The Top Is Probably In

Let’s flashback to March 2000 when the Dot.com Bubble topped. The NASDAQ closed above 5,000 twice – Thursday 3/9 and Friday 3/10. And that was it. Today, the NASDAQ closed above 10,000 for the first time. Because of human psychology, these round numbers are important. You very frequently see the indexes find support and resistance at them.

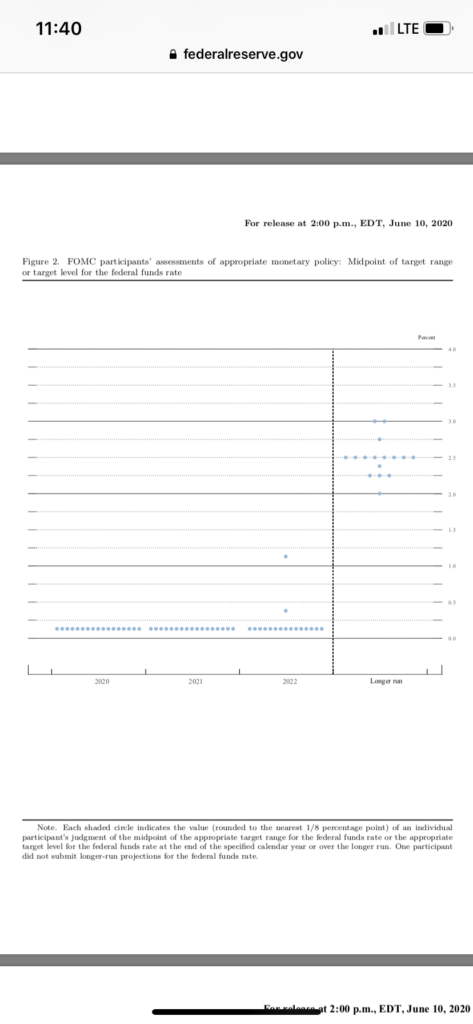

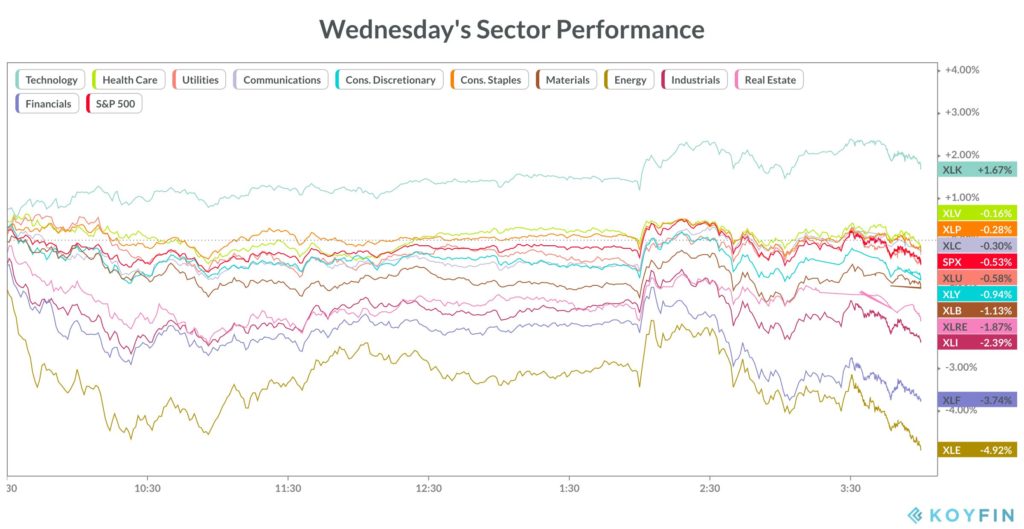

But even more significant was today’s action post-Fed. The Fed made a very dovish announcement, saying that they intend to keep the Fed Funds Rate at 0% through 2022. At first, markets surged higher but it was short lived as they sold off into the close, with the NASDAQ finishing marginally higher than before the Fed and the S&P actually finishing lower. In other words, J-Pow once again fired his “bullzooka” but it did not work.

