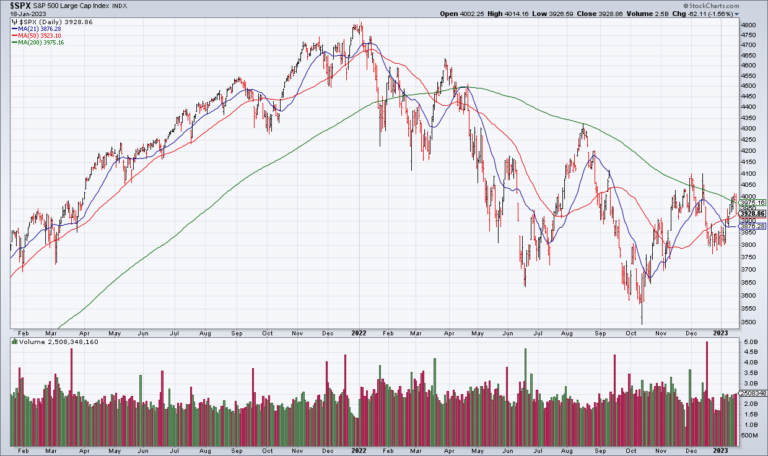

The 200 DMA

Technical Analysis is bullshit. You can always find a line to draw that makes it look like support or resistance. For example, I remember technicians on Twitter talking about the 200 Week Moving Average being support at the end of last year. Not the 200 Day Moving Average – mind you – because the S&P…