The Fed Is Done, Small Caps Eye Breakout, NVDA Earnings, Value In ZM

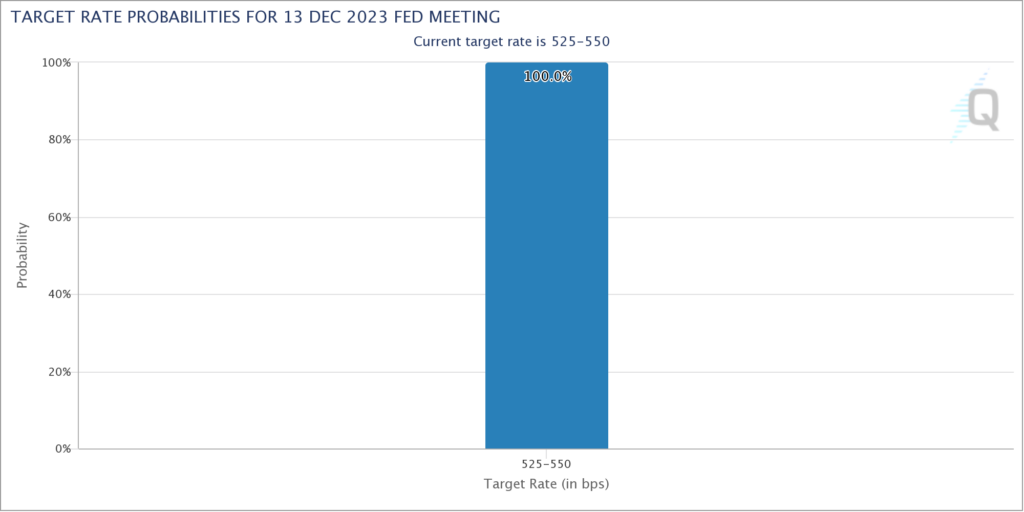

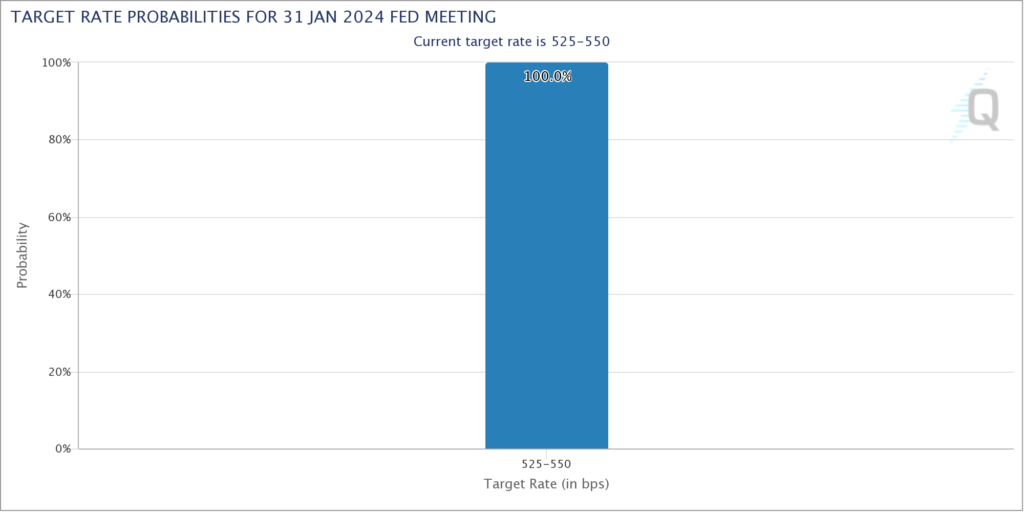

The better than expected October CPI last Tuesday morning has ended the Fed’s rate hiking campaign. As you can see in the Fed Futures Probabilities charts above, the market is placing no chance of anything other than a pause at the next two Fed meetings in December and January. To many, this clears the way for a year end rally and the attainment of new highs: “The setup is there to make a run at that peak”, said Jay Woods, Chief Global Strategist at Freedom Capital Markets.

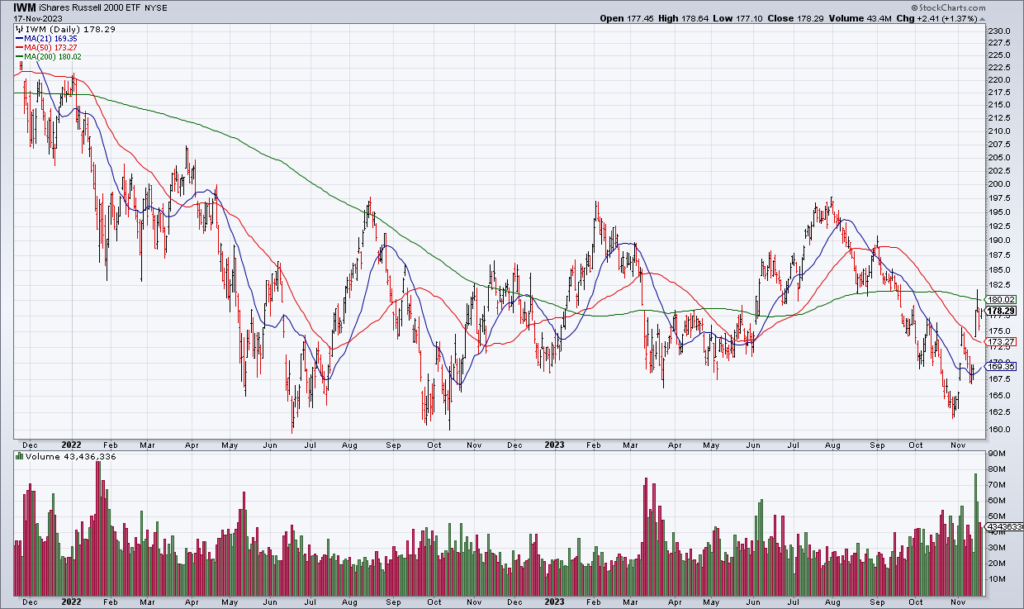

The main bearish technical argument against stocks – and one I have placed a lot of weight on – is the lack of breadth. The Magnificent 7 have carried the market this year, masking a lot of underlying weakness. However, small caps made a huge move on Tuesday and are flirting with their 200 DMA. If they can breakout, that would put this argument to rest – though they have not yet.

Perhaps the most important data point for the remainder of 2023 is Nvidia’s (NVDA) earnings report next Tuesday afternoon. NVDA initiated the AI hype in May with its huge forecast and followed through with a great quarter three months ago. The bar is high with NVDA guiding current quarter revenue to $16 billion – double any quarter in its history besides for the most recent which came in at $13.5 billion. $500 is the breakout level to watch.

Last, I continue to see value in Zoom (ZM). If you back out the $6 billion in cash and marketable securities on their balance sheet ($20/share), you get the stock for less than 10x current year EPS guidance of $4.63-$4.67. While there is a lot of competition in the space, ZM does have a recognizable brand, makes a lot of money and could be an acquisition target for a larger player wanting to enter the space. ZM reports earnings Monday afternoon. I have small position.