Rotation Will Shortly Turn Into Distribution As A New Bear Market Begins

The market got the benign January CPI Report this morning at 5:30am EST that it needed with Core CPI increasing 0.295% compared to the previous month according to Nick Timiraos – below the median forecast of 0.34%. But while the S&P rallied early in the day, it gave back all those gains in the last hour or two finishing flat. No bounce.

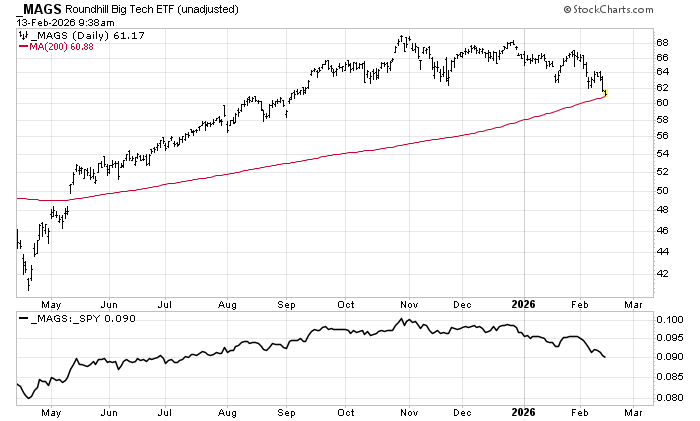

The recent trend continued with a 1.04% gain in The Equal Weight S&P ETF (RSP) offset by a -0.94% decline in The Magnificent 7 ETF (MAGS). The problem is that the market can’t get escape velocity from its current range without The Magnificent 7 because of their ~35% weighting in the index.

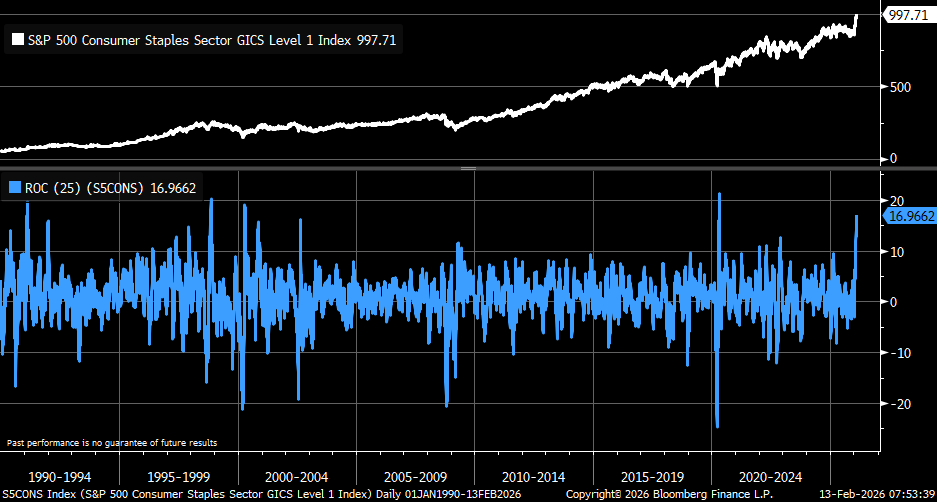

While the S&P is still less than 3% off its all time highs, I suspect this rotation is about to turn into distribution as a new bear market begins. One major reason is the outperformance of consumer staples. The S&P Consumer Staples ETF (XLP) contains stocks like Walmart, Procter & Gamble, Coke, Pepsi, Phillip Morris, Altria, Mondelez and Kroger. These are the kinds of stocks that investors historically buy during difficult periods in the market.

As Kevin Gordon, Head of Macro Research and Strategy at Schwab, tweeted early this morning, XLP is +17% over the last five weeks and there have only been 4 stronger periods in the in the last 25+ years: April 2020 (COVID), April 2000 (Dot Com Top), November 1998 (Long Term Capital Management blow up) and February 1991 (Savings and Loans Recession).

Indeed, there is only one other date – November 30, 2000 – on which 19% of XLP stocks have been at 52-week highs while 18% of S&P Technology stocks (XLK) have been at 52-week lows. As you can see, the S&P rolled over hard in the ensuing couple of years.

While consumer staples are outperforming, The Magnificent 7 which have led this bull market are down by more than 10% since their October 29, 2025 high and are now testing their 200 DMA. Unless these former leaders can find support and rally hard, I think this market is in the early stages of falling apart as it simply can’t rally without them.

One possible catalyst for the next leg lower could be Walmart (WMT) earnings next Thursday morning. WMT is the biggest weight in XLP at 12%, now carries a market cap in excess of $1 trillion and is wildly overvalued at 51x FY26 EPS Guidance after an incredible run (+144%) over the last two years. If investors start to take profits in the wake of the report, that could be a problem for the market as a whole given WMT’s weight.

I’ve been trying to pick a top in this market for ~6 months and I think it’s finally in. The new regime will be very different from the one that has reigned over the last 15+ years. While most investors will stick to the old playbook, those who understand the transition we are going through are poised to make windfall profits.