NEM: The Precious Metals Miners Are Poised To Rally

Leading gold miner Newmont (NEM) reported 3Q22 earnings Tuesday morning. NEM continues to execute with 1.49 million ounces in attributable gold production putting it on pace for 6 million ounces of production in 2022. Adjusted EBITDA of $850 million and Adjusted EPS of 27 cents – however – were down 35% and 55% year over year, respectively. Why?

As we all know the Fed has been slamming on the breaks tightening monetary policy to reign in inflation. That has resulted in a decline in the prices of all commodities including the precious metals. NEM’s average realized price per ounce of gold was $1691 in 3Q22 – down from $1892 in 1Q22. The precious metals miners are obviously highly levered to the price of gold. NEM can control its own business but not the macro factors effecting the price of gold.

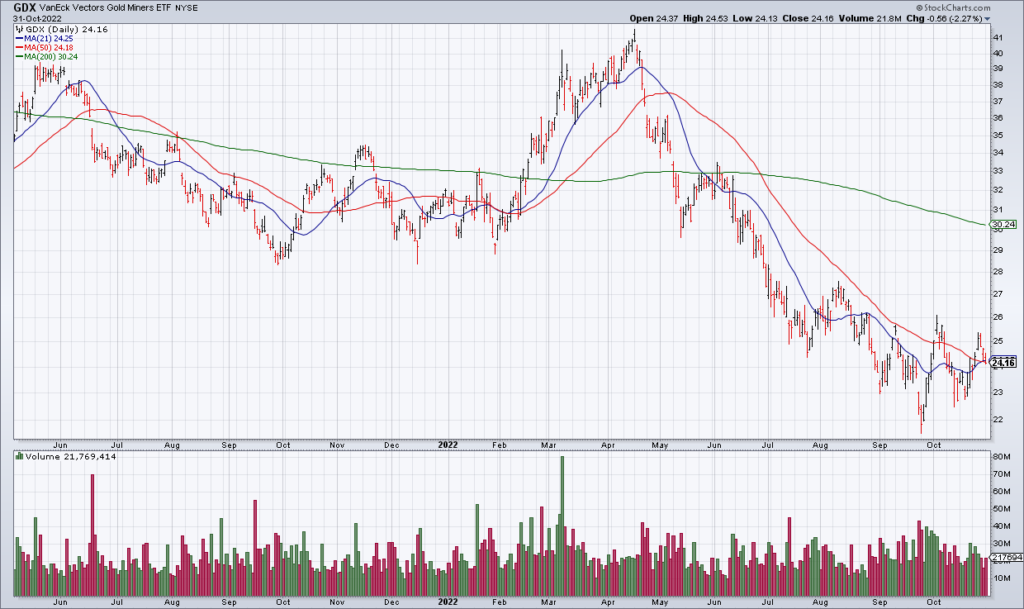

However my sense is that – with the Fed poised to pivot as soon as Wednesday and the precious metals miners as beat up as they are – commodity prices including the precious metals are poised to rally lifting the miners that are levered to them along for the ride.