NOTE: Every week I write a Client Note for my clients. For a limited time, I am allowing non-clients to sign up and receive the Client Note. You can sign up at the top right hand corner of the website. I will also be posting the notes on my blog with a time delay from time to time. Here is this week’s.

Originally sent December 10, 11am PST.

*****

Don’t overthink the market. It is OK to own stocks for the next six weeks or so, as long as one remains vigilant….. Seasoned traders are reasoning that because Friday’s jobs data was the last major economic report of 2010, Wall Street has more freedom to color perception of the market for the next few weeks.

After a correction in November, stocks have rallied powerfully in the early days of December. The S&P has tacked on 55 points (4.7%) to new 2-year highs in the first eight trading days of the holiday month.

The catalysts have been improvement in the European situation (

“Top Gun FP Client Note: Europe Leads”, sent to clients December 2), a deal between Obama and Republicans to extend the Bush tax cuts, and positive seasonality.

On Tuesday, financial markets responded to news that Obama had reached a deal with Republicans to extend the Bush tax cuts for everyone – including the top two brackets – for two years in exchange for an extension of long-term unemployment benefits. Other goodies in the package include an extension of current capital gain and dividend tax rates, a 35% estate tax above $5 million, a one year reduction in employee payroll taxes to 4.2%, and full expensing of most corporate investment (

“Obama, GOP Reach Deal On Taxes”,

The Wall Street Journal, December 7, A1).

Obama is taking some heat from liberal Democrats as a result of the deal. But the midterm elections were a referendum on him and he may be moving to the center in order to win in 2012 (

“Obama And The Democratic Revolt”, Karl Rove,

The Wall Street Journal, December 9).

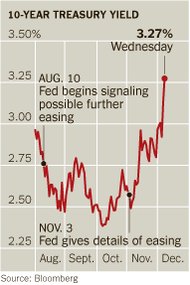

While stocks have rallied in December, bonds have continued to selloff. The yield on the 10-year treasury has risen to 3.25% from 2.50% in early November. Rising rates are a concern for a heavily indebted economy. This is starting to get attention and could be a headwind if it continues.

*****

Even after all this, these reflexive Bears refuse to flip. They will not admit the economy is getting better, albeit slowly. They insist the recession was a depression; they insist it never ended. These are the bears who cannot be killed. They will stay bearish, regardless of the data that all but insists otherwise.

These are the Zombie Bears . . . they cannot be killed.

How could anyone be a bear right now?

The S&P has rallied more than 80% in the last 21 months and is currently making 2+ year highs. The NBER said the recession that began in December 2007 ended in June 2009 (though they didn’t declare that until September 2010). Warren Buffett recently praised the government for saving the economy from the abyss in a

New York Times op-ed with a “Mission Accomplished” tone (

“Pretty Good For Government Work”,

The New York Times, November 17).

It isn’t hard to see how bears could be viewed as permanently pessimistic, backward looking, brain dead zombies longing for the good old days of 2007-2009 when their apocalyptic visions were finally realized (

“Still Betting On Economic Doomsday – And Still Waiting”, Tom Petruno,

The Los Angeles Times, November 27).

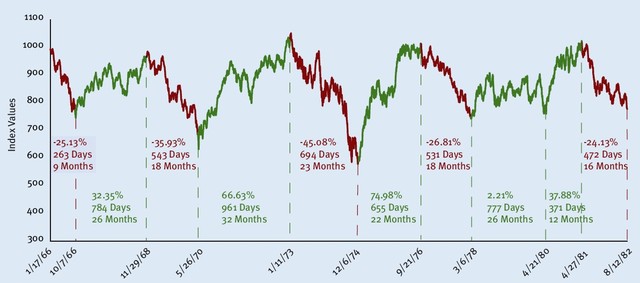

I will only point out that everything that has happened over the last 21 months is perfectly consistent with a secular bear market (for an explanation of secular bull and bear markets see

“Top Gun FP Client Note: A Secular Bear Market”, July 7, 2009).

During the secular bear market of 1966-1982, stocks made no lasting progress despite some powerful rallies. From May 26, 1970 through January 11, 1973, the Dow rallied almost 67%. From December 6, 1974 through September 21, 1976, the Dow surged 75% in just 22 months.

But all of the gains proved ephemeral. The bull markets were cyclical. Stocks could not sustain a durable rally until macroeconomic imbalances played themselves out and the economy – and thereby the stock market – found a true foundation from which it could build.

SPECIAL OFFER – FREE INVESTMENT REVIEW: For a limited time I am offering a free investment review. Pick any stock, bond, ETF or mutual fund. I will do a comprehensive fundamental/macro/technical analysis, write a concise analyst report, and consult with you for 30 minutes by phone or in person for free.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay, CA 95746

(916) 224-0113

CALL NOW FOR A FREE INVESTMENT REVIEW!