Setting Up For A Rough Day As AAPL & AMZN Get Hit On Earnings, Is The Bull Market Over?

The most important earnings this week were Microsoft (MSFT) and Google (GOOG / GOOGL) Tuesday afternoon and now Apple (AAPL) and Amazon (AMZN) Thursday afternoon. The former posted stellar results and carried the market higher for most of the day Wednesday before a late day flush left the S&P down 51 basis points and the NASDAQ flat. Surprisingly, the market had short term memory Thursday and rallied into AAPL and AMZN earnings. Unfortunately, that is looking like another head fake as both companies reports were poorly received, at least in the after hours.

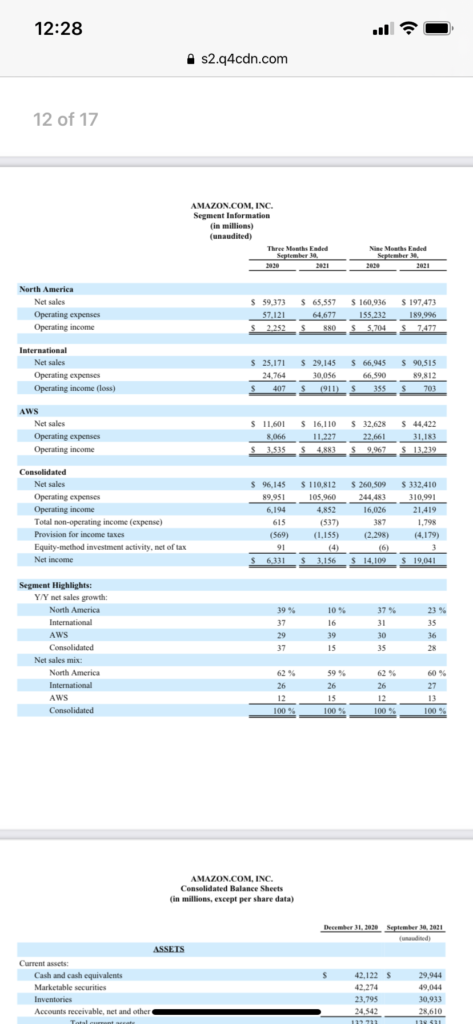

AAPL’s numbers were fine in my opinion but high expectations were baked into the stock price after a 37% move over the last year. AMZN’s numbers were more problematic with revenue up only 15% and 4Q guidance of up only 4% to 12% and operating income of $0 to $3 billion. Further, retail contributed no operating income in the quarter (as you can see in the graphic above). Amazon Web Services was a bright spot with Revenue +39% and Operating Income +38% but the combination produced a 22% decline in operating income compared to 3Q20.

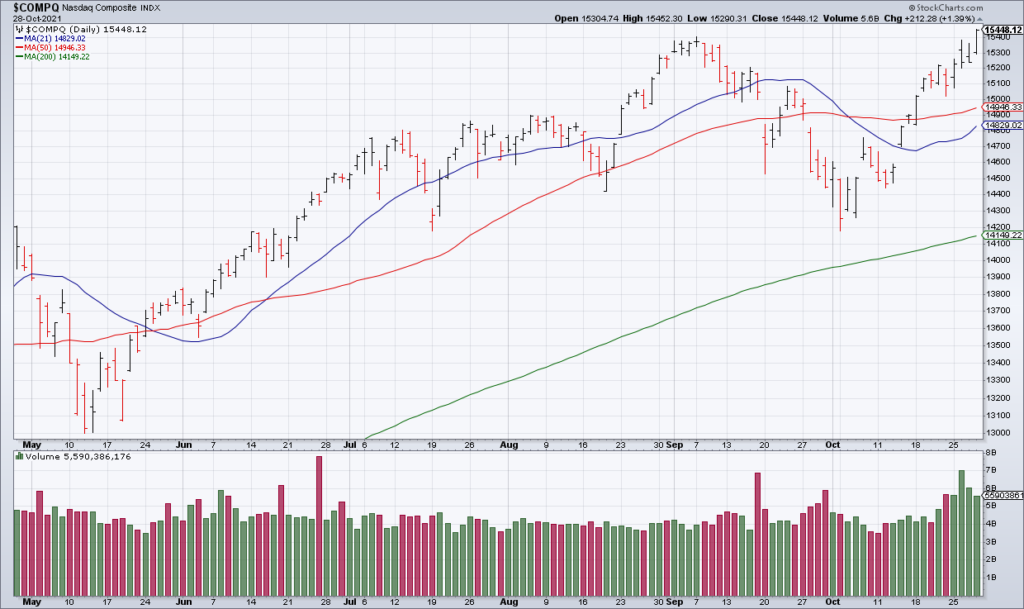

So, unlike Wednesday when MSFT and GOOG / GOOGL propped up the market while everything else got hit, Big Tech is looking like a headwind Friday rather than a tailwind. Unless TSLA unexplainably breaks out and/or the rest of the market finds a bid, things are setting up for a nasty day.

In the last stage of the bull market, the indexes are carried by the leading stocks while the rest have already fallen by the wayside. When the leaders finally top so do the indexes and the bull market is over. And that is exactly what we are seeing right now and in microcosm [Wednesday] – “MSFT & GOOG Mask Underlying Weakness, This Is How Bull Markets Top”, Top Gun Financial, Thursday 10/28

More broadly, the reaction to AAPL and AMZN earnings raises the question: Is the bull market over?

As I explained yesterday and in “The Stealth Bear Market And The Nature Of Bull Market Tops” (10/8), bull market tops are a process in which weakness beneath the surface, as smaller and less known stocks top and fall by the wayside, is masked by strength in the leaders which prop up the indexes until they themselves top and the bull market is over.

As I showed in that post, the former has already occurred. If Big Tech – the leader of this bull market since 2009 – is now topping, the market is out of gas. There is no guarantee that Big Tech can’t resurrect itself or that the rest of the market doesn’t find a bid. But, in all probability, it seems unlikely. Calling major market trend changes in real time is incredibly difficult and you don’t need to do it to do well in the market. But the possibility exists that yesterday was as good as it gets.