A Fed Pivot But Weak Earnings

When I go out I like a burger with fries or a margarita with salt. But that’s not what the market is serving. We’ve got a Fed pivot with weak earnings. What should we do?

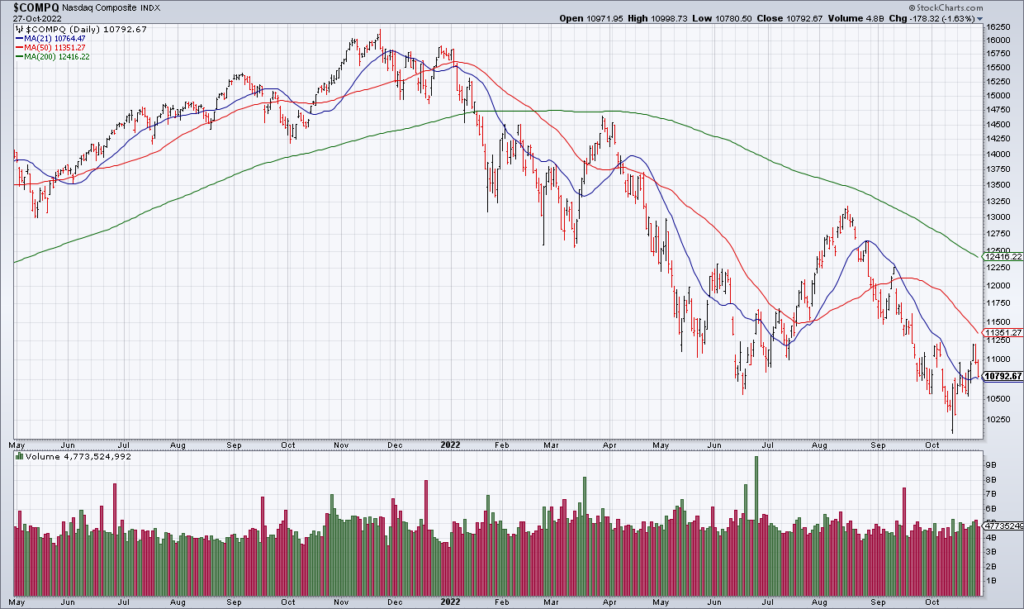

Obviously a Fed pivot – if it really is finally upon is – is bullish and accounts for the second half of the rally we saw from Thursday October 13 through Tuesday October 25. However weak earnings from Google (GOOG/GOOGL) and Microsoft (MSFT) Tuesday afternoon followed by Facebook (META) Wednesday afternoon and Apple (AAPL) and Amazon (AMZN) Thursday afternoon have quashed the rally. How are we to invest in such an environment?

From a stock perspective I believe the answer is defensively. While I have taken small positions in META and Snapchat (SNAP) the overwhelming majority of my stock portfolio is in defensive names in the consumer staples, healthcare and utility sectors. I don’t expect great returns from this part of my portfolio but it should hold up well in a difficult environment.

