The Soft Landing Narrative And Its Critics, Argentina Elects A Quirky Libertarian, BBY Earnings

We’re in a mini Goldilocks scenario. The soft landing is playing out – Alessio de Longis, Senior Portfolio Manager, Invesco

There’s too much reliance on a soft landing at this point. We need to be a little bit cautious – Victoria Fernandez, Chief Market Strategist, Crossmark Global Investments

Source: Both quotes from the WSJ article linked to below

There was a good article on the front page of today’s WSJ Exchange section about how the market is now pricing in a soft landing (“An Expected Soft Landing Fuels Stock Market Rally” [SUBSCRIPTION REQUIRED]). In the wake of the better than expected October CPI last Tuesday, the market is convinced – correctly IMO – the Fed is done hiking rates. Since inflation and the Fed’s rate hikes to counteract it have been the main source of pressure on stocks, this is a logical inference.

However, the contrary thesis – one that I subscribe to – is that all the Fed’s rate hikes have yet to make their full effects felt on the economy and markets to date. Those who hold this premise expect a recession in 2024.

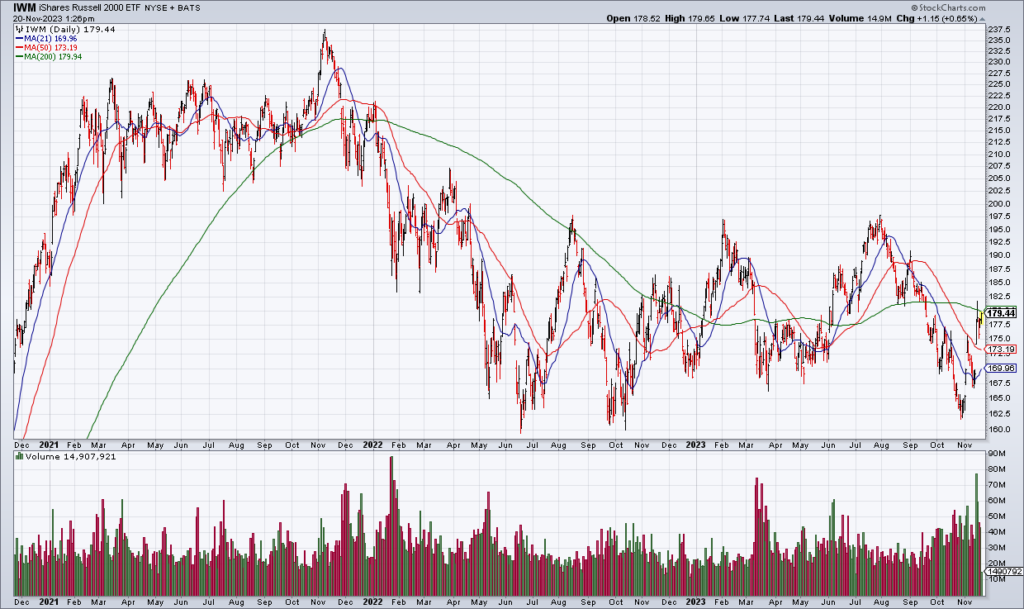

One area of the market where this debate is playing out is the Russell 2000 index of small cap stocks. IWM surged 5.5% on big volume last Tuesday but is still struggling to clear its 200 DMA. Bulls expect this to be resolved to the upside and bears expect it to fail. I’m keeping a close watch.

In other interesting news around the world, Argentina elected an eccentric Libertarian – Javier Milei – President over the weekend. Argentina is in an economic crisis with inflation over 100% and more than 40% of the population living in poverty. Milei wants to make the US dollar Argentina’s currency, end its central bank, and reduce a bloated state sector (“Firebrand Libertarian Elected In Argentina” [SUBSCRIPTION REQUIRED], WSJ A1). Milei named a couple of his dogs after the famous free market economists Milton Friedman and Murray Rothbard. It is reminiscent of the Chicago Boys that came to power 50 years ago in Chile under Pinochet. The Argentina ETF (ARGT) is +12% on big volume today.

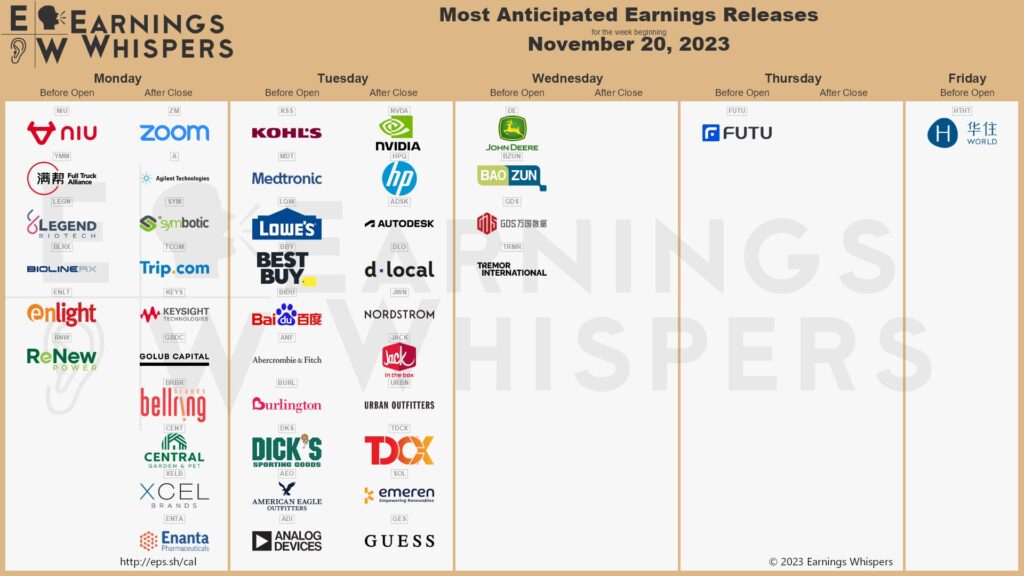

In addition to Zoom (ZM) and Nvidia (NVDA) earnings Monday and Tuesday afternoon, respectively, consumer electronics giant Best Buy (BBY) reports earnings Tuesday morning. BBY has been mired in a nasty slump with six straight quarters of negative high single digit and low double digit same store sales. Home Depot (HD) and Target (TGT) – which tilt towards discretionary merchandise like BBY – both reported weak same stores sales last week and I see no reason why BBY should buck the trend. The stock is cheap at 11x EPS guidance for the current year but I have a small short position.