Signs Of Supply, TSLA & FB Technicals, Strong MSFT & GOOG Earnings

On Friday, the market opened strong only to suffer a powerful intraday reversal before recovering somewhat. This created a “doji” on the S&P 500 which is a sign of “indecision” and a potential “trend reversal indicator” according to the technician Callum Thomas.

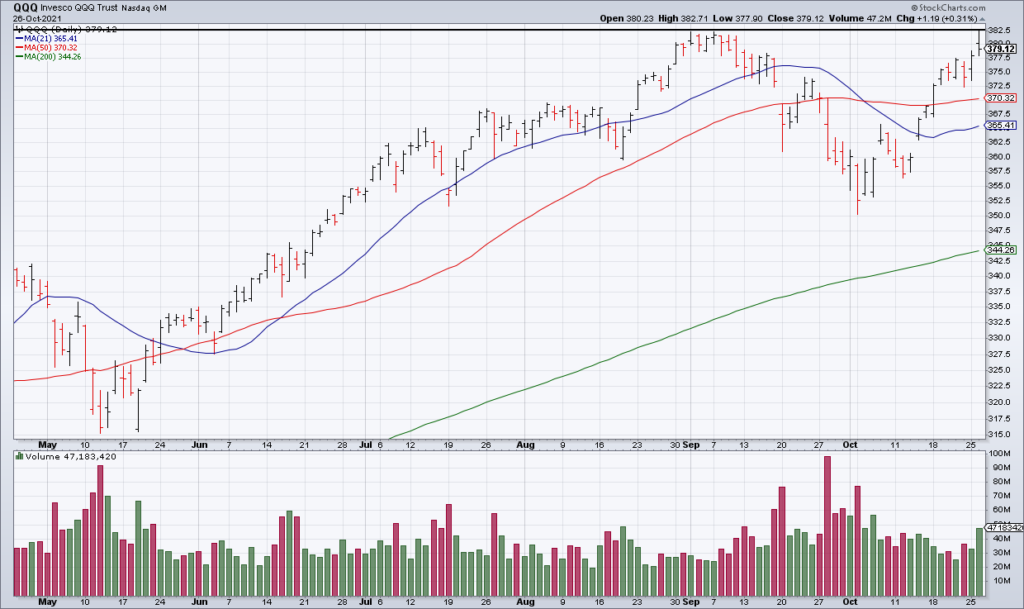

Something similar happened yesterday (Tuesday). The QQQ tested its all time intraday high of $382.78 (from September 7), reaching $382.71 early in the morning before reversing hard to close at $379.12.

A similar thing happened with Tesla (TSLA) which tested $1100 early in the morning only to roll over and find support at $1000 a couple hours later and close at $1018.43. Notice the huge volume in TSLA the last two days. This is characteristic of a blow off top. With TSLA being the most important stock in the market right now, a failure to hold $1000 would likely spillover to the rest of the market in my opinion.

These massive intraday reversals are signs that there is a lot of supply at these levels. It doesn’t mean the market can’t go higher but they are tells that we are at high altitude.

The second most important stock yesterday was Facebook (FB) which reported mediocre earnings Monday afternoon and fell 3.92% to $315.81, closing below its 200 DMA for the first time since March.

Microsoft (MSFT) and Google (GOOG/GOOGL) did report strong earnings after the close yesterday so it’s possible that strength there could hold up the market today. After TSLA, they will be the focus during today’s session.