Monday’s Bad Breadth, A Psychotic Bubble, Technical Overview, The Fed Put

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Monday didn’t feel terrible with the S&P -0.09%, the NASDAQ -0.60% and the Russell -2.83%. However, because the small caps performed so poorly, NYSE + NASDAQ breadth was terrible with 2,104 Advancers (27% of total issues traded) to 5,407 Decliners (70%) out of 7,699 issues traded (Advancers plus Decliners doesn’t equal 100% due to securities that were unchanged).

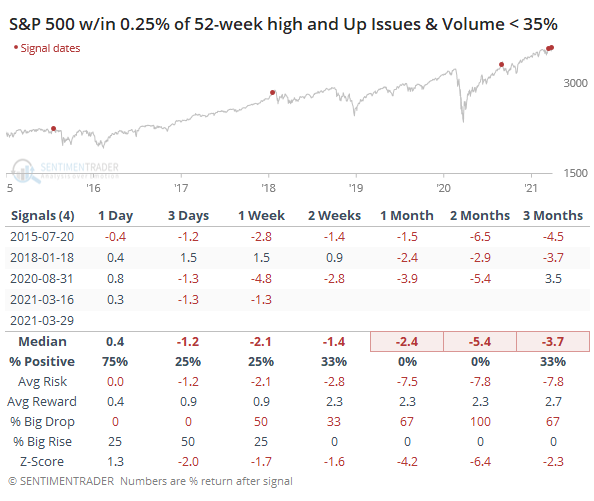

Sentimentrader had a fascinating blog [SUBSCRIPTION REQUIRED] after the close showing what happens when NYSE Advancers and Advancing Volume is < 35%, as it was yesterday, while the S&P is within 0.25% of ATHs. As you can see in the table below, this signal fired on January 18, 2018 ahead of a significant correction, August 30, 2020 right before a major correction and it has now fired twice in the last two weeks.

Next, I’d like to address the question “Is it a bubble?”. To demonstrate that it’s a bubble, all one needs to do is to look at the valuations of a lot of different stocks, which I’ve done in the preceding months here. Yesterday, I wrote “LULU, CHWY & KMX Earnings Preview” showing that all three are significantly, even massively, overvalued heading into earnings this week. Last Friday, I covered “DRI: A Case Study In The Reopen Trade”. I could go on but from doing valuation work on many, many stocks I can say that this market is extremely overvalued. Comparisons to the Dot Com Bubble are well justified.

Beyond the overvaluation is the bizarre, even psychotic, nature of the current market environment, as evidenced in the tweets referencing Jason Zweig’s Saturday WSJ article and James Mackintosh’s WSJ article from Monday. From new investors who admittedly don’t have a clue making money hand over fist to stocks with negative revenue exploding higher, it is absolutely surreal.