Now let’s flashback to the 2007 topping process. The S&P made an initial top on 7/19/07 with an intraday high of 1555. Then, a couple of Bear Stearns hedge funds invested in subprime mortgage backed securities blew up, investors realized that many other funds as well commercial and investment banks were exposed to these securities, and the market cratered for a month, finding an interim bottom of 1404 intraday on 8/15/07. From there, the S&P rallied back, making a marginal new intraday high of 1565 on 10/9/07. And that was it (See my “Revisiting The 2007 Topping Process” (4/27/20): https://www.topgunfp.com/revisiting-the-2007-topping-process/).

Something very similar could be happening with the NASDAQ, which is where all the action is, right now. The NASDAQ made an initial intraday high of 9,838 on 2/19/20. Then we crashed into the 3/23 low from which we rallied back to an intraday high of 10,087 post-Fed today.

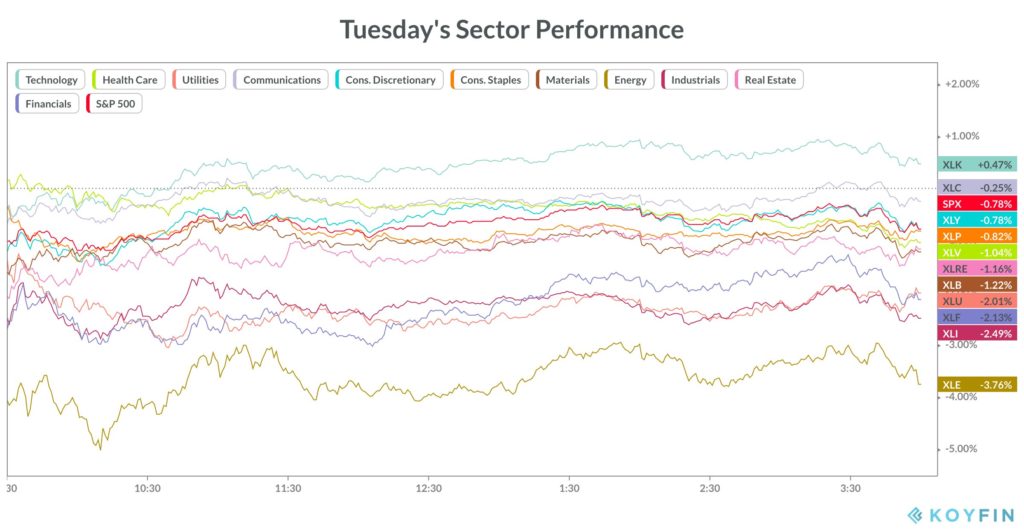

Let’s dig a little deeper into the market action the last couple of days. Breadth has been bad with Advancers to Decliners on the NYSE + NASDAQ 1980/4354 today and 1796/4513 yesterday. Crucially, the only S&P sector to close higher the last two days was Tech; every other S&P sector was down. In other words, this market is very thin; that is, the only thing really going higher right now is Tech.

In fact, 7 stocks with the acronym FANGMAN (FB AMZN NFLX GOOG GOOGL MSFT AAPL NVDA) are driving the entire market, making up more than $6 trillion of the NASDAQ’s approximately $20 trillion market cap. Keep your eye on these 7 stocks: When they crack, it’s GAME OVER.

So far, I’ve been talking pure technicals. But let’s not forget that this is absolutely a bubble. That is, there is a massive disconnect between the market and the economy. GMO’s Jeremy Grantham said it best when he wrote in his 1Q20 Letter: We are in the top 10% of historical price to earnings ratios for the S&P on prior earnings and simultaneously are in the worst 10% of economic situations, arguably even the worst 1%! (https://www.gmo.com/americas/research-library/1q-2020-gmo-quarterly-letter/). This was borne out yesterday when Tiffany (TIF) reported that global comps for May were approximately -40% and Starbucks (SBUX) said this morning that May US comps were -43%.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

825 San Antonio Road #205, Palo Alto, CA 94303

(916) 224-0113