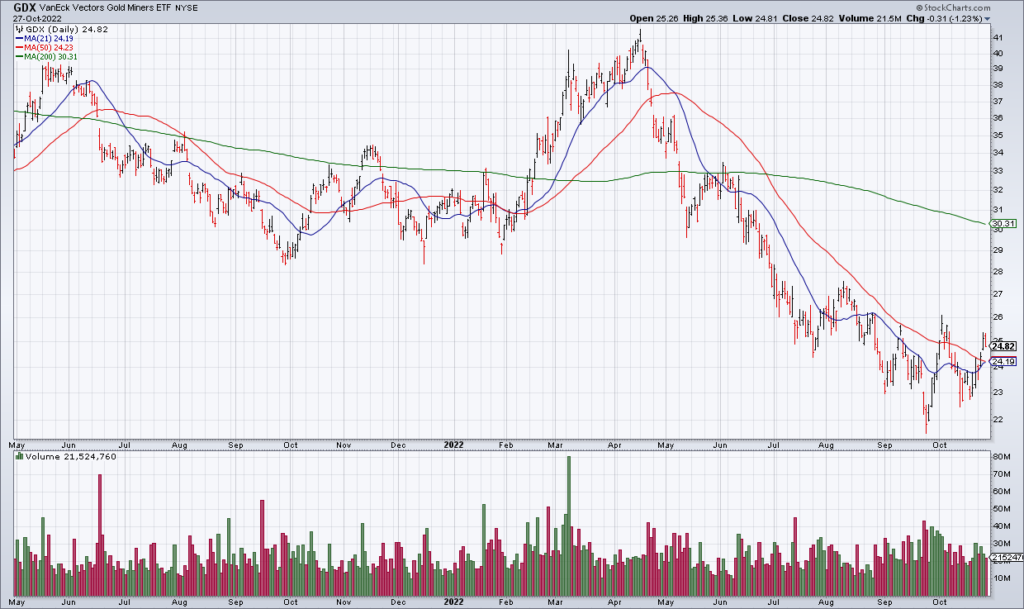

I believe the more interesting plays are precious metals and long term treasuries. With the Fed poised to pivot as soon as next Wednesday (November 2) that will take some pressure off of the inflation trade best expressed via the precious metals. They have performed horribly but I believe they will get a reprieve because while the Fed has done a lot to reign in inflation it is still far higher than optimal. Further I expect this to continue for the foreseeable future as the Fed makes tradeoffs between controlling inflation and managing the economy. For this reason I reestablished positions in my four favorite precious metals ETFs (GDX GDXJ SIL SILJ) Monday morning.

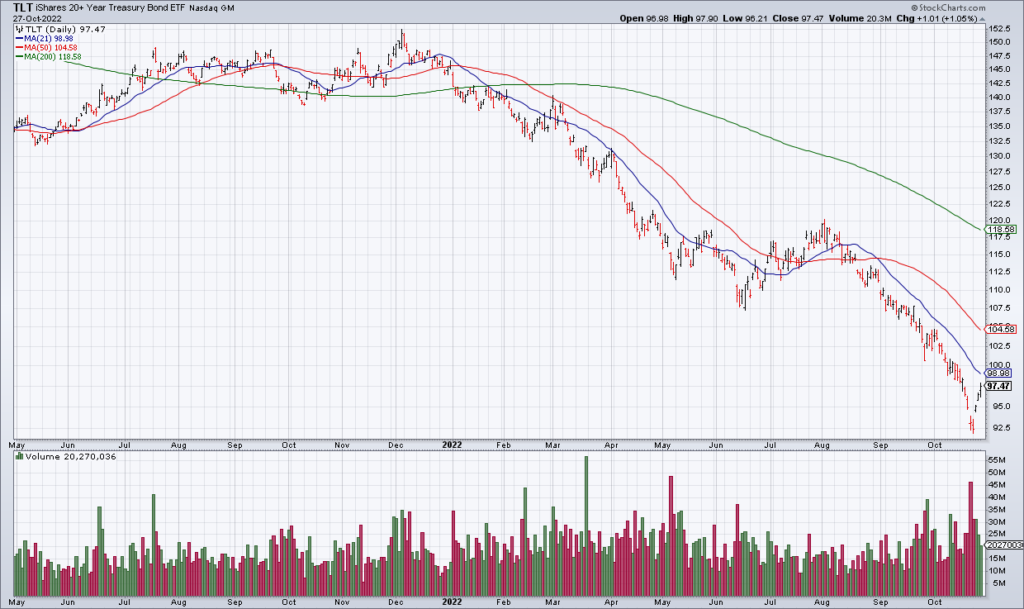

It might seem contradictory to be long precious metals and long term treasuries but in the current context I don’t think so. Long term treasuries have been walloped by inflation over the last year as you can see in the TLT chart above. However with all the Fed’s tightening up to this point having reigned in inflation to a great extent I believe long term treasuries are poised to rally hard from an extremely oversold position. TLT continues to be my largest position (closely followed by the precious metals ETFs).