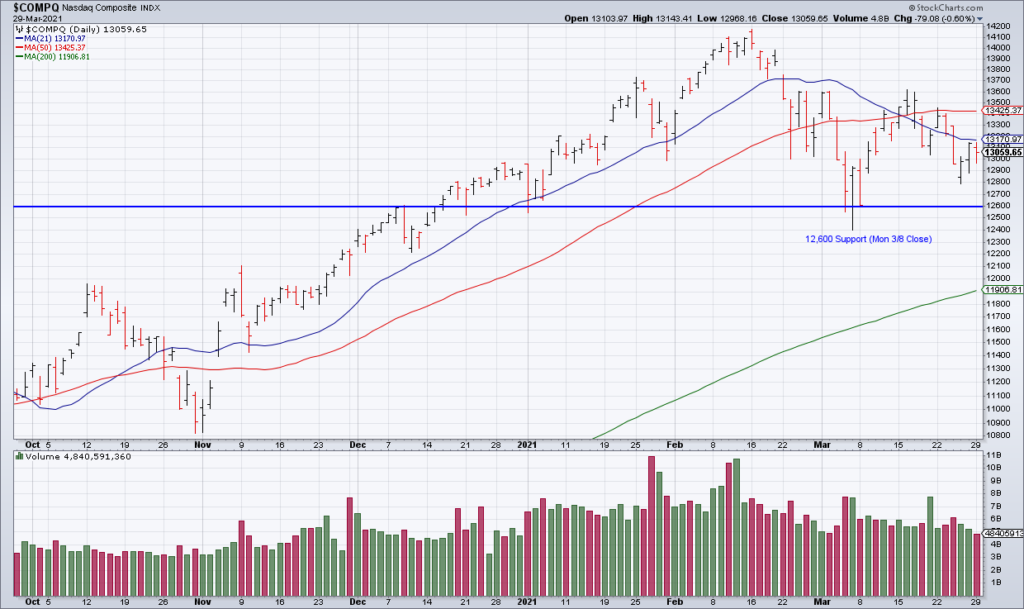

Now, valuation is extremely important but it isn’t a timing tool. To time a top in the market, you need overvaluation but you have to wait for the technicals to develop. Well, the technicals are starting to break down now as well. The NASDAQ is more than 1,000 points off its closing high from Friday February 12 and about 450 points above the closing low of the current correction. It needs to hold the latter level or else it is in complete breakdown mode.

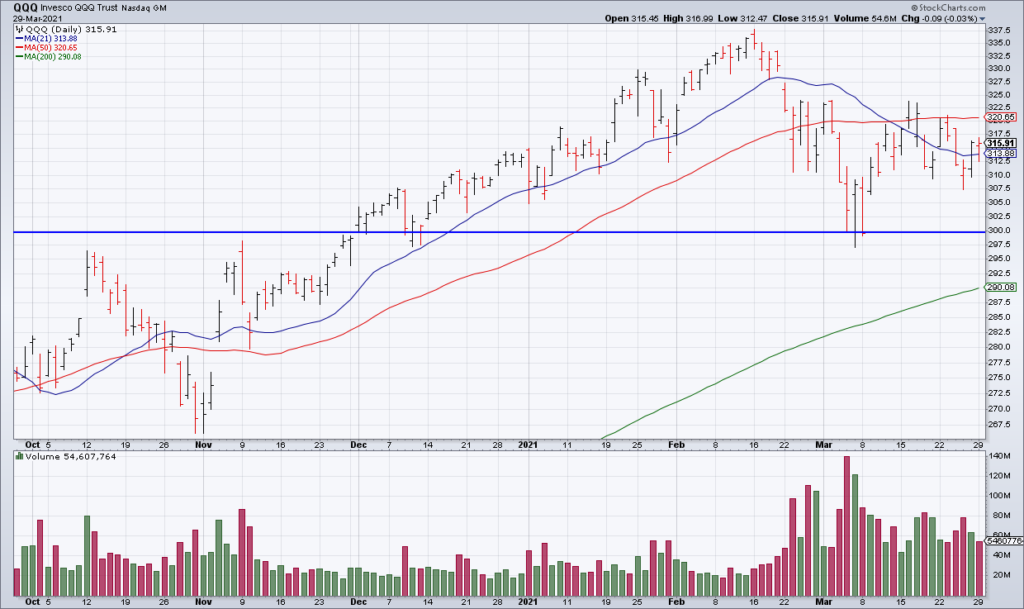

Mega Cap Tech as represented by the QQQ is holding up a little better than tech overall as it is square in the middle of the range established by its February 12 high ($336.50) and correction low ($300). However, rates are up this morning putting pressure on Tech and short term trading wizard Scott Redler says to keep an eye on yesterday’s intraday low of $312.47 today to see if it holds.

Redler also has his eye on Tesla (TSLA) this morning. Again, keep your eye on yesterday’s intraday low of $596 to see if it holds. After that, the next level of support is $539. One of last year’s big winners, TSLA appears to be on the verge of breaking down.

