It’s Big Tech And All The Rest

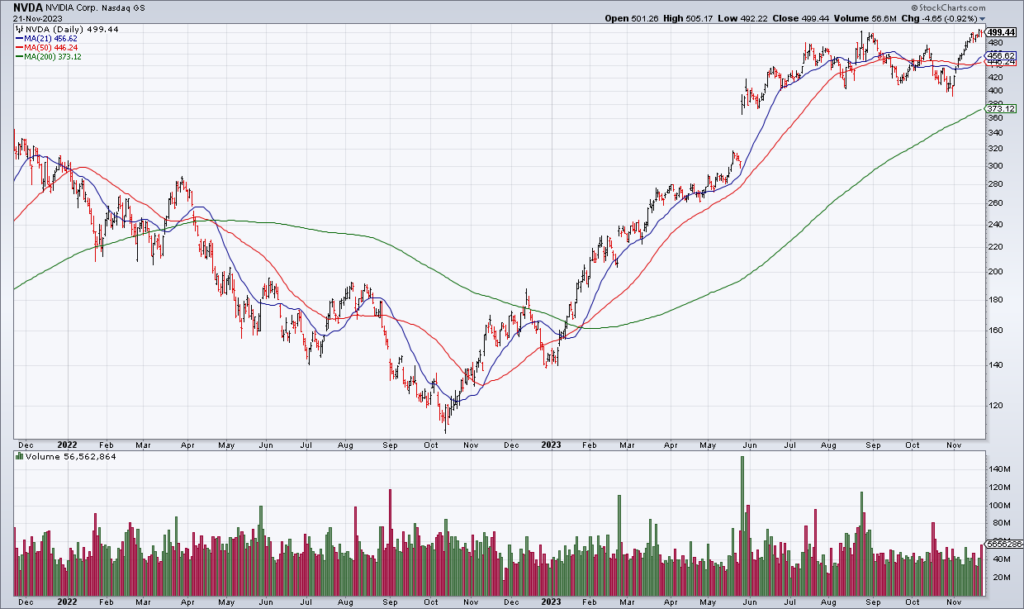

I probably sound like a broken record but it’s a tale of two markets: Big Tech and all the rest. Nvidia (NVDA) reported a monster quarter Tuesday after the close and will be the focus of Wednesday’s session. Revenue of $18.1 billion and guidance for $20 billion this quarter are blowout numbers. Spectacular. And yet the stock – which ran up into the report – appears exhausted with shares currently flat in the premarket (as of 8am EST).

Beyond Big Tech, there’s not a lot to get excited about. The consumer is clearly under pressure as evidenced by reports from Best Buy (BBY) and Lowe’s (LOW) Tuesday morning. BBY reported a 7.3% decline in US comps on top of a 10.5% decline a year ago. LOW’s comps were -7.4% due to a greater than expected pullback in Do-It-Yourself (DIY) discretionary projects. Both companies lowered their full year comp and EPS guidance.

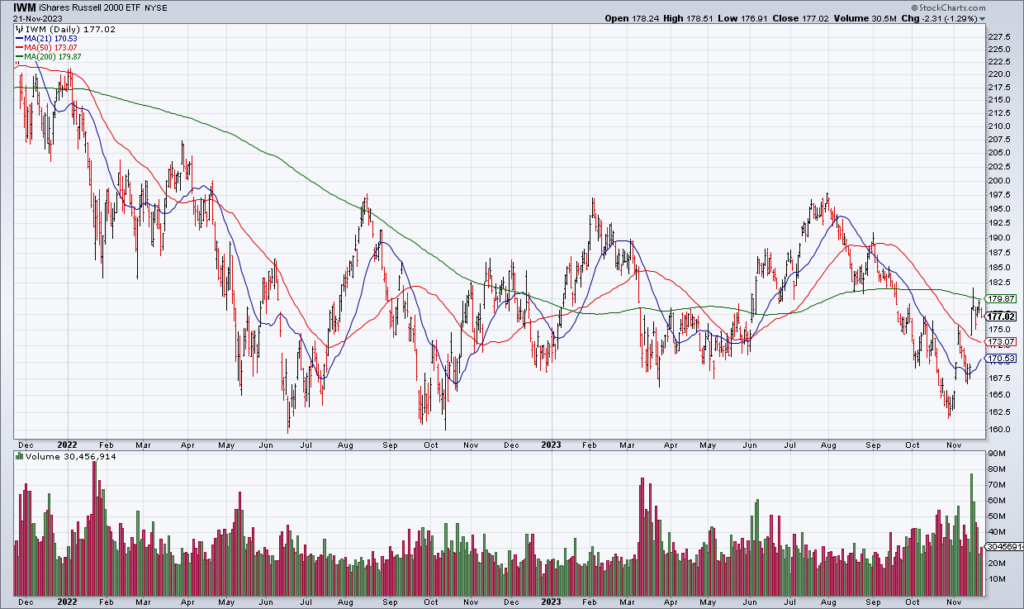

Small caps (IWM) got dinged 1.29% Tuesday and continue to be unable to break above their 200 DMA.

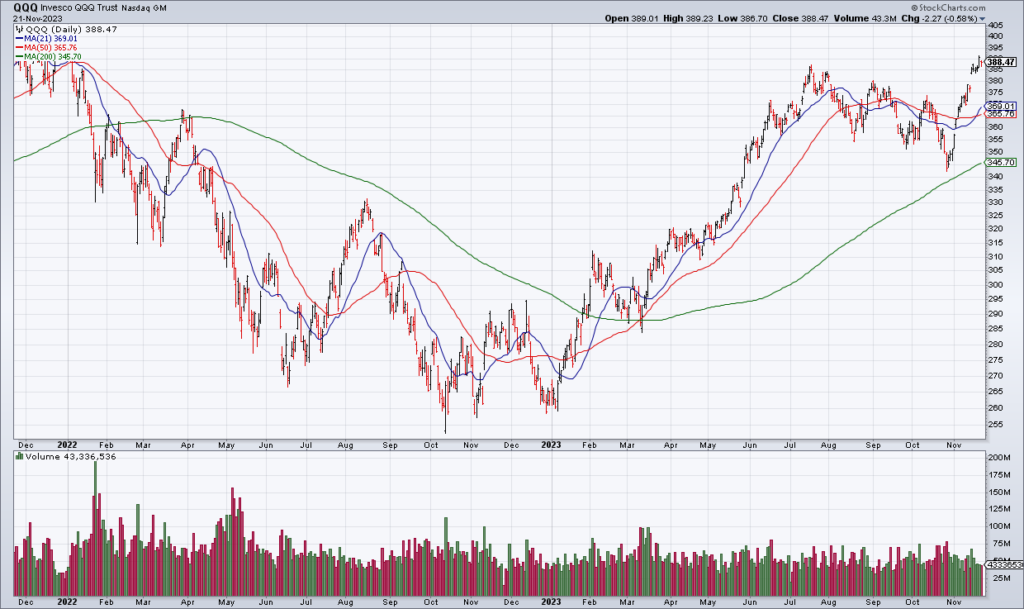

If you’re looking at the market cap weighted indexes, things appear fine. But beneath the surface this continues to be a very thin market.