Fed On Hold, Small Caps Explode, On Target (TGT)

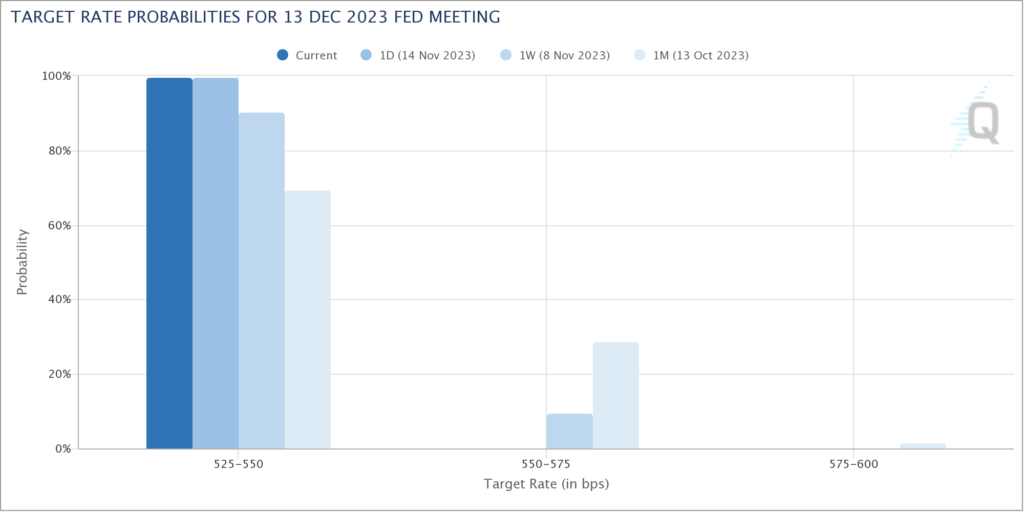

On Tuesday morning, the October CPI came in below expectations (0.0% headline, 0.2% core) leading to an explosive move higher in stocks and bonds. The rationale is that with inflation now apparently under control, the Fed no longer has any reason to continue hiking. As you can see in the Fed Futures Probability chart above, the market was pricing in about a 10% chance of a hike on December 13 prior to the CPI and a 0% probability after. The Fed is now on hold and likely done raising rates for this cycle.

While everything rallied Tuesday, the most striking move was in the Russell 2000 index of small cap stocks. As you can see in the chart above, IWM rallied 5.49% on the biggest volume in the last 12 months. This is important because the primary bearish technical case has been the lack of breadth. If the small caps can continue to move higher and get above their 200 DMA, that would go a long way toward mitigating that argument.

Lastly, Target (TGT) reported better than expected earnings Wednesday morning. While comps were still weak at -4.9%, Adjusted EPS was significantly better than expected at $2.10 (TGT had guided to $1.20-$1.60). As I wrote on Monday afternoon, the stock was extremely oversold and potentially represented deep value. Shares are currently +14% in the premarket.