Speculative Tech as represented by ARKK is hanging on by a thread, having closed yesterday only a dollar above its correction low of $110.

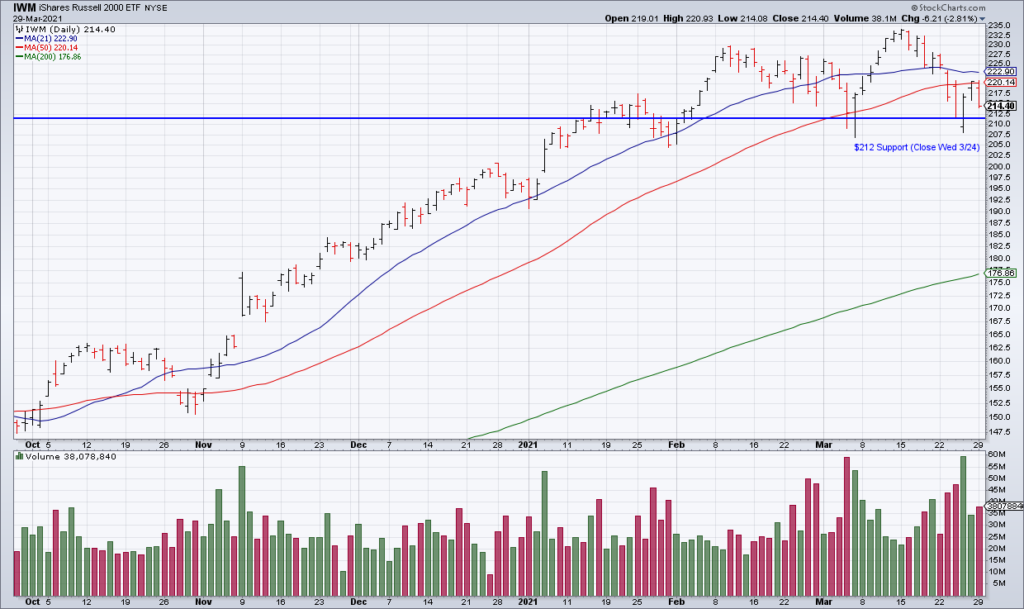

The Reopen Trade as represented by the Russell 2000 Small Cap ETF (IWM) is also hanging on by a thread, having closed yesterday only two dollars above its correction low.

