van Eck Gold Miners ETF (GDX), for example, was +2.33% and did indeed rip through its 200 DMA as I surmised it would yesterday afternoon. Silver and the silver miners had a big day as well.

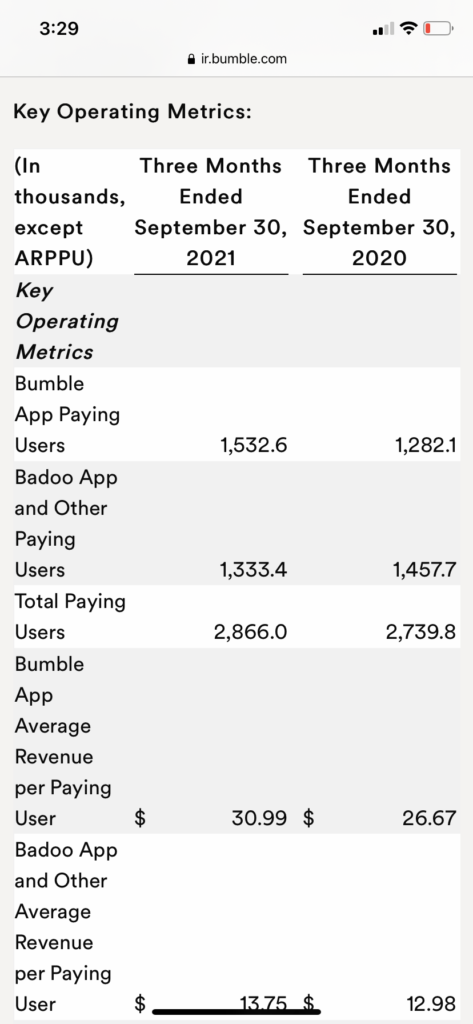

Of special interest to me was a major selloff in dating app company Bumble (BMBL). I am a Bumble subscriber, long term bull on the stock and I think the 19.25% selloff was a major overreaction. The cause was a 2% decline in paying subscribers compared to 2Q21.

A closer look, however, shows that the decline was entirely due to BMBL’s secondary app Badoo, which is big in many international markets that suffered from COVID-19 restrictions. Bumble app itself had a fine quarter, increasing paying subscribers by 4% compared to 2Q21.

I like BMBL long term because it has strong brand appeal – especially for women who are empowered by having to initiate the first message – great management and the growth story has been excellent for the 2 years for which they have reported numbers.

The selloff created a perfect buying opportunity in the stock – which I believe is a 10 bagger from here long term – and I picked up some shares.

Lastly, I must mention the IPO of electric vehicle maker Rivian (RIVN). RIVN started trading on the NASDAQ Wednesday and closed Thursday with a market cap of $120 billion. The incredible thing is that RIVN has delivered only 156 cars through October 2021 (as you can see in the excerpt from its S-1 above) – and almost all of them to its own employees (“Rivian, the Government Unicorn”, The Wall Street Journal, Friday November 12). That investors are valuing what is essentially a start up (Dan Nathan called it “pre revenue” on CNBC Wednesday) at that price is an indication of the scale of the bubble. I am using the term clinically when I say that the stock market is delusional.