Tuesday Morning Rundown

There’s not a lot going on this morning but I’ll touch on a few things to keep an eye on.

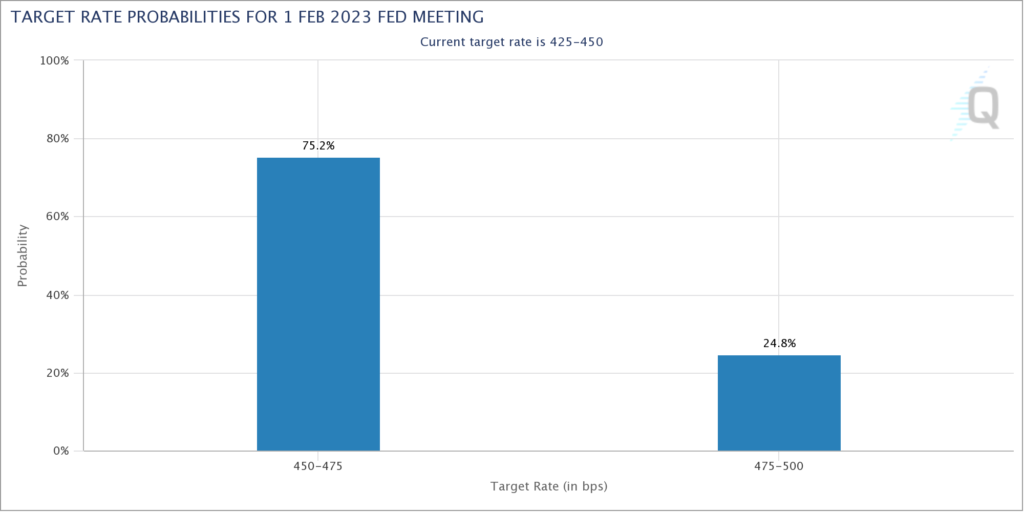

The most important event this week is the December CPI on Thursday morning at 8:30am EST. In this morning’s WSJ, “The Fed Whisperer” Nick Timiraos profiled San Francisco Fed President Mary Daly who will likely support a quarter point hike on February 1 as long as the inflation data on Thursday show continue cooling. Atlanta Fed President Raphael Bostic is on the same page (“Daly Sees Merits In Quarter-Point Rise” [SUBSCRIPTION REQUIRED]). Therefore I continue to believe that the CPI report could be a “bear killer”.

Lululemon (LULU) yesterday modified current quarter guidance. Gross margin is expected to be 100-130 basis points lower than previously expected though Selling, General and Administrative (SG&A) expenses will offset about half of that by improving 70 basis points. Revenue is also expected to be higher than expected with the upshot that EPS guidance is essentially unchanged. Nevertheless LULU shares fell 9.29% yesterday on heavy volume and I would still stay away from them for the reasons noted last month.

Lastly the Big 4 commercial banks report earnings Friday morning. As I noted in the “Market Preview Week of Jan 9-13”, their loan portfolios will be scrutinized for any increase in delinquencies and defaults that the weakening economy may be causing though my guess is that this will most likely not be felt until later this year.