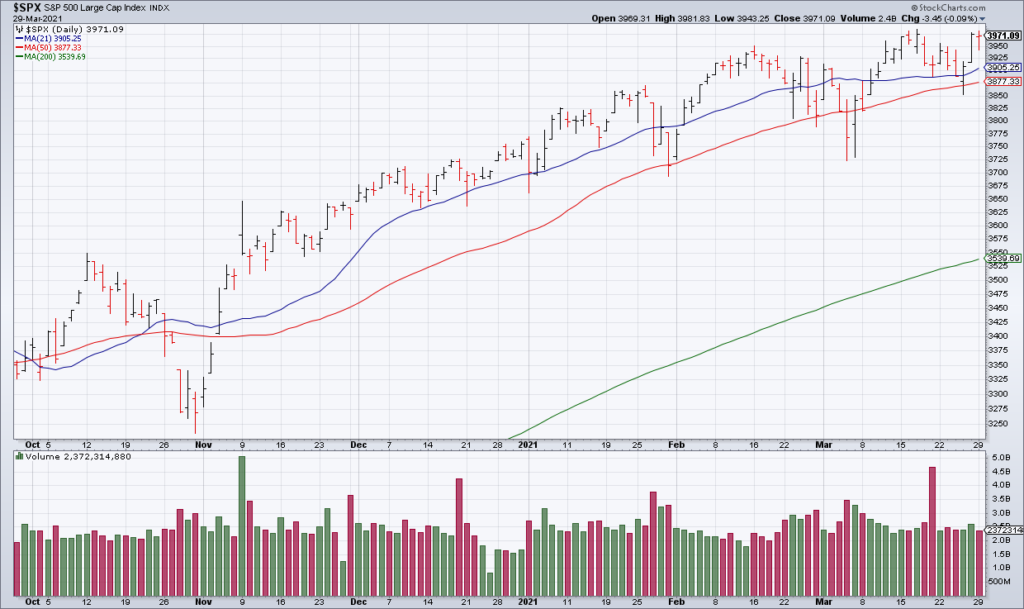

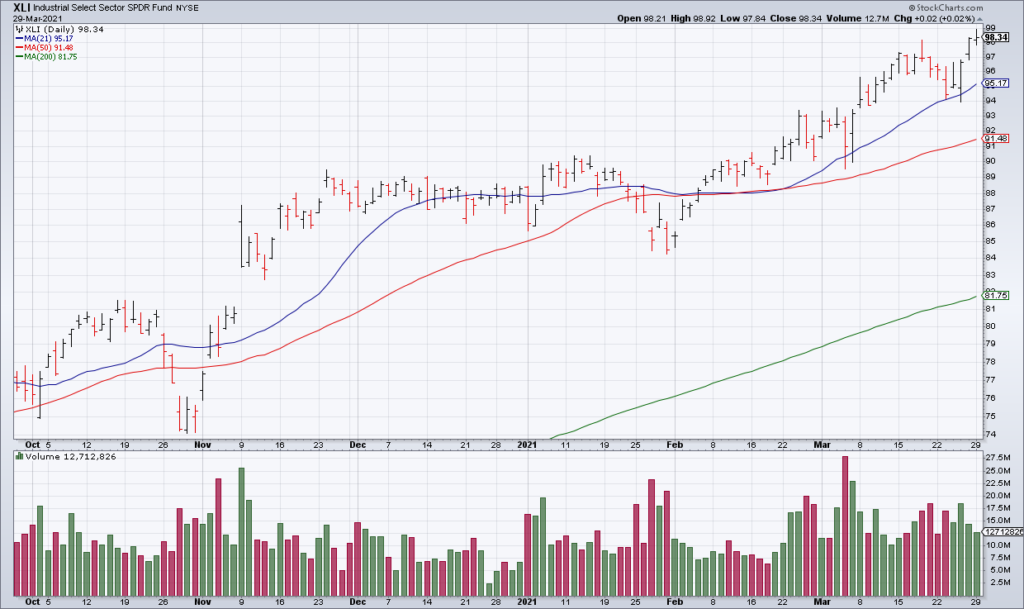

The one index that continues strong is the S&P 500 but it is now being led by the Industrials (XLI), the one offensive sector in the index that has not rolled over, and defensive ones (Consumer Staples (XLP) and Health Care (XLV)). So, while the overall index looks healthy, the failure of some of the reopen sectors like Financials (XLF) and Energy (XLE) and the rotation into defensive ones like Consumer Staples and Health Care doesn’t bold well for its underlying strength.

The test of a first rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function – F. Scott Fitzgerald

Despite extreme valuation, weak technicals and short positions that were working, I covered my shorts at Monday’s open because I am convinced that Friday’s last hour melt up has the Fed’s fingerprints all over it (see “The Bear Market Has Been Forestalled: Understanding Friday’s Final Hour Melt Up”, Top Gun Financial, Saturday March 27). If they did it Friday, they’ll do it again the next time the market starts to break down and, until it stops working, that limits the upside of shorting. I’m not interested in playing for a few percent only to have the Fed take back a good portion of my gains in an hour like Friday.

Things didn’t go the way I expected yesterday as ARKK continued to go lower as did IWM and SMH (QQQ was essentially flat). The stuff I was short, excepting IWM, is down in the premarket currently as well so I left some money on the table but I’m happy with the play. There will be a time to short again but not until the Fed’s stock buying stops working. At that point, they will have lost control of the long end of the yield curve as well as the stock market and all hell will break loose: stagflation, soaring interest rates and a crashing stock market.