The Fed Is Done, Small Caps Eye Breakout, NVDA Earnings, Value In ZM

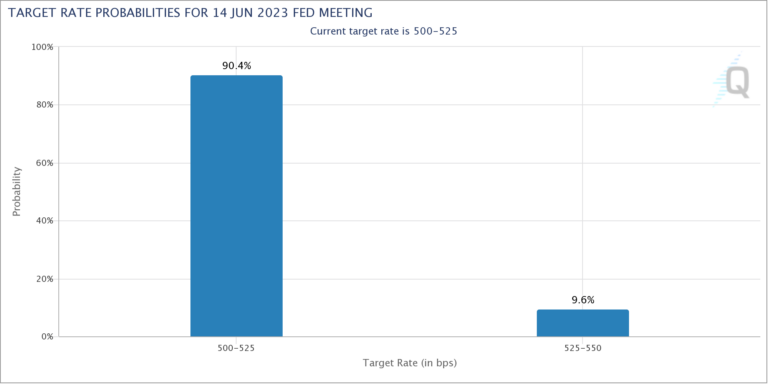

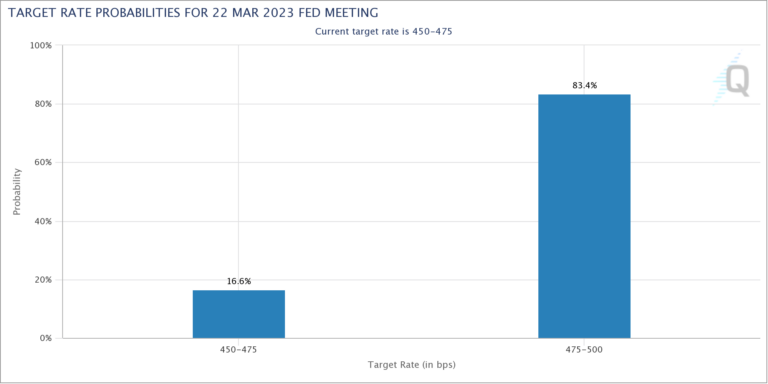

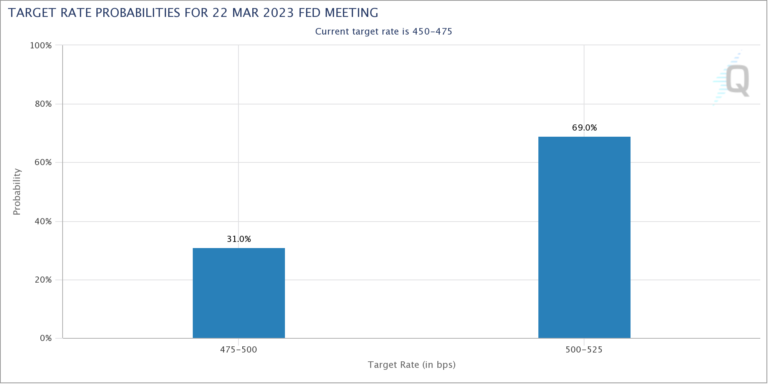

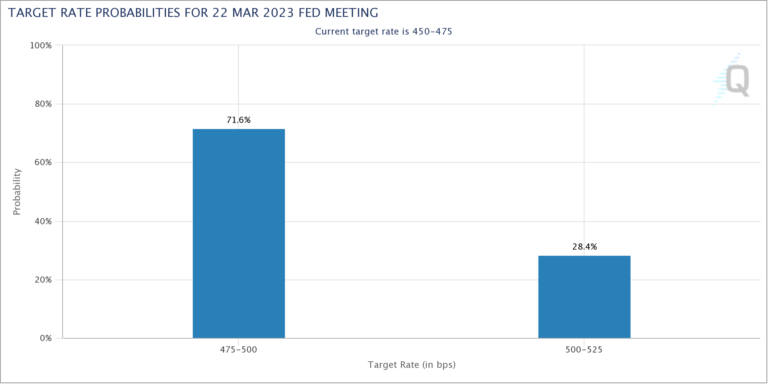

The better than expected October CPI last Tuesday morning has ended the Fed’s rate hiking campaign. As you can see in the Fed Futures Probabilities charts above, the market is placing no chance of anything other than a